Are you the one who is thinking of giving a shot at your startup registration but has a lack of funds? Then you might be thinking of taking a business loan, right? Starting or running even a small business in India might require a hefty financial investment, in this scenario, Business loans turn out to be a great help. But if you are a first-time entrepreneur then you might face a lot more confusion and difficulties while obtaining a loan. Bid a farewell to all your worries as this blog will guide you through the steps on how to get a Business Loan for Your Startup in India, making the as smooth as butter.

Table of Contents

Everything You Need to Know About Business Loans for Small Businesses in India

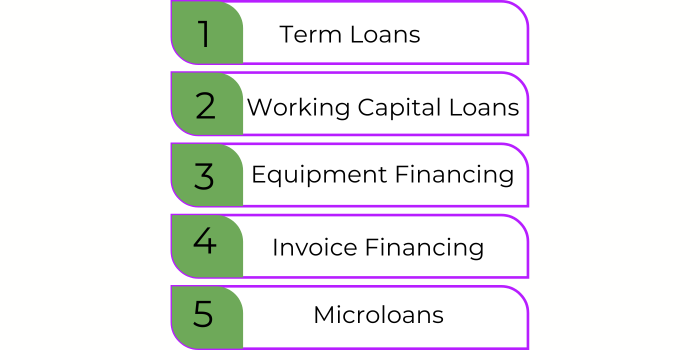

Understanding Different Types of Startup Loans

Before getting into the game, let’s understand the application process. As you may know, there are different types of Business Loan for Your Startup in India where different loans cater to different needs. In this case, choosing the right loan for you becomes the most crucial part of your business journey. Some of the loan types are as follows:

Term Loans

The most common type of business loans are term loans. Want to purchase some equipment, want to expand facilities, or even want to fund long-term projects- Term loans cover it all. Term loans can be secured or unsecured, and usually come to the plate with fixed interest rates and repayment schedules.

Working Capital Loans

Facing issues in paying for day-to-day operational expenses? Worry not, working capital loans got your back. This type of loan covers inventory expenses, payroll, and even rent. Unlike term loans, these are short-term loan that helps businesses manage their cash flow during lean periods.

Equipment Financing

Need a loan to buy some equipment or machinery? Wait! Equipment financing is a mind-boggling option for you. This type of loan lends you money for all necessary equipment and then uses it as collateral, making it an easier option than any other unsecured loans

Invoice Financing

Have a record of outstanding invoices? Great!! As they will help you to borrow money against your invoices. This type of loan helps in improving cash flow by providing immediate funds while you are waiting for customers to pay their pending invoices.

Microloans

Last but not least, Microloans. If you own a microfinance institution or a non-banking financial company (NBFC), then these loans are just for you. These loans work great if you want a Business Loan for Your Startup in India or small businesses that may not qualify for traditional bank loans.

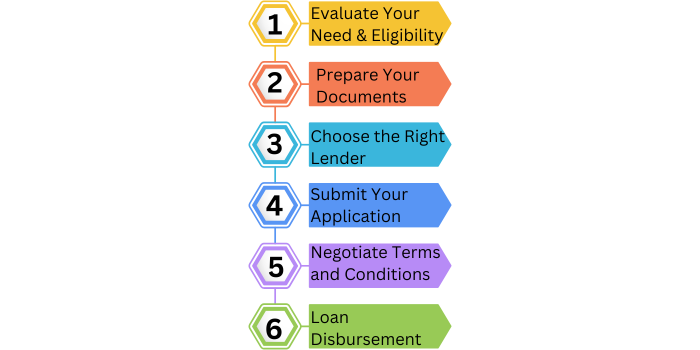

Steps to Secure a Business Loan for Your Startup in India

Now that you have an idea of what will be the best Business Loan for Your Startup in India, this is time for some action! Securing a loan consists of several steps, from preparing your documents to choosing the right financial institution. But don’t you worry as listed below is a step-by-step guide to help you navigate the process: Keep on reading the blog to learn more 5 important benefits of startup India registration

Evaluate Your Needs and Eligibility

Before jumping to the class, do your homework! All you have to do is evaluate how much funding you need by considering some factors such as the purpose of the loan, repayment, interests, collateral, etc.

After evaluation comes eligibility, and now the lenders will look at factors like business financial health, credit score, years of operation, etc, before lending you money. Make sure to meet the minimum requirements before hand to avoid rejections. also It might be useful for you 15 Things to Know, Before Starting A New Business

Prepare Your Documents

Now buckle up! It’s time to have all the needed documents in one place to speed up your loan approval. Mostly, lenders need the documents listed below:

- Business Plan showcasing your business model, revenue projections, and how you intend to use the loan.

- Financial Statements: Balance sheets, profit and loss statements, and cash flow statements for the past 2-3 years.

- Income Tax Returns for the past 2-3 years.

- Bank Statements for the past 6-12 months.

- KYC Documents: Proof of identity and address for all business owners and directors.

- Collateral Documents: If applying for a secured loan, details of the assets being offered as collateral.

Choose the Right Lender

You can approach various financial institutions in India to get a business loan, some are:

- Commercial Banks: Public and private sector banks offer a range of business loans with competitive interest rates.

- NBFCs: Non-banking financial companies provide flexible loan options, especially for those who may not qualify for bank loans.

- Microfinance Institutions: These institutions offer microloans to small businesses and startups.

- Government Schemes: The Indian government offers several loan schemes to support small businesses, such as the Pradhan Mantri Mudra Yojana (PMMY) and Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Submit Your Application

You can submit your loan application once you finalize your lender. To avoid delays you should make sure that the application and documents are accurate and complete.

Negotiate Terms and Conditions

Let’s say your loan application got a green flag, what now? The lender will provide you with the loan with certain terms and conditions, all you have to do is go through the conditions thoroughly and pay attention to the interest rate, repayment tenure, or any extra charges to ensure a hassle-free loan repayment. Just a tip, don’t hesitate to negotiate the terms.

Loan Disbursement

After accepting the loan offer, the lender will disburse the funds to your business account. Now you have to make sure that the funds are put to use according to your business plan.

Tips for a Successful Loan Application

Wait a second! We discussed the loan process in advance, Never mind, let’s look at some tips to secure a loan for your business.

Maintain a Good Credit Score

As you know karma catches up, so if you pay your bills on time, settle debts, and check your credit report for errors regularly, it will lead you to a great credit score which in turn will help you get the Business Loan for Your Startup in India.

Develop a Strong Business Plan

Put your all focus on the fish’s eye, and in your case, the fish’s eye is your business plan. If you have a well-structured business plan it will project your business potential and your ability to repay your loan.

Show Consistent Financial Performance

No one wants to invest money in a lame horse, you need to have a track record of consistent financial performance. You need to keep your financial records up-to-date and accurate.

Leverage Government Schemes

Take advantage of government schemes designed to support small businesses. These schemes often come with lower interest rates, longer repayment tenures, and minimal collateral requirements. Research and apply for schemes that match your business needs.

Build a Relationship with Your Lender

Having a good relationship with your lender can be beneficial. Maintain open communication, be transparent about your business operations, and seek advice when needed. A strong relationship can lead to better loan terms and faster approval.

Lets wrap up

Securing a Business Loan for Your Startup in India can be a straightforward process if you understand the different loan options, prepare your documents meticulously, and approach the right lender. By evaluating your needs, maintaining a good credit score, and leveraging available government schemes, you can enhance your chances of obtaining the funding necessary to grow your small business or startup. consult a startup registration In this regard, feel free to contact Actax India

Remember, a business loan is not just about getting funds; it’s about strategically using those funds to drive your business forward. Plan carefully, use the loan wisely, and watch your business thrive.