Irrespective of the fact whether you’re a creditor, an investor, or a Startup Founder, you need to have significant clarity about the meaning of paid-up capital to smoothly run your financial endeavors and make informed decisions.

Let’s break it down –

If you’re an investor, you need to know about paid-up capital to assess financial strengths and understand share dilutions.

Similarly, if you’re a Startup Founder, you need to know about it, for financial planning and regulatory compliance.

And if you’re a creditor, you need to know about it to assess creditworthiness.

This blog has covered everything you need to know about the meaning and associated concepts of paid-up capital.

Table of Contents

Paid-Up Capital: Meaning, Importance and Associated Concepts

What is the Meaning of Paid Up Capital?

Paid-up capital refers to the total amount of money a company receives from its shareholders in exchange for issuing the shares. To be precise, any company or organization can issue shares. Now, these shares are often bought by people, who are designated as investors, to get back a certain return in the future, by leveraging the profitability of the company. The money that these investors give in the process of buying the shares to the company is deemed to be “paid-up capital”.

Key Characteristics of Paid-Up Capital

Exhibition of Equity Financing:

The concept of equity financing is closely associated with the meaning of paid-up capital or the process by which it is obtained. In simple terms, equity financing refers to the process of amplifying capital by the selling of shares. Unlike debt financing, in which a company raises money by lending them from a bank or an associated entity, to be repaid (usually with interest) later, equity funding does not require any repayment. This makes the phenomenon more viable and safe.

A Source for Company Funds:

Paid-up capital, in its truest form, is the safest source of financial funds for a company. By leveraging this fund, a company can invest, plan for financial growth, clear debts, and so on. The importance of paid-up capital has further been discussed in the next sub-heading.

Reflection of Possession and Ownership:

Shareholders are one of the most dominant stakeholders of a company. Not only that, the shares owned by a shareholder typically represent ownership and possession. In other words, a share represents a shareholder’s proportional ownership stake in the company. Therefore, paid-up capital represents the collective ownership of the company by its shareholders. Hence, the true meaning of paid-up capital can be referred to as the collective representation of ownership by the shareholders of a company.

Core Significance of Paid-Up Capital

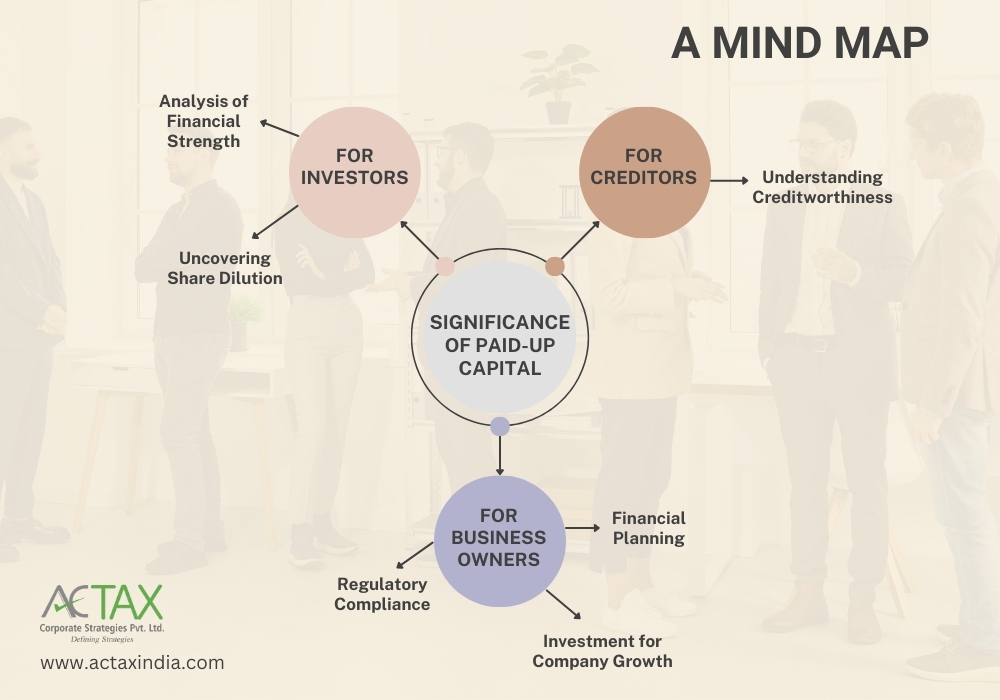

The significance and meaning of paid-up capital varies from person to person, each with its perspectives and benefits. The investors gain something completely different out of paid-up capital than that of a business owner or creditor. Hence, its significance has been subdivided into three key sections, based on what it offers to different entities.

In Support of Business Owners or Founders:

1. Regulatory Compliance

In India, the minimum paid-up capital requirement for the incorporation of a public company is ₹5,00,000/-. To avoid any legal complications, business owners are required to comply with these regulations. Please note that the Companies (Amendments) Act 2015, abolished any requirement of paid-up capital for private limited companies.

2. Financial Planning

The true meaning of paid-up capital lies in the fact that it forms the basis for calculating share dilution, which is extremely important for analyzing the impact of new share issuance (i.e., whether or not to issue more shares), based on the previous ownership percentages. A company often needs to make such informed decisions.

3. Investment for Company Growth

Paid-up capitals are typical company funds, as mentioned earlier. A company or organization can leverage the same to invest in new ventures and ideas or to clear off debts.

In Support of Investors:

1. Analysis of Financial Strength

The meaning of paid-up capital can also be bisected as a representation of actual money invested by the company shareholders (i.e., this hugely differs from the phenomenon of debt). This showcases the financial foundation of the company. By leveraging this, the investors can make informed decisions (i.e., consideration of the profitability quotient) on whether to invest in such a company by buying shares.

2. Uncovering Share Dilution

Whenever an organization issues new shares, it can dilute the ownership of existing shareholders. Herein, it is important to know the paid-up capital of the company, as it has the potential to help the investors calculate the new share’s potential impact on their respective ownership stake.

In Support of Creditors:

1. Understanding Creditworthiness

Paid-up capital, coupled with the other metrics of company finances like cash flow statements, industry benchmarks, solvency, and profitability ratio of the company, can provide the creditors with a concrete idea about the company’s competency to meet financial obligations. By understanding the concept and meaning of paid-up capital, the creditors can assess the creditworthiness of the company as a whole.

Formula Based on the Meaning of Paid-Up Capital

Paid-up capital = Number of Shares * Par Value Per Share + Capital Share Surplus

To enable a proper evaluation of the formula, a detailed description has been provided hereunder:

- Number of Shares: Total number of shares issued by a company to the shareholders.

- Par Value Per Share: Nominal share value as per the company charter.

- Capital Share Surplus: Extra amount the shareholders pay for a share above its par value.

Associated Concepts Tagged Along With The Meaning of Paid-Up Capital

1. Authorized Share Capital

Authorized share capital refers to the ‘maximum amount of capital’ that can be issued by a company to the shareholders in concern, as per the decided value mentioned in the AOA (Articles of Association). It can be connected to the meaning of paid-up capital, as it refers to the actual paid amount of the shareholders.

2. Financial Ratios

A financial ratio can be defined as the phenomenon used to calculate the financial status of a company, which includes its liquidity, profitability, and operational efficiency. The two most important financial ratios are the equity ratio & debt to equity ratio. Both are used to determine the financial health of a company. The value of paid-up capital is essential to be known to calculate these ratios.

3. Shareholder Equity

Shareholder equity refers to the difference between the total assets of a company and its total liabilities. It is important to know the value of paid-up capital to calculate shareholder equity, as the true meaning of paid-up capital showcases that it is nothing more than a company asset.

4. Share Dilution

Share dilution refers to the phenomenon by which a company reduces the percentage of its equity by issuing additional shares that are usually put up for sale. Understanding the meaning of paid-up capital is essential for calculating the probable impact of new share issuance on the existing structure of share ownership.

Conclusion: Key Points Representing the Meaning of Paid-Up Capital

Paid-up capital is the amount received by an organization, by selling shares to the investors. These transactions are facilitated through the primary market. The par value of the shares and excess capital represents the entire funding segment of paid up capital. The phenomenon of equity financing has an uncanny resemblance with the nature and meaning of paid up capital. Further during accounting, the paid-up capital values are usually typically analyzed. Stay tuned with Actax India to get more such informative revelations. Register Your Company today with right paid up capital planned for your business with help of our Experts.