Reconciliation in accounting is a crucial process that helps prevent accounting errors and financial losses, fraud, or other mishaps. It occurs at both individual and organizational levels, so it’s important for everyone to understand its key concepts. Use this information to learn about reconciliation accounting principle and determine if it’s a service you need.

Reconciliation in Accounting: Everything You Need to Know

Table of Contents

What is Reconciliation in Accounting?

Reconciliation in accounting refers to the process of comparing two financial data sets to check the precision of either or both of the financial data/reports. This usually involves a comparison between cash registers, bank statements, balance sheets, receipts, invoices, and general ledger accounts. The general ledger accounts are dominantly verified through this process. Frauds, misrepresentations, and deceptions are mitigated through this process of reconciliation.

Reconciliation in accounting is not only limited to business purposes, individuals can also check for the same. Individuals can use this method to verify their account statements (i.e., both credit and debit). Moreover, a survey by the “Association of Certified Fraud Examiners” (ACFE) revealed that the frauds associated with misrepresentation of financial statements constituted 9% of all the reportedly fraudulent cases in 2022. This showcases the importance of reconciliation in accounting. Previously, the process of reconciliation was conducted manually, but since the inception of cloud accounting, the landscape has changed significantly.

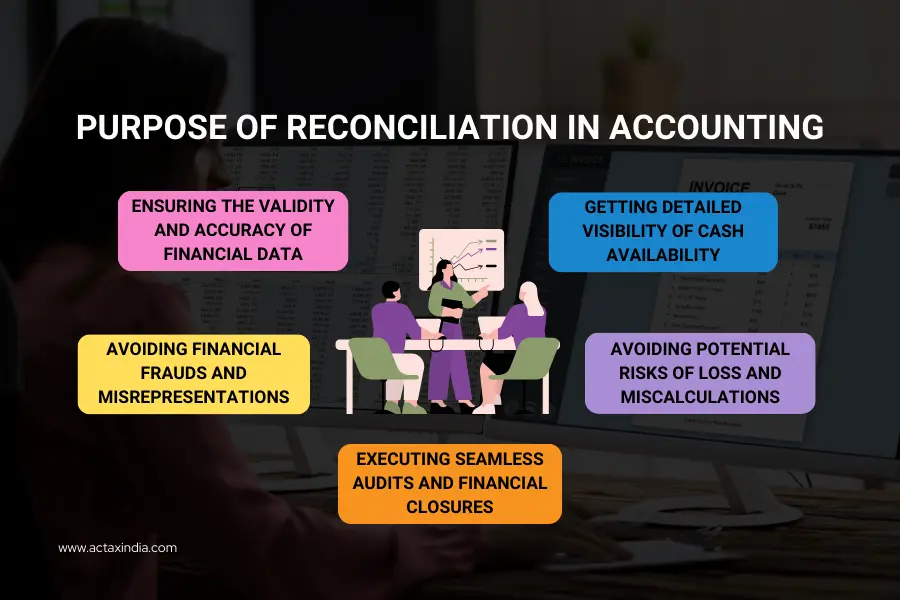

Purpose of Reconciliation in Accounting

The key purposes of reconciliation in accounting are as follows:

Ensuring the Validity and Accuracy of Financial Data

Reconciliation is a balancing mechanism. It involves the verification of the data entered in a company’s ledger against other figures from outside sources including bank statements, the supplier’s invoices, or the purchasers’ receipts. This process assists in making corrections of any mistakes or inadequate coherence of the figures involved in the financial status of the company, to release accurate information for dispatching in the statements as well as to aid in decision making. In simple terms, it ensures the accuracy and validity of financial data and keeps everything financially sorted for a company or an individual. also refer this blog Learn Top Features of Accounting Services

Avoiding Financial Frauds and Misrepresentations

Reconciliation, as a technique, is effective in discouraging fraudulent transactions and serves as an analytical approach to identifying irregularities in the accounts. Comparing the two monetary volumes or financial data sets may reveal deceitful transactions that otherwise would not be detected. This is something that is usually done by leveraging a multi-faceted cross-checking technique. It also assists in avoiding the manipulation of the financial statements and also protects the reliability of the financial reporting systems of the business enterprises.

Executing Seamless Audits and Financial Closures

The financial closing also becomes easier to do when there is regular reconciliation. This is because the errors that could have existed can be seamlessly mitigated as they are easily noticed within this process. Regular reconciliation of accounts adds reliability to the financial statements and can make the audits much easier to conduct. In short, it helps in the seamless execution of audits, further facilitating a smooth financial closure.

Avoiding Potential Risks of Loss and Miscalculations

Reconciliation may reveal issues that have the potential of causing loss of money in business transactions. For example, if an actual bank statement is different from the cash account statement, it may suggest that there are some cash flow problems. If such problems are recognized in the beginning, organizations have a greater chance to prevent negative effects that can cause significant losses. In other words, reconciliation in accounting helps in the avoidance of potential risks of loss and miscalculations

Getting Detailed Visibility of Cash Availability

Bank statement reconciliation is the process of verifying the balance in the company’s internal cash account and the balance reported by the bank. This gives one a good picture of the future cash flows that the company will be experiencing in the current financial year and the cash that it will be receiving and paying in the next few years. This is very important in financial planning, creating budgets, and generally in managing the company in a way that it can support its future projects as well. This eventually showcases a detailed visibility of the company’s overall cash availability.

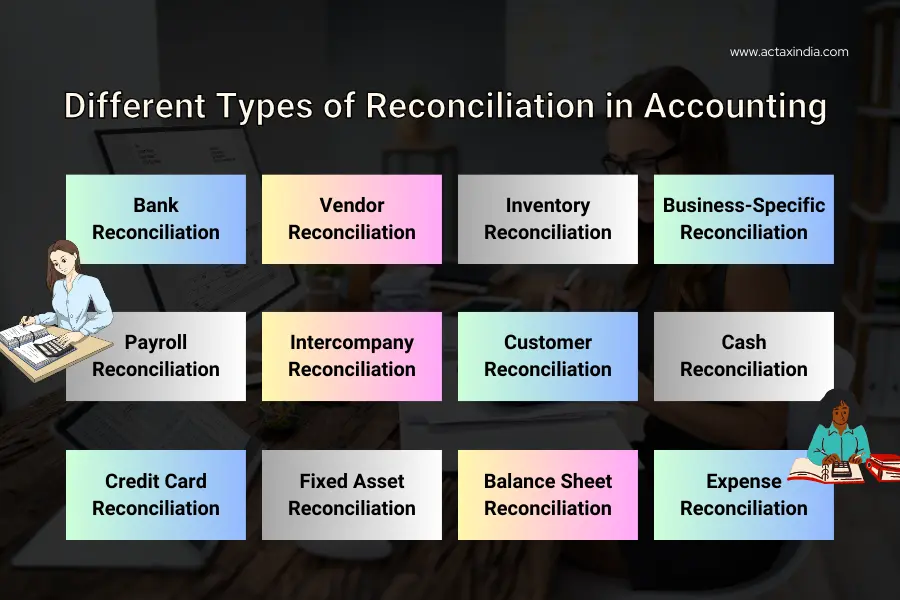

Different Types of Reconciliation in Accounting

There are various kinds of reconciliation in accounting. These different types of reconciliation in accounting have been briefly discussed in the section here under:

Bank Reconciliation

Bank reconciliation refers to the process by which a business compares its bank statements with the accounting records. This is done either to identify any discrepancies or mismatches or to verify whether both are in perfect sync or not. Herein, the discrepancies (e.g., deposits in transit or outstanding payments), are usually treated as timing differences.

Vendor Reconciliation

Vendor reconciliation, also known as accounts payable reconciliation, refers to the process of verifying the vendor’s financial statement with the company’s financial statements. This is done to identify how much balance the company owes to the vendor. To be more specific, within this process the accounts payable documents are compared with the invoices provided to the vendor.

Inventory Reconciliation

Inventory reconciliation refers to the process of comparing the monetary data associated with inventory management with the actual or physical inventory that a business would have in stock. The comparison helps in the identification of any existing discrepancies associated with the value of the present stock and the money spent behind them in the records.

Business-Specific Reconciliation

Business-specific reconciliations are unique to every business, depending on its structure and nature. However, as a general rule, it compares the internal records of the business at the beginning of a financial cycle with the ending of the cycle, to cross-check that the goods and services sold rightly match the overall financial record of the company.

Payroll Reconciliation

Payroll reconciliation refers to the process of cross-checking the information and records supporting an organization’s employee compensation plan. It verifies the amount paid to the employees by comparing it to the already established compensation plan of the organization. This is done to double-check the math and ensure that the employees are being paid correctly Here are some payroll services offers

Intercompany Reconciliation

Intercompany reconciliation happens when a company has one or more subsidiaries. It usually compares the transactions that happen between those subsidiaries to avoid any financial discrepancies and losses. The original data is always kept with the parent company and it is the parent company who conducts the cross-check.

Customer Reconciliation

Customer reconciliation, also known as accounts receivable reconciliation, refers to the process of comparing the bill of a customer with that of the company’s financial statements, to check the accuracy of the money earned and products and services sold. Frauds and errors are usually very dominant in this arena, heightening the need and importance of customer reconciliation.

Cash Reconciliation

Cash reconciliation, yet another type of reconciliation in accounting, refers to the process of comparing the external bank statements to the internal ledger entries of an organization. The core objective of cash reconciliation is to ensure the recorded fund balance matches up with the recorded bank balance.

Credit Card Reconciliation

As the name suggests, credit card reconciliation refers to the process of comparing all the credit card transactions with the company’s ledger account to ensure accurate bookkeeping. This process is extremely important for budgeting and subsequent financial reporting. That is why most of the companies conduct it every month.

Fixed Asset Reconciliation

To verify accuracy and spot financial inconsistencies, a company’s physical inventory, and accounting records for fixed assets are compared in a process known as fixed asset reconciliation. These fixed assets usually include plants, properties, industry equipment, PPEs, and so on.

Balance Sheet Reconciliation

Again as the name suggests, balance sheet reconciliation refers to the process of comparing the balance sheet of the company with the supporting financial documents of the company. This probably is the simplest type of reconciliation in accounting, conducted to prevent minor financial errors.

Expense Reconciliation

Lastly, expense reconciliation refers to the process of comparing the actual expenses of a business with the accounting and bookkeeping entries of the company. This helps in the maintenance of record-keeping accuracy and consistency. As a whole, it helps to balance bookkeeping and keep track of the cash flow of the company.

Best Practices of Reconciliation in Accounting

The best practices of reconciliation in accounting as per the industry standards are as follows:

Prioritize Reconciliation in Accounting

Concentrate on high-risk accounts in the first instance. They may include the accounts that post frequent transactions, complex arithmetic computations, or past experiences that entail making mistakes.

Leveraging a Standardized Process of Reconciliation

Reconciliation procedures should be standardized for every reconciliation. It helps in minimizing procedural errors, streamlining the training processes, and ensuring that all hands are on deck in following the process.

Utilize Technology and Embrace Automation

Optimize for data entry to avoid problems, such as errors or duplication of data, to enhance the workflow. Ai Accounting Automation is flexible and could help in time reduction, especially the chances of making mistakes that are associated with manual work.

Use KPIs to Monitor the Reconciliation Process

Monitor metrics such as time spent on reconciliation, number of errors found, and overall accuracy. This makes it easier to facilitate areas that need correction. Keep track of the corrections also to avoid repetition in the future.

Utilize Modern Tools and Techniques to Streamline Reconciliation

The open banking APIs allow their users to connect their bank accounts with various other financial services. Leverage that to streamline the process of reconciliation without putting any extra effort into connecting the data that are supposed to be compared.

Maintain Optimal Transparency during Reconciliation

Opt for a clear and consistent audit trail to maintain transparency throughout the process of reconciliation in accounting. This not only manifests transparency but also ensures future traceability on an overall basis.

Minimize Errors through Consistent Workflows

Try to maintain a consistent flow of work while opting for reconciliation. Even better if a standardized template can be maintained to conduct the process. This has the potential to reduce errors and misrepresentations.

Ensure Timely Completion of the Reconciliation Process

Create timelines for the reconciliation process and try to complete it within the created deadline. Timely reconciliation provides a precisely accurate picture of the company’s financial health (or individual financial health, as the case may be).

Review the Source Documents of Reconciliation

The first step in checking the accuracy of the reconciliation process lies in the verification of the transaction source. So, firstly check the documentation like bank statements, invoices, etc., and their validity and usability in the reconciliation process.

Carefully Investigate the Errors and Discrepancies

Investigate all the errors and discrepancies found after the reconciliation process. It tells a lot about what is going wrong with the company’s finances. Take that insight and find mitigation techniques to strategically bypass them.

Conclusion: Reconciliation in Accounting – Key Takeaways!

Reconciliation in accounting saves you from a lot of trouble associated with financial fraud, loss, and misrepresentation. It not only saves you financially but also legally. The blog has outlined the various types of reconciliation in accounting (i.e., bank reconciliation, vendor reconciliation, customer reconciliation, etc.) and what are its best practices (e.g., use of KPIs, checking the source, use of automation, etc.). Keep on reading the blog to learn more differences between Bookkeeping & Accounting

FAQs

How reconciliation works in India?

Reconciliation in India is defined as the process of verifying financial statements (bank statements, internal records) from multiple sets of data to identify differences. Though the core is intact, formats of key bank statements, local regulatory requirements, and evolution in digital payments could ensure some variance in data as it’s collected to be compared and documented. For the ultimate guidance on what is required in reconciliation practices within India, small businesses would do well to consult a local accountant services who knows Indian accounting standards. In this regard, feel free to contact Actax India and get your reconciliation done.

How often should a company or business be ideally reconciling its accounts?

A company or a business should ideally be conducting reconciliations regularly. That is to say, reconciliation on a monthly basis would work fine for a business or a company. However, quarterly reconciliations are also an option, if it is a really small business or organization.

How often should an individual be reconciling his/her accounts?

Same as businesses, individuals can also opt for either monthly or quarterly reconciliations. To get more insights on the same, contact Actax India.