Table of Contents

Intro to Professional Tax in India

Professional tax registration is a state-level tax levied on individuals earning an income through a profession or employment. It’s a mandatory financial obligation for professionals and employees, contributing to state revenue. Understanding its importance is crucial as compliance ensures legal standing and avoids penalties. Although relatively modest, this tax plays a vital role in sustaining various state services, contributing to infrastructure, and fostering economic development. Professionals should prioritize awareness and adherence to professional tax regulations to maintain financial compliance and contribute responsibly to the development of the state.

What is Professional Tax Registration?

Professional Tax Registration is a mandatory process by state-level regulations that individuals engaged in a profession or employment must undergo. This registration is a legal requirement, and failure to comply can result in penalties.

How to Register for Professional Tax?

The process involves obtaining a unique registration number from the appropriate state authority overseeing professional tax matters. This authority varies from state to state in India, as professional tax is state-level. Generally, it falls under the purview of the State Commercial Tax Department or a similar body.

Document Submission

Individuals must submit the necessary documents to initiate the registration process, including proof of identity, address, and their profession or employment details. Once the application is processed and approved, the registrant is issued a unique professional tax registration number.

The registration applies to salaried employees, professionals, traders, and people involved in various vocations. The purpose is to create a database of professionals and ensure that they contribute to the state’s revenue by paying professional tax.

The frequency and quantum of professional tax payments may vary by state. In some states, it is a monthly obligation; in others, it might be quarterly or half-yearly. The tax rates also differ, usually based on income slabs. In Karnataka professional tax is to be paid annually.

Compliance with Professional Tax

Professional Tax Registration fulfills a legal obligation and allows individuals to avail themselves of various benefits and rights associated with their profession. It ensures that professionals contribute to the state’s resources, which are utilized for public welfare, infrastructure development, and other essential services.

Who is responsible for collecting and paying professional tax?

Professional tax is a state-level tax imposed on individuals engaged in various professions, trades, and employment. The responsibility for collecting and paying professional tax rests on both employers and professionals, and it is crucial to understand the roles and obligations of each party.

Employer’s Responsibility in Professional Tax Registration:

Employers play a pivotal role in the professional tax process. Their responsibilities include:

- Registration of the Establishment: Employers are required to register their establishments with the appropriate state authority. This involves providing details about the business, its employees, and other relevant information.

- Deduction from Employee’s Salary: Employers are responsible for deducting professional tax from the salary or wages of their employees. The amount deducted varies based on the employee’s income and the applicable slab rates in the respective state.

- Payment to Government: After deducting the tax from employees, the employer must deposit the collected professional tax amount with the state government within the stipulated time frame. This is usually done on a monthly or quarterly basis.

- Filing Returns: Employers must file regular returns with the state tax department. These returns detail the professional tax collected from employees and provide other necessary information.

- Maintaining Records: Employers must keep accurate records of the professional tax deducted from each employee. These records may be subject to scrutiny by tax authorities.

Professional’s Responsibility:

Professionals, including self-employed individuals and those in non-salaried professions, also have specific responsibilities:

- Registration: Professionals must register for professional tax with the appropriate state authority. This is typically an individual registration process, separate from the employer’s registration.

- Self-Assessment: Unlike salaried employees, professionals are often responsible for assessing their professional tax liability. They must determine the correct slab rate based on their income and pay the tax accordingly.

- Direct Payment to Government: Professionals must directly pay the professional tax to the state government within the prescribed timelines. Depending on the state, this can be a monthly, quarterly, or half-yearly obligation.

- Filing Returns: Like employers, professionals must file regular returns with the state tax department. These returns detail the income earned and the corresponding professional tax paid.

- Maintaining Records: Accurate records of income, expenses, and professional tax payments are essential for professionals. These records may be needed for audits or verifications.

Professional Tax Registration and Process

Professional tax is a state-level tax on individuals engaged in various professions, trades, and employment. The professional tax registration process is essential for employers and professionals to comply with state regulations. Below is a detailed guide on professional tax registration and the associated process.

1. Registration for Professional Tax

Eligibility for Professional tax registration:

Any person in a profession, trade, or employment must pay professional tax. Both salaried employees and self-employed professionals are subject to this tax.

Application for professional tax registration:

Employers are required to apply for registration within 30 days of employing staff. Self-employed professionals must initiate the registration process themselves.

2. Documentation Required for Professional Tax Registration

Employers:

- Certificate of Incorporation (for companies).

- PAN card of the business.

- Address proof of the business.

- List of employees with their details.

- Memorandum and Articles of Association (for companies).

Professionals:

- PAN card.

- Address proof.

- Qualification certificates.

- Passport-sized photographs.

3. Can I Register for Professional Tax Online?

Yes. Many states facilitate online registration for professional tax. Applicants can visit the official state tax department website and fill in the required details.

4. Registration Certificate:

Once the application is processed and approved, a registration certificate is issued. This certificate serves as proof of compliance with professional tax regulations.

Professional Tax Registration Process

1. Determining Tax Liability:

The tax liability is calculated based on the individual’s income or employee salary slab.

2. Deduction by Employers:

Employers are responsible for deducting professional tax from the salaries of their employees. The deduction is made at the source before disbursing the salary.

3. Payment Frequency:

Professional tax is typically paid on a monthly or quarterly basis. The frequency may vary among states.

4. Payment to Government:

Employers and self-employed professionals must deposit the collected professional tax with the state government. This can usually be done through designated banks or online payment portals.

5. Filing Returns:

Employers and professionals must file regular returns with the state tax department. Returns detail the amount of professional tax collected or paid and other relevant information.

6. Penalties for Non-Compliance:

Non-compliance with professional tax regulations can lead to penalties and legal consequences. Timely filing of returns and payments is crucial to avoid penalties.

7. Record Maintenance:

Employers and professionals must maintain accurate records of professional tax payments and filings. These records may be subject to audit by tax authorities.

8. Amendments in Registration:

Any business structure or employment status changes must be promptly updated in the registration.

Get Your Professional Tax Registration Now!

Exemptions in Professional Tax

Professional tax is a state-level tax imposed on individuals earning an income from their professions or employment. While it is a mandatory obligation for many, there are certain exemptions in professional tax that individuals can leverage to reduce their tax liability. Understanding these exemptions is essential for professionals to optimize their tax planning. Here are key points regarding exemptions in professional tax:

1. Income Thresholds:

Many states exempt individuals with income below a specified threshold from professional tax. The threshold varies among states, and individuals earning below this limit may be exempt from paying professional tax.

2. Senior Citizens and Disabled Individuals:

Some states provide exemptions or concessions to senior citizens and individuals with disabilities. The age criteria for such exemptions may differ, and individuals falling into these categories may enjoy reduced tax obligations.

3. HUFs (Hindu Undivided Families) and Other Entities:

Certain entities, such as HUFs, may be exempt from professional tax in some states. Exemptions for entities depend on the specific regulations each state’s tax department outlines.

4. Agricultural Income:

Agricultural income is often exempt from professional tax. Individuals whose primary income source is agricultural may not be liable to pay professional tax on that income.

5. Employment in Multiple States:

Professionals working in multiple states may be eligible for exemptions in one state based on the tax already paid in another form. This prevents individuals from being doubly taxed for the same income.

6. Tax Rebates:

Some states provide rebates on professional tax for specific categories of professionals or businesses. This can include professionals engaged in specific industries or occupations.

7. Profession-Specific Exemptions:

In some instances, exemptions are provided for individuals engaged in specific professions or industries deemed beneficial for economic development. These exemptions aim to encourage growth in particular sectors.

8. Women Employees:

Some states offer exemptions or concessions to women employees. This is often part of efforts to promote gender equality and encourage the participation of women in the workforce.

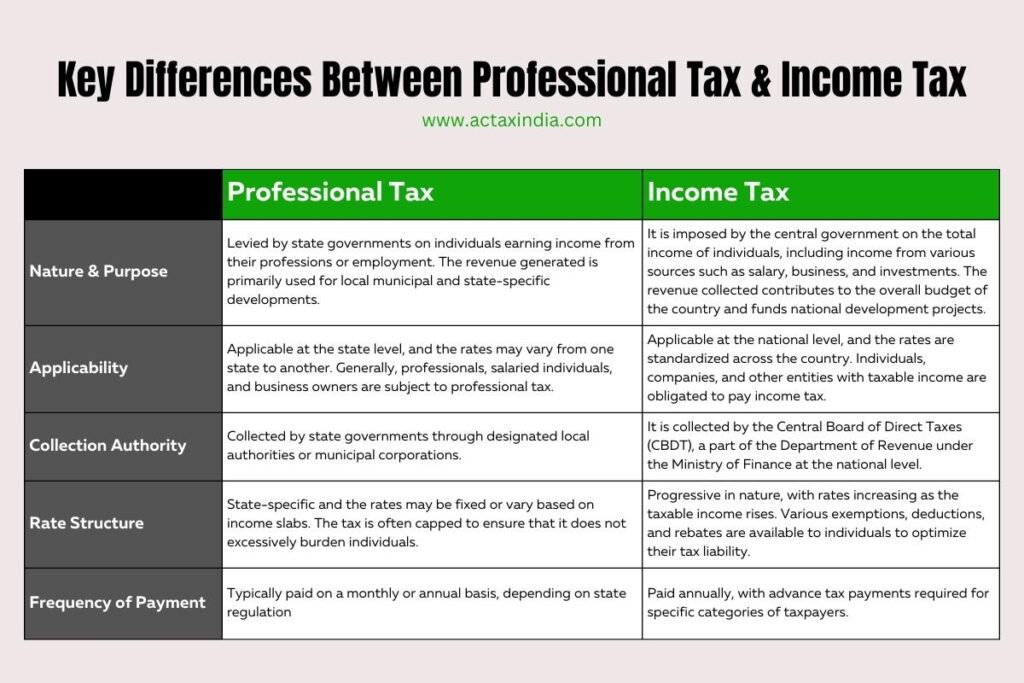

Professional Tax vs. Income Tax: Key Differences

Professional and income tax are distinct types of taxes imposed by governments to generate revenue, but they differ significantly in scope, applicability, and purpose. Here are the key differences between professional tax and income tax:

1. Nature and Purpose

Professional Tax:

Levied by state governments on individuals earning income from their professions or employment. The revenue generated is primarily used for local municipal and state-specific developments.

Income Tax:

It is imposed by the central government on the total income of individuals, including income from various sources such as salary, business, and investments. The revenue collected contributes to the overall budget of the country and funds national development projects.

2. Applicability

Professional Tax:

Applicable at the state level, and the rates may vary from one state to another. Generally, professionals, salaried individuals, and business owners are subject to professional tax.

Income Tax:

Applicable at the national level, and the rates are standardized across the country. Individuals, companies, and other entities with taxable income are obligated to pay income tax.

3. Collection Authority

Professional Tax:

Collected by state governments through designated local authorities or municipal corporations.

Income Tax:

It is collected by the Central Board of Direct Taxes (CBDT), a part of the Department of Revenue under the Ministry of Finance at the national level.

4. Rate Structure

Professional Tax:

State-specific and the rates may be fixed or vary based on income slabs. The tax is often capped to ensure that it does not excessively burden individuals.

Income Tax:

Progressive in nature, with rates increasing as the taxable income rises. Various exemptions, deductions, and rebates are available to individuals to optimize their tax liability.

5. Frequency of Payment

Professional Tax:

Typically paid on a monthly or annual basis, depending on state regulations.

Income Tax:

Paid annually, with advance tax payments required for specific categories of taxpayers.

Conclusion

In summary, employers and professionals share the responsibility for collecting and paying professional tax. Employers play a crucial role in deducting tax from their employees’ salaries, depositing it with the government, and fulfilling various reporting requirements. Conversely, professionals are responsible for their own tax assessments, direct payment to the government, and compliance with filing and record-keeping obligations. Understanding and adhering to these responsibilities is essential to ensure compliance with state-level professional tax regulations.

sfIkzdjeWqwb