It is an open secret that the financial market of India is a highly dynamic business environment currently filled with a lot of opportunities. The one who rules the kingdom is CIC among all these players. To anyone who may be interested in diversifying into this sector, you for a thrilling ride. But what exactly are core investment companies? Oh, it is more like a financial behemoth that mainly functions to invest in shares and securities of group companies. CICs do not engage in trading these investments like traditional investment firms do. Rather, their primary objective is to either retain or even expand the proportionate ownership of such group companies.

Intrigued? Feel like starting your CIC journey? Well, guess what? You’re in the right place! Hang in there as we are going to demystify all that you wish to know about core investment companies requirements to invest in India. Everything you need to know from starting your business to all the administrative work required. Well then, let’s get to it!

Table of Contents

What Makes a Core Investment Companies Tick?

Before plunging straight into the details of registration, let us first take our time and identify essential characteristics of Core Investment Companies. As for the Reserve Bank of India (RBI), it regulates the CICs and considers them a subset of Non-Banking Financial Companies (NBFCs).

Here’s the key thing to remember: CICs are closely aligned with the purchase of shares and securities. They cannot engage in any other business-related activities. Specifically, in order to become a CIC, a company must have an astounding 90% of its net assets invested in the shares of group companies. That is something referred to as putting all your eggs in one basket!

This unique feature places CICs in a strategic position within a corporate organization and most of them act as the parent companies of other major conglomerates. The latter helps businesses optimize their processes and to have proper control over their investments also keep reading the blog for detailed guide 15 things to know before starting a new business

The CIC Family Tree: Types of Core Investment Companies

Alright, let’s break down CICs into two flavors:

First, we’ve got the big dogs – Systemically Important CICs. These are the heavyweights with assets of ₹100 crore or more. They’re called “systemically important” because if they sneeze, the whole financial system might catch a cold. So, the regulators keep them on a tight leash.

Then there are the little guys – Non-Systemically Important CICs. These are the smaller players with less than ₹100 crore in assets. They’re still part of the game, just not big enough to shake things up if they stumble. The rules are a bit more relaxed for these underdogs.

Understanding which category your CIC falls into is crucial, as it will determine the specific regulations you’ll need to comply with.

The Rule Book: Regulatory Framework for CICs

If you’re going to play in the CIC sandbox, you need to know the rules. Core Investment Companies in India are governed by a triad of regulatory frameworks:

First up, the RBI Act of 1934 – it is just like the big boss, setting the floor policies for all financial players, consisting of CICs.

Then we’ve got the CIC Directions from 2016. This is your pass-to guide for CICs, protecting all of the nitty-gritty from a way to register to what reports you want to report.

Don’t overlook the Companies Act of 2013 – CICs aren’t unique snowflakes, they have got gotta follow identical regulations as different groups.

All these guidelines work collectively to preserve CICs in line and the financial system wholesome.

Getting Ready: Prerequisites for Registering a Core Investment Companies

Ready for the lowdown on getting your core investment companies registering off the ground in India? Buckle up, ’cause here it comes:

First things first, you gotta make it official. Head over to the Ministry of Corporate Affairs and get your company registered under the Companies Act, 2013. No workarounds here, folks.

Now, let’s talk money. You’ll need a cool ₹2 crore in net worth to play this game. Yeah, it’s a big number, but that’s how they weed out the tire-kickers.

Here’s the real kicker: 90% of your net assets need to be core investment companies invested in your group companies’ shares and securities. That’s your bread and butter, your whole reason for being.

And remember, you’re in the investment game only. No side hustles allowed. No lending, no taking deposits, none of that jazz. Think of yourself as an investment monk – totally focused on one thing also refer to this blog 7 benefits of company registration for startups

So, you got the cash and the commitment? Welcome to the CIC club!

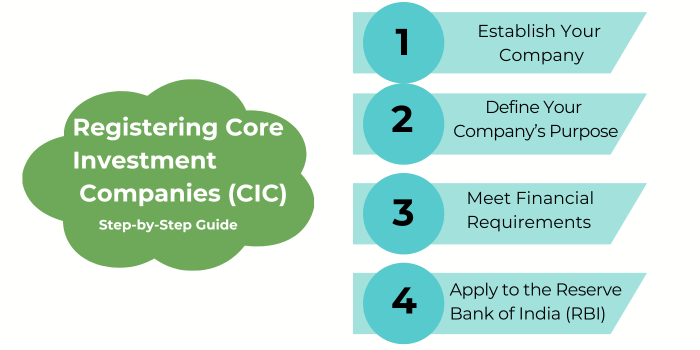

The Journey Begins: Step-by-Step Registration Process

And here comes the most awaited part!! Buckle up as dive into the depths of getting your core investment companies (CIC) off the ground. Don’t worry – we’ll take it step by step:

Step 1: Breathe Life into Your Company

First things first, let’s make your company official under the Companies Act, 2013.

Pick a relevant name: The Ministry of Corporate Affairs (MCA) has some picky rules. Make sure your organisation name screams “core investment companies.”

Paperwork hassles: Time to channel your inner bureaucrat. You’ll need to whip up your Memorandum of Association (MoA), Articles of Association (AoA), and a bunch of forms with names like INC-32 (SPICe), INC-33, and INC-34. Take all these at the MCA and cross everything you’ve got.

The company came to life: If the stars align, the MCA will bless you with a Certificate of Incorporation. Boom! Your company’s officially alive.

But all this may take time so don’t panic. Let’s move to the next part:

Learn – Company Registration Bangalore Everything You Need to Know

Step 2: Write Your Company’s Playbook

Next up, you’ve gotta craft your MoA and AoA. These are like your company’s constitution and house rules.

The MoA is crucial here. Make it crystal clear that your company’s main gig is investing in shares and securities of your group companies. This is your CIC’s whole reason for existing, so spell it out like you’re explaining it to your grandma.

As for the AoA, this is where you lay out how your company’s gonna run. Who calls the shots? What are the bigwigs responsible for? How do you dish out shares? Get it all down on paper.

Step 3: Money! Money!

Time to flex your finances! You need to prove that you got what it takes- we’re talking of a minimum net worth of ₹2 crore.

Get all your financial statements that show off your net worth- these need to follow the Indian Accounting Standards (Ind AS). Why don’t you give a shot to a chartered accountant? Your accountant will help you to arrange the numbers.

Step 4: Hello Reserve Bank of India!

Alright, this is the big leagues now. Time to sweet-talk the Reserve Bank of India. Here’s what you need to bring to the party:

- A cover letter politely requesting registration as a CIC

- The RBI’s prescribed application form for CIC registration

- Copies of your Certificate of Incorporation, MoA, AoA, and financial statements

- A declaration from your directors promising that the company won’t engage in any financial activities except investing in shares and securities of group companies

Pro tip: Triple-check everything before you send it off. One missed shot and you could be back to square one.

And there you have it! That’s the guide to getting your CIC up and running. It’s no walk in the park, but hey, if it was easy, everyone would be doing it, right? Just take it one step at a time, and before you know it, you’ll be the proud parent of a bouncing baby core investment companies feel free to contact Actaxindia to company registration in Bangalore or Company Registration in Mumbai Good luck, and may the financial gods be with you!

Comments are closed.