If you’re planning to go solo with your business/ startup, then registering it as an OPC is the right choice for you. Now, what is an OPC (One Person Company)? Section 2(62) of the Companies Act, 2013, defines OPC as a company having only one member / director / shareholder / sole business owner. OPCs are best for really small startups, with fewer funds and workforce, and having constricted business objectives. This is because it has very little compliance and it is easy to manage and incorporate. Most importantly, the cost of registration is also very low if compared to other setups. Before you dive into the process of OPC registration, get the ultimate breakdown of OPC registration charges in Bangalore, so that you can plan your finances accordingly.

Table of Contents

Your Guide to the OPC Registration Charges in Bangalore

Breakdown of the Basic Fee Structure of OPC Registration Charges in Bangalore

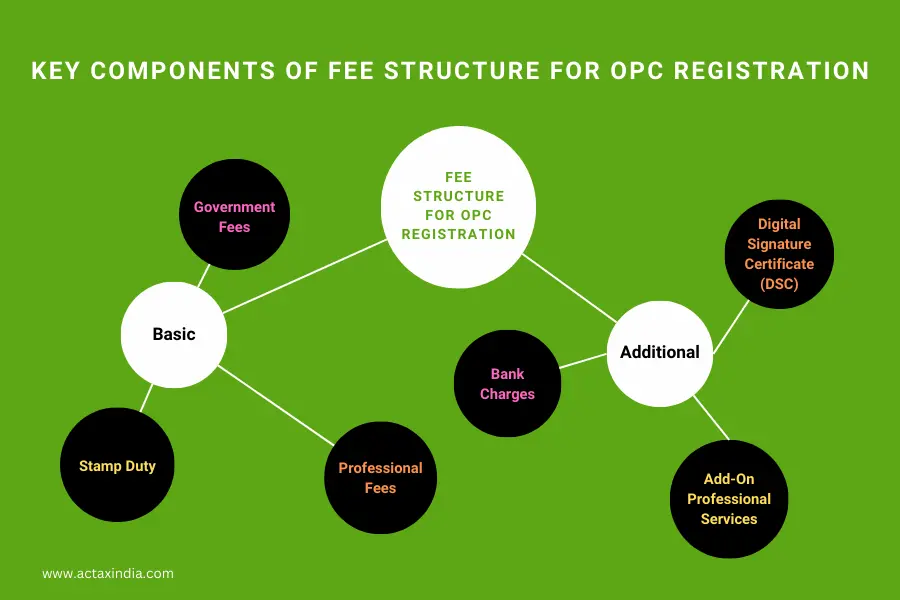

The fee structure of OPC registration charges (in Bangalore) can vary for multiple reasons. For example, Government charges may vary from company to company based on the authorized share capital. And, professional fees vary depending on the services and service provider you’re opting for. Nonetheless, here’s a comprehensive breakdown of the basic fee structure of OPC registration charges in Bangalore.

Government Fees

The Government fees for an OPC start from ₹900 in India, which can significantly vary from company to company, based on its authorized share capital. The same thing works in Bangalore. For authorized share capital not exceeding Rs. 10 lakhs, the government registration fee is around ₹ 2,000. This functions uniformly for all Bangalore-based startups.

Stamp Duty

Stamp duties are always subject to changes, as they are levied by the State Government, and depend on the discretion of the State Government only. Presently, the stamp duty for OPC registration in Bangalore is around ₹1000. However, due to the fluctuating nature of the stamp duty rates, it is suggestible for you to clarify the same by directly contacting the ROC office in Karnataka, or by visiting the Karnataka Government Website.

Professional Fees

Breakdown of Fees by Authorized Share Capital Based On Bangalore

Based on authorized share capital, this table (as displayed hereunder) gives an approximate split of Bangalore’s OPC registration fees. The real fees may differ slightly from these estimations, so please be aware of that and subsequently consider it. It is always advisable to speak with an expert for the most precise figures. Contact Actax India for such advice.

|

Authorized Share Capital |

Government Fees |

Stamp Duty |

Professional Fees (Approx.) |

Estimated Total |

|

Up to ₹1,00,000 |

₹900 |

₹1,000 |

₹3,000 – ₹5,000 |

₹4,900 – ₹6,000 |

|

₹1,00,001 to ₹5,00,000 |

₹2,000 |

₹1,000 |

₹5,000 – ₹10,000 |

₹8,000 – ₹13,000 |

|

₹5,00,001 to ₹50,00,000 |

₹2,000 (Might vary) |

₹1,000 (Might change) |

₹10,000 – ₹15,000 |

₹13,000 – ₹18,000 (Can vary hugely) |

|

Above ₹50,00,000 |

₹(2,000 + ₹20 for every ₹10,000 above ₹1 lakh) + ₹ (₹100 for every ₹10,000 above ₹50 lakh) |

₹1,000 (Might change) |

Above ₹15,000 |

Above 20,000 (Depends on the authorized share capital and professional service provider) |

P.S. For professional fees, only high-quality service providers have been considered. Stamp duty, as mentioned earlier can fluctuate.

Additional Costs

Some additional costs can further be incurred during the OPC registration process. Here are some of the additional costs of OPC registration charges in Bangalore:

- Digital Signature Certificate (DSC): DSC is a mandatory online filing requirement for OPC registration. Costs of obtaining a DSC usually vary between ₹500 to ₹1,500. Given an OPC has only one Director, the costs won’t be any higher.

- Add-On Professional Services: Some add-on professional charges can be incurred by the professionals if you opt for additional services like post-registration compliance, additional legal draftings, etc. from them.

- Bank Charges: It is important to open a bank account for your registered OPC separately. Some minimal bank charges might be required in this regard.

Conclusion

Registering an OPC in Bangalore is not only an easy process but also a pocket-friendly one. This blog has typically briefed the breakdown of the OPC registration charges in Bangalore, wherein the key takeaway suggests that your Authorized Share Capital and the professional service provider you’re choosing, decide your registration cost structure and range. Plan your finances accordingly and make sure to choose wisely while selecting your professional service provider.