If you’re dreaming about owning your startup, you must be aware of the problems and benefits you could face, if you do or do not register your startup. Precisely speaking, you would face a three-fold problem, if you do not choose to register your startup, i.e., legal issues, financial problems, and inability to attract investors. However, registering your startup comes along with multi-faceted benefits (and you can find them all over the internet). This blog has been leveraged to rank the top 7 benefits of company registration for startups, with a clear rationale, so that you have more clarity and set your priorities right. Simply speaking, so that you know how to leverage the core advantages of company registration for startups.

The Core Advantages of Company Registration for Startups: Ranked Through Critical Appraisal

Ranked 7: Easy Exits

If your startup is registered, you can easily wind it up whenever it pleases you. To be precise, within 90 days from the date of exit application filing, you can wind it up. You can easily close off your startup by closing its bank accounts and by subsequently filing DIN KYC, GST Cancellation and ITR-6, coupled with a winding up statement.

This specific advantage has been taken into consideration because of its capacity to enable the startup owners to liquidate the company stocks. Herein, it must be understood that the financial limitations of the startup owners are significantly huge. By registering a company, they can keep themselves from the financial headache of not being able to make their startup work. Eventually, this psychology can set them free from any fear, thus enhancing their overall performance quotient.

Ranked 6: IPR Protection

If your IPR is not protected, then understand that your business originality is at stake. IPRs protect all your unique business ideas, branding, and USPs. To put it simply, anyone can steal your original ideas and make them their own and eventually start a business if you do not keep them protected. So, IPR protection has been ranked in 6 as a dominant advantage of company registration for startups.

By legally registering your company, you’re opening yourself up to the benefits of legal protection provided by the law of the land (i.e., India), and IPR protection is one of them. In India, the Trade Marks Act, of 1999, the Copyright Act, of 1957, the Designs Act, of 2000, and the Patents Act, of 1970, protect your business from any intellectual theft. By registering the copyright, trademark, patents, and designs of your startup, you can enhance its protective quotient.

Ranked 5: Brand Development

Company registration enhances brand credibility. In other words, by legally establishing your business, you can prove the existence of your business in the market (i.e., through brand name registration). Moreover, during the company registration process itself, you are required to select a unique name for your business to create a differentiating factor. By leveraging it, you can seamlessly develop a strategy around your brand’s uniqueness to promote it.

It is ranked in the middle spot (i.e., spot 5) because it is pointless to point out how important branding is, for a startup. The entire growth strategy of a startup revolves around branding and how it will be positioned in the market. Based on that positioning, a startup either survives or falls apart (especially in the long run). Hence, brand development can be considered one of the most prominent advantages of company registration for startups.

Ranked 4: Fundraising Feasibility

A registered company will always attract more investors than an unregistered one. In this regard, firstly, it is important to understand the significance of fundraising for a startup. Startups come with their financial limitations. Startups are just long-term future investments; the result of which remains highly volatile at all times. Their entire funding comes either from business loans or angel investors or venture capitals/Government. Instances of crowdfunding and bootstrapping are very rare and only happen in exceptional cases.

To raise funds from core sources like bank loans or venture capital, the legality of the company must be established, which is not possible without registration. In short, the fundraising capacity that gets enhanced with company registration can be considered worthy of rank 4 because a startup cannot start without finance.

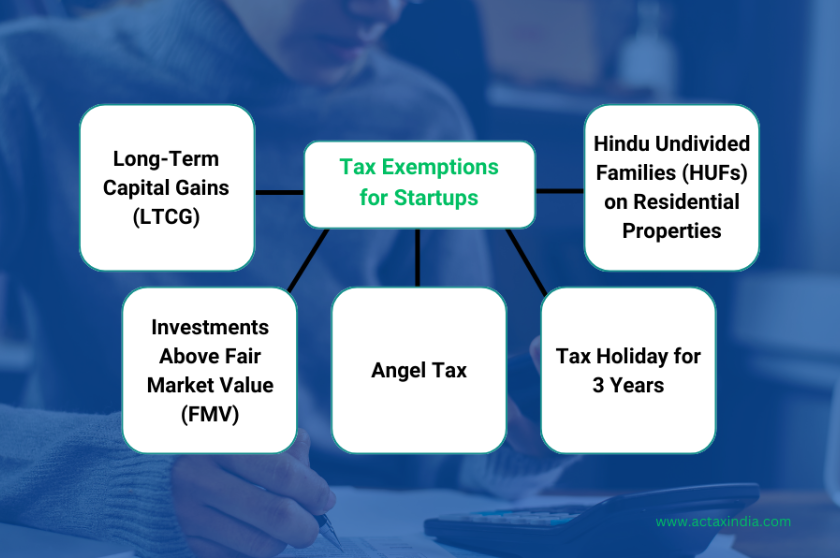

Ranked 3: Tax Exemptions

In India, a registered startup enjoys a wide range of tax exemptions, and hence it has been ranked so high in the list of benefits of company registration for startups. These are exclusive benefits that put the startups in an advantageous position regarding investments, holidays, capital gains, IT reliefs, and so on. The core tax exemptions that are available to the registered startups of India are as follows:

Long-Term Capital Gains (LTCG):

Legally recognized startups can invest their long-term capital gains on Government-specified funds, as implemented by Section 54EE of the Income Tax Act, within the first 6 months since its inception to avoid taxes. Herein, the maximum investment amount is ₹50 lakhs, which must be held for three years.

Investments Above Fair Market Value (FMV):

Investments that exceed a startup’s fair market value by incubators, angel investors, or non-venture capital funds are tax-exempt. This provides more finance for the startups. Section 56(2)(viib) of the Income Tax Act, talks about investments over fair market value.

Section 54GB of the Income Tax Act, 1961:

Hindu Undivided Families (HUFs) or individuals selling residential property have the potential to reinvest the gained finances in eligible startups and avoid the previously mentioned LTCG tax. However, these shares cannot be sold within the time limit of 5 years, and neither can the startup unhand the invested amount for the upcoming 5 years.

Tax Holiday for 3 Years:

If your startup is either identified as a private limited company or an LLP, you can opt for this exemption, as mentioned under Section 80 IAC of the Income Tax Act. If your startup is registered between April 1, 2016, and March 31, 2022, then you can get 3 consecutive tax holidays for your financial years out of the first 10 years.

Section 56 of the Income Tax Act, 1961:

To avoid angel tax in India, your startup must be DPIIT recognized startup. It must have a total share capital and a premium under ₹25 crore after any new share issuance. This targets smaller startups with government approval for easier access to angel investors.

Ranked 2: Limited Liability Protection

Limited liability protection helps you (i.e., the startup owner), as an individual from any and every unwanted financial liability that might arise from business loans, losses, and credits, by separating you from your business as two different legal entities. Hence, it has been ranked in the spot 2 within the list of benefits of company registration for startups. However, to enjoy limited liability protection, your company must be registered under either the Companies Act, 2013, or the Limited Liability Partnership Act, 2008.

Limited liability protection manifests as personal asset protection. Suppose, your startup gets sued financially for some regulatory breach; and if you were not eligible for the limited liability protection, then all your personal belongings like savings, house, etc. would have come in between. In other words, this protective right sets you free to take calculative business risks. Precisely speaking, this protective benefit stands out from the rest of the benefits.

Special Mentions

Here are some special mentions, before uncovering the number 1 spot (for the advantages of company registration for startups :

Networking Opportunities

As mentioned previously, by registering your startup, you establish its credibility in front of the world. This further opens up a lot of networking doors. Now, you look more approachable in front of your potential partners, collaborators, and investors. This is mainly because registration increases the transparency quotient of your business.

Superior Talent Acquisition

Backed by the same point of transparency, it can be asserted that the increased transparency quotient also increases the authenticity of your business. Think from the worker’s perspective! If you’re a skilled or highly skilled individual, would you like to work for a company that is not legally established or registered?

Expansion in Foreign Markets

An unregistered company can never expand its businesses or services in the foreign market. To get global recognition or to draw foreign clients, you must register your startup. International laws do not permit unregistered trading. It can even be read as a felony in extreme situations, depending on the nature of your business.

Ranked 1: Legal Recognition

Now, coming to the number 1 spot, company registration ensures legal recognition. All the previously mentioned benefits come down to this one point! By registering your company, you ensure its legal validity. As a result, your startup becomes eligible for all the legal protections and benefits that the law of our land offers.

To name a few, your startup becomes eligible for opening a separate bank account. It also becomes eligible for entering legal contracts and agreements. As it becomes a legal entity, it can separately sue some other person or entity. It is almost like getting a birth certificate for your company! Hence, the core advantage of legal recognition has been ranked 1 in the list of “Benefits of Company Registration for Startups”.

Conclusion

Registering your startup is no formality! It authenticates your business in front of the world. In the end, it can be said that it is the authenticity that pushes the business/startup towards an advantageous position, by attracting investors, workers, professional networks, etc. The legal benefits and protection that comes along with the registration, shields both the startup as well as its owner from any unnecessary harm.

For startups in metro cities, especially those opting for company registration in Mumbai, these benefits can be a game-changer in establishing a strong market presence and legal standing. So, support business registration for your benefit! Hope the list of advantages governing company registration for startups was helpful to you. For more such delightful lists, follow Actax India.

Comments are closed.