Bangalore is known as the IT Hub of India. Since 2020, the number of small businesses in Bangalore has climbed up to 5,062, backed by its favorable entrepreneurial and financial ecosystem. As exciting as it sounds, launching a small business in Bangalore can be overwhelming. Such launches demand a strong business plan, enough funding, and a complex procedure of regulatory compliance. In this regard, this blog is going to shed significant light on the essential regulatory compliances to start a small business in Bangalore. It must also be understood that the responsibility does not end with its launch, rather it gets started. Hence, this blog has also covered the post-launch compliances required to seamlessly run a small business in Bangalore for you.

Table of Contents

Some Useful Compliance Tips for Your Small Business in Bangalore

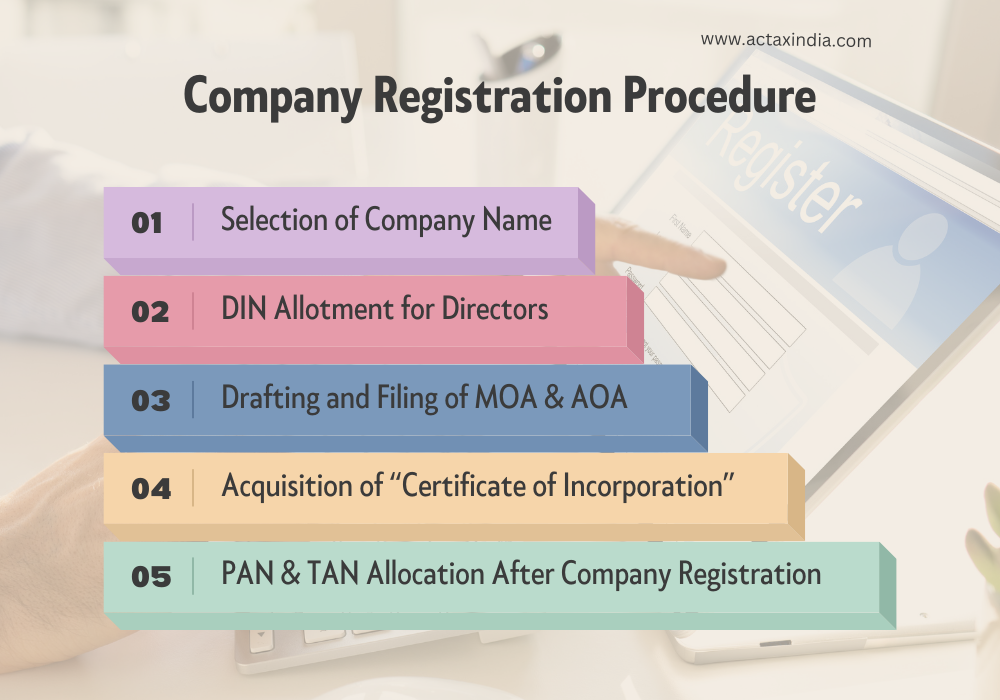

Company Registration Procedure for the Small Businesses in Bangalore

Legally speaking, the process of company registration in Bangalore is not that complex. Assuming by the name that it is a small business, the selection of a Private Limited Company as its organizational structure is more suggestible. A partnership can also work in this context. Here are the following steps, by which you can seamlessly register a small business in Bangalore (based on the guidelines of the Companies Act, 2013):

-

Selection of the Company Name:

Select an attention-grabbing company name that would somewhat be aligned with your business goals. Make sure that the name is aligned with the guidelines of MCA (refer to the Companies Act, 2013). Then, check the availability of the chosen name through the official MCA site and reserve it with ROC. The reservation process usually secures your preferred company name for 20 days.

-

DIN Allotment for the Directors:

In the next step, you should initiate the process of registration, by opting for DIN (Director Identification Number) allotment from ROC. Herein, every individual who would be acting as a company director must opt for the DIN numbers. The documents required in this process are photographs, address proof, and identity proofs, which you must submit along with the DIN allotment form and pay the prescribed MCA fees.

-

Drafting and Filing of MOA & AOA:

In the following step, draft your MOA (Memorandum of Association) and AOA (Articles of Association), which should clearly outline the objectives and rules of the company, along with its internal governance structure and regulations. Again, refer to the Companies Act, 2013 to frame them. After that, file them along with the prescribed ROC forms.

-

Acquire the “Certificate of Incorporation”:

Please note that the documents required for ROC approval include identification proof, address proof, DIN, DSC, proof of registered office, MOA, and AOA. Once all the documents are submitted and approved by ROC, the body will provide you with a “Certificate of Incorporation”. You will further receive a CIN (Corporate Identification Number). This step signifies the legal or official company incorporation. Choose Actax India to experience a seamless process of company registration, right at Bangalore!

-

PAN & TAN Allocation:

In the last step, apply to acquire the official company PAN and TAN, as these become a necessity during tax compliance. Reach out to the Income Tax Department to apply for the same.

Post-Registration Compliances for the Small Businesses in Bangalore

To ensure the smooth running of your Bangalore-based small business, you must follow these post-registration compliances to avoid any legal consequences.

-

Auditor Appointment:

As per Section 139(1) of the Companies Act, an auditor must be appointed within 30 days of company registration. The auditors must further be chosen by the Board of Directors. In case you fail to comply, an extraordinary general meeting must be held within 90 days to choose an auditor.

-

First Board Meeting:

As per Section 173(1), the first board meeting must also be held within 30 days of company registration. Every director should be notified about the meeting before one week. Apart from that, you’re also supposed to hold a minimum of 4 board meetings per year. The gap between these meetings should not be more than 120 days.

-

Disclosure of Interest:

According to Section 184(1) of the Companies Act, all the directors must disclose their shares and stakes at the board meetings with full transparency. Any change in disclosure should further be communicated immediately by them. By DIR-3 KYC, all the Directors are further subjected to submit their KYC details.

-

Annual General Meeting:

According to Section 96, your company should further have an annual general meeting. The meeting should be held on a non-public holiday and during office hours. The venue can be the registered office itself, or it can be held in some nearby location (i.e., within the village/town/city of the registered office). You must also make sure that the meeting is being held within 9 months (of the financial year) since the company’s inauguration.

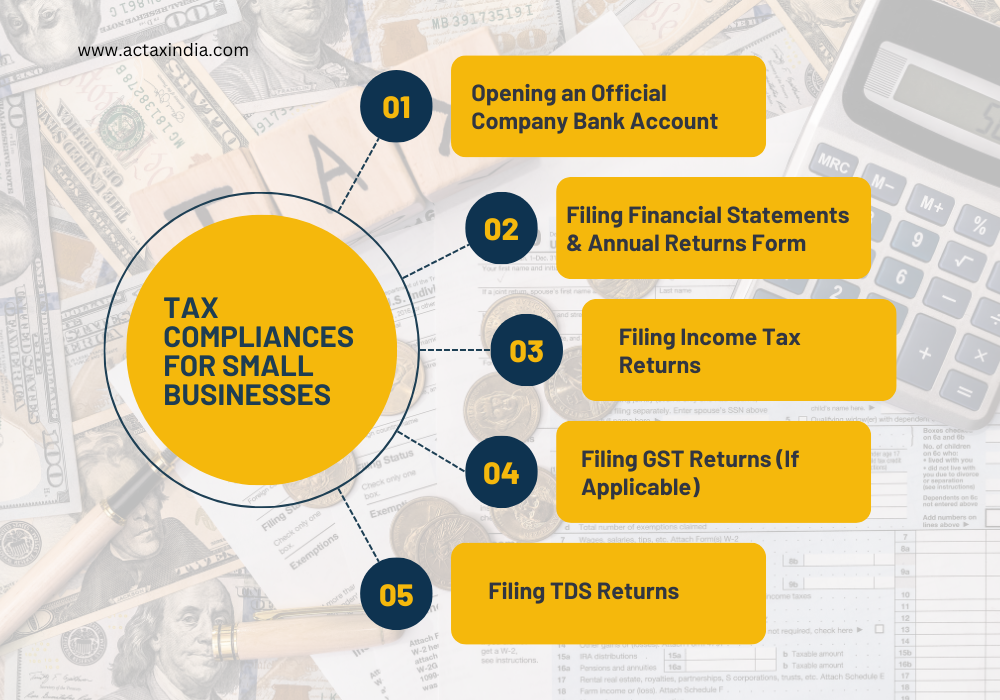

Mandatory Tax Compliances for the Small Businesses in Bangalore

Taxation can be hectic, and tax compliance can be even more frantic. Hence, select Actax India to smoothen your taxation journey! Here are some of the mandatory tax compliances that your small business must follow in Bangalore mandatorily:

Opening an Official Company Bank Account:

It is important to open an official company bank account within the first 60 days of company registration. You should set up the bank account under company name only. In this context, the required documents include the “Certificate of Incorporation”, MOA, the Board’s resolution to open the bank account, address proof (of the company), identity proof and PAN of the Director and the letter of PAN allotment.

Filing Financial Statements & Annual Returns Form:

As per Section 128 of the Companies Act 2013, it is equally mandatory for the small businesses of India to maintain proper books of accounts. All the companies are required to file their Profit and Loss Statements (refer to AOC-4 Forms), Balance Sheets and and so on, at the AGM (Annual General Meeting). The auditor of your company must further file the annual returns, by leveraging the MGT-7 Forms.

Filing Income Tax Returns:

It is also necessary for your small business to annually file the IT returns by July 31st (i.e., the usual due date as per the financial calendar of organizations).

Filing GST Returns (If Applicable):

Your company must register for GST if its annual turnover is more than ₹20 lakhs. In simple terms, a company must file its GST returns as per its business nature, turnover, and activities. The frequency of filing can either be monthly or quarterly or annually.

Filing TDS Returns:

If your company deducts TDS (Tax at Source) from payments like professional fees and salaries, then you need to make a Government deposit, and in turn you can claim it through filing returns.

Basic Licenses to be Obtained to Run Small Businesses in Bangalore

For all the small businesses in Bangalore, the attainment of all these licenses is suggestible:

- PAN (Permanent Account Number) & TAN (Tax Collector Account Number)

- TIN (Taxpayer Identification Number) under Karnataka CST and VAT (for goods category)

- Registration under Karnataka Shops & Establishments Act, 2023

- Service Tax Code (for service category)

- PF/ESI Registration (if more than 20 individuals are employed)

- Professional Tax (PT) Registration

- Udyog Aadhaar Registration (to leverage Governmental advantages)

Labour Law Compliances for the Small Businesses in Bangalore

If you own a small business in Bangalore, make sure to incorporate a healthy work culture. This is beyond the circumference of any regulatory compliance. Instead, it is more obvious because of Bangalore’s competitive employment culture and labor market, wherein your competitors are always one step ahead to steal your best talents. However, it is not without its share of regulatory requirements, which are as follows:

EPF Registration:

An EPF (Employees’ Provident Fund) Registration is mandatory if your company has over 20 employees. This relevant registration contributes to PF (Provident Fund) schemes.

ESI Registration:

Similarly, an ESI (Employees’ State Insurance) Registration is mandatory if your company has over 10 employees. The relevant registration contributes to the social and medical benefits of the employees. The HR Policy of your organization should further be aligned to the Minimum Wages Act 1948, Payment of Wages Act 1936, Equal Remuneration Act 1976, and Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act 2013, to ensure optimum compliance.

IPR Compliances for the Small Businesses in Bangalore

There has been an alarming increase in the number of small businesses in Bangalore since 2020. As a result, instances of IPR breaches (i.e., with similar logos and product designs) have become very frequent. Protecting your intellectual property rights is crucial for safeguarding your unique business ideas. Hence, it is suggestible that you keep all your IPRs registered. These include trademark registration, copyright registration, patent application, trade secret protection, and industrial design registration.

Conclusion: Compliance Safeguards You and Your Business.

Regulatory compliance not only protects your startup from adversary legal consequences but also keeps your business on track, both morally and intellectually. It ensures seamless administrative functioning as well. Most importantly, it fosters a positive work environment. So, prioritize compliance for your benefit. Retain more employees and attract potential customers by staying legally sound. To opt for regulatory services for small businesses in Bangalore, select Actax India! We provide company registration services as well as other regulatory services like auditing and accounting, GST registration and filings, ITR filings and TDR returns, secretarial compliances, and so on. To know more, visit our website.