Company registration can be a daunting task! Be it an LLP registration or a Pvt Ltd. Registration. What if you could do it on your own? Form SPICe+ and Form FiLLiP bring on an integrated platform, where you can opt for any company registration type. Form SPICe+ further ensures name approval and PAN/TAN registration. Form FiLLiP, on the other hand, enables company conversion to LLP.

However, navigating these forms on your own can be a little challenging. To simplify the process, this blog has presented a simplified version of the SPICe+ Form Help Kit and FiLLiP Form Help Kit, which you will find easy to understand.

SPICe+ Form Help Kit & FiLLiP Form Help Kit: Instructions & Comparative Analysis

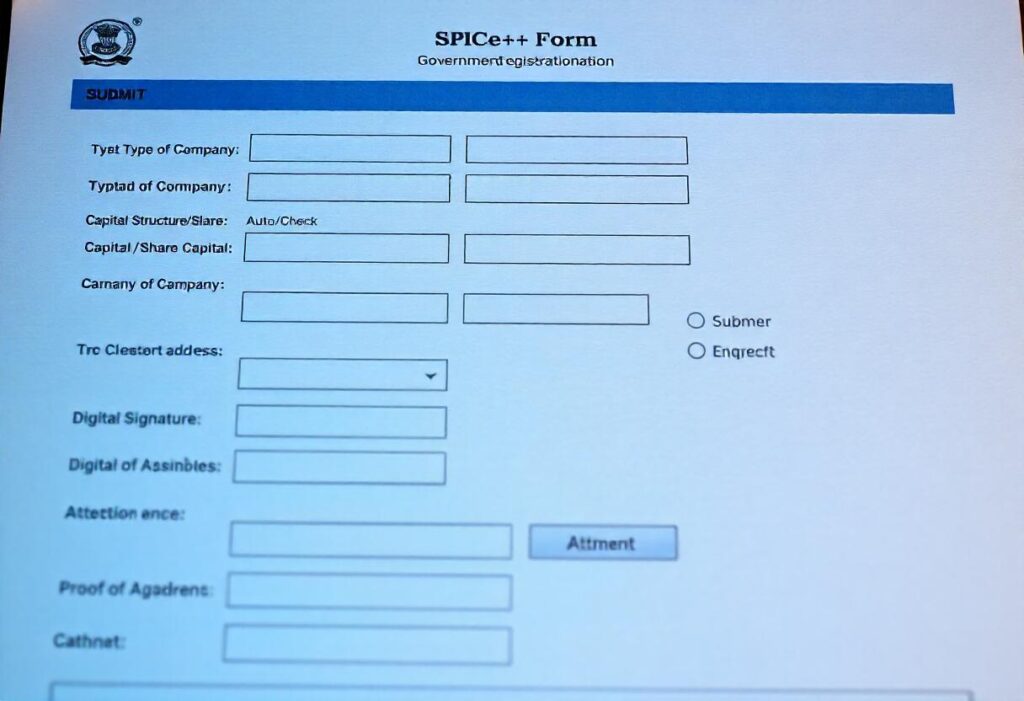

Purpose of SPICe+ Form

The SPICe+ Form lets users reserve the company name, apply for company incorporation, and apply for DIN, TAN, and PAN simultaneously. It is more like an integrated platform for company registration. It is also known as the INC-32 Form, usually used to incorporate company structures like Private Limited Company, Nidhi Company, One Person Company, Public Limited Company, Section 8 Company, and Producer Company

SPICe+ Form Help Kit

References | Description | Instructions |

1.(a) | Type of Company | Select the correct type for your company (e.g., OPC, Public Limited, Private Limited, etc.). |

1.(b) | Class of Company | Select the correct class for your company (e.g., One Person, Private, Public, etc.). |

1.(c) | Category of Company | Select the correct category for your company (e.g., Company Limited by Shares, Unlimited Company, etc.). |

1.(d) | Subcategory of the Company | Select the correct subcategory for your company (e.g., Guarantee and Association company). |

2. | Main division of Industrial Activity of the Company | Enter by finding the main division code and description (e.g., manufacture of textiles -17, Construction -45, etc.). |

3. | Particulars of the Proposed or Approved Name | Enter the proposed name of the company. |

Attachment | Attach supporting documents, in case the company name has been already approved. | |

Auto-Check | – | Click to validate the entered name. |

Save | – | Click to save the entered information. |

Submit | – | Click to submit the application for name reservation/ incorporation. |

4. | Articles of Association | Specify if any articles (within the AOA) are different from the standard AOA template and provide details. |

6.(i) | Capital Structure/ Share Capital | Enter details of subscribed and authorized shares. Minimum amounts are applied here. Give details via segments like number of equity shares, total amount of equity shares, nominal amount per equity share, etc. |

6.(ii) | Number of Members | Enter the number of members by applying the minimum and maximum limits. |

7.(a) | Correspondence /Registered Address | Enter the company’s correspondence address (including email and PIN code). |

7.(b) | Registered Office Address | Select if the correspondence address is also the registered office address. If not, provide proof (e.g., utility bill) for the different registered address. |

7.(c) | ROC Office Selection | Select the appropriate ROC office based on the state valid for the company. |

8.(a) | Subscribers and Directors | Enter the number of directors and subscribers (including those with and without DIN). |

Non-individual Subscribers | Enter the number of non-individual subscribers. | |

Individual Subscribers | Enter the number of individual subscribers. These are not directors. | |

Individual Directors and Subscribers | Enter the number of individual subscribers, who are also directors. | |

8.(b) | Particulars of Non-individual First Subscriber (not having DIN) | Enter category, CIN/FCRN, authorized person details, and share subscription details. |

8.(c) | Particulars of Individual First Subscriber (Non-Director) | Enter DIN, share subscription details (if applicable), and KYC documents (if not having DIN). |

8.(d) | Particulars of Individual First Subscriber & Director | Enter DIN, share subscription details, designation, category, and KYC documents (if not having DIN). |

8.(e) | Particulars of Directors (other than First Subscribers) | Enter DIN, designation, category, shareholding details, and KYC documents (if not having DIN). |

9.(a) | Nomination | Enter the name of the nominee (only applicable for OPC). The nominee must not be a subscriber/nominee of another OPC. |

9.(b) | Nominee Particulars | Enter DIN (if available) or PAN, KYC details, and proof of address/identity (only applicable for OPC). |

10.(a) | Stamp Duty | Pre-filled based on company address. |

10.(b) | Electronic Stamp Duty Payment | Choose Yes/No/Not Applicable. |

10.(b).(i) | Stamp Duty Details (if applicable) | Auto-filled based on state rules for e-Form, MOA, and AOA. |

10.(b).(ii) | Pre-paid Stamp Duty Details (if applicable) | Enter details if stamp duty was already paid. |

11. | TAN & PAN Application | Enter necessary details associated with TAN and PAN registration. |

Source of Income | Select the business/profession code (e.g., engineering -2, IT -12, interior decoration -5). | |

Attachments | MOA & AOA | Mandatory if it is a Section 8 company, or a Part I company, or a company having non-Indian subscribers, or more than 7 subscribers. |

Declaration | Mandatory if the company has more than 20 subscribers/directors. Also, mandatory when the subscribers/directors are without PAN/DIN. | |

Proof of Registered Office Address | Mandatory if the correspondence address of the company is the same. | |

Foreign Subscriber Certificate | Mandatory if a subscriber is a foreign company (optional for Body Corporate subscriber). | |

Promoter Company Resolution | Mandatory if a subscriber is a company. | |

Director’s Interest Disclosure | Mandatory if a director has interests in other entities. | |

OPC Nominee Documents | Mandatory for OPCs (requires consent, and proof of ID/address of nominee.). | |

Subscriber Proof of ID/Address | Mandatory if subscriber lacks DIN. | |

Director Proof of ID/Address | Mandatory if director (including subscriber-director) lacks DIN. | |

Unregistered Company Resolution | Mandatory for Chapter XXI (Part I) companies. | |

Section 8 Company Declarations | Mandatory for Section 8 companies. | |

Optional Attachments | Other necessary documents, if required, depending on the company registration case. | |

Declaration | Applicant Details | Enter the name of the applicant, along with other necessary details. Herein, either a director can come forward for the declaration, or a professional eligible to do so can come forward. |

Profession | Select professional type (e.g., CA, CS, CMA, Advocate, etc.) and enter membership/certificate number (in case the applicant is a professional). | |

Digital Signature | Put the DSC of any of the authorized directors, or the applicant’s DSC (as the case may be). | |

DIN/PAN/Membership Number | Enter approved DIN (if available) or PAN/membership number associated with the DSC of the applicant (as the case may be). |

Note: Visit https://www.mca.gov.in/Ministry/pdf/SPICe+_help.pdf for more details.

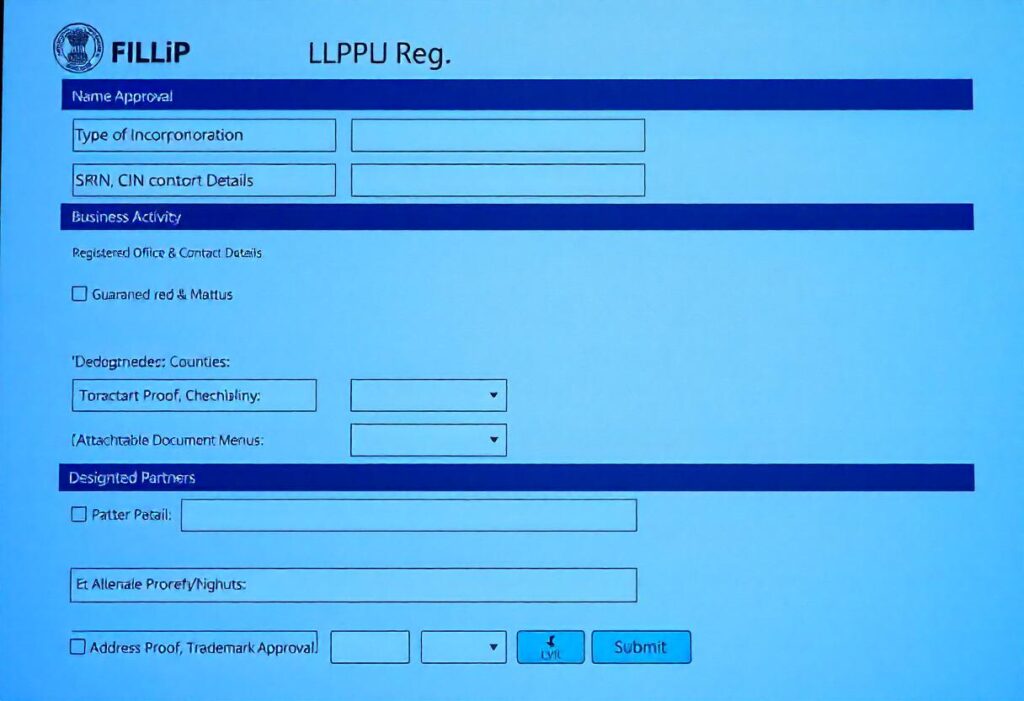

Purpose of FiLLiP Form

Form FiLLiP lets users streamline the registration process for LLP (Limited Liability Partnership). To be more specific, it is an integrated platform that enables the users to opt for name reservation (only for LLPs), DPIN allotment, LLP registration, consent of the partners to an LLP, conversion of a Private Limited Company or a Partnership Firm or an unlisted Public Company into LLP, and facilitates PAN/TAN allocation for the LLP in context.

Start Your Company Registration Process!

FiLLiP Form Help Kit

References | Description | Instructions |

1.(a) | Name Approval | Indicate if the name is already approved (select “Yes” if the name is already approved). |

1.(b) | SRN of RUN-LLP | Required if name is already approved. Enter the SRN of RUN-LLP. |

1.(c) | Type of Incorporation | Pre-filled if SRN is entered. Else, needs to be filled manually. Choose the incorporation type correctly (e.g., New LLP, Conversion, etc.). |

1.(d) | CIN | This option is only required for conversion of a company into an LLP. Enter a valid CIN of a private/unlisted public company. |

2.(a) | Proposed or Approved Name | Pre-filled if SRN is entered (non-editable). Else, needs to be filled manually. |

2.(d) | Trademark Analysis | Indicate if the name is based on a registered or pending trademark and attach proof. |

Attachments | Regulatory Authority Approval | If the name is not already approved thus requiring regulatory approval. |

Trademark Approval | If the name is based on a registered or a pending trademark. | |

Central Government Approval | If the name contains certain prohibited words or certain specific words indicating government association. | |

Foreign Collaboration Approval | If the name suggests foreign connection or collaboration. | |

LLP/ Company Consent | If the name matches with an existing company or LLP (or sounds similar to it). | |

3.(a & b) | Registered Office & Contact Details | Enter complete address and contact information of the LLP in context |

Attachments | Address Proof | Upload proof of the LLP office address through lease deeds, or rent agreement, etc. Include utility bills (not older than 2 months). |

4. | Business Activity | Select primary industry sub-class (NIC code) and enter additional NIC codes (up to 3). Select only one “Primary” subclass. |

4.(a) | Main Industrial Activity | Pre-filled based on either the selected primary NIC code or the SRN of RUN-LLP. |

5. | Number of Partners | Enter the total number of designated partners and partners. The “Total number of Designated Partners (having DIN/DPIN and not having DIN/DPIN) shall not exceed 3”. |

6.(A) | Designated Partner (DIN/DPIN) | Pre-filled if DIN/DPIN is entered. |

6.(B) | Designated Partner (No DIN/DPIN) | Enter the details of the designated partners manually (along with verifying PAN). Upload ID proof & address/residential proof mandatorily. |

6.(C) | Body Corporate Nominee | Attach resolution and nominee details (through DIN/DPIN) if a body corporate is a designated partner. |

8. | Total Contribution | Pre-filled based on partner contributions. |

9. | PAN/TAN Application | Enter the area code for PAN/TAN application. |

Codes | For conversion/new LLP registration: Area Code: 3-letter code (e.g., ABC). AO Type: 2-letter code (e.g., XY). Range Code: 3-digit number (e.g., 123). AO No.: 2-digit number (e.g., 45). Business/Profession Code: Between 01 and 20. | |

Attachments | Valuation Certificate | If any non-cash contribution has been made. |

Optional Attachments | Up to 5 additional attachments can be uploaded. | |

Consent by Designated Partners/Partners | – | Provide details of partners, their consent to join the LLP, and contribution details. |

Subscribers’ Sheet | – | Attach a signed copy of the subscribers’ sheet. |

DSC | – | Ensure a designated partner digitally signs the form. |

DIN/DPIN/PAN | – | Enter the approved DIN/DPIN or PAN of the signing designated partner. |

If Applicant Is Professional | – | If signed by a professional, enter their details (i.e., CA, CS, CMA, Advocate, etc.) and PAN. |

Note: Visit https://www.mca.gov.in/content/dam/mca-aem-forms/instructionkits/Instruction%20Kit_Form%20FiLLiP.pdf for more details.

SPICe+ Form Help Kit Vs. FiLLiP Form Help Kit

Criteria | SPICe+ Form Help Kit | FiLLiP Form Help Kit |

|---|---|---|

Audience | For new or unregistered startups. | For conversion to LLP or formation. |

Complexity | More complexity due to the wide magnitude of company registration options. | Less complexity as it only deals with LLP and associated processes of conversion. |

Utility | Enables Private Limited Company, Nidhi Company, One Person Company, Public Company, etc. registration | Enables DPIN allotment, LLP registration, Private Company or Public Company Conversion into LLP. |

Usage Frequency | Used more frequently by startups. | Used less due to lesser LLPs. |

Approval Timeframe | 10-18 business days | 7-10 business days |

Conclusive Interpretations: SPICe+ Form Help Kit & FiLLiP Form Help Kit

Both the SPICe+ Form Help Kit and FiLLiP Form Help Kit enable the budding entrepreneurs of India to start or restructure their businesses. Knowing the purpose of each form, observing the steps defined, and analyzing the differences, you will know how not to get lost in the legal labyrinth.

This blog aims to offer a roadmap to assist you as an entrepreneur in turning your business ideas into a reality. Follow Actax India for more such informative blogs.