Table of Contents

Planning to register your business within the scope of the LLP structure? Then, you must know about the LLP registration fees. Do not proceed before you have full clarity on this subject. Firstly, if you’re unaware of the standard government fee and stamp duty, your service provider can extract excessive money from you. Secondly, understanding the total estimated cost will further help you to plan your budget. This is because some of the Indian states levy a heavy stamp duty, which requires prior financial planning. This blog provides a crisp breakdown of LLP registration fees in India.

What Are the LLP Registration Fees in India?

What All Fees are Included in LLP Registration in India?

Three main fee breakdowns are included within the scope of LLP Registration in India, other than the miscellaneous fee. Each of them has been described briefly in the section hereunder.

Government Fee

Government fee can be viewed as the first LLP registration fee category. Planned by the MCA, it remains uniform all over India. It is generally incurred based on a percentage of the company’s key contribution. For example, an LLP whose contribution does not exceed ₹1 lakh, needs to pay a government fee of ₹500. Similarly, as the contribution increases, so does its government fee structure. A vivid Government fee structure has been added under this blog only.

Stamp Duty

Stamp duties are the second category of LLP registration fees in India. Unlike Government fees, which are levied centrally, stamp duties are levied by the State Government. Hence, it varies from state to state. Some Indian states possess a uniform stamp duty, and for some states, the stamp duty also depends on the LLP’s financial contribution. A vivid stamp duty structure has further been added under this blog.

Professional Fee

The professional fee varies as a whole. Be it LLP registration or OPC registration or Private Limited Registration, professional fees depend on the service provider you will be opting for and the quality of service they provide. However, each state/city/location has its competitive price rate. Directly contact the service provider to know that. Refer to the website of Actax India to understand the rate of company registration in Bangalore!

How to figure out the professional charges from an LLP fee package, as provided by the service providers?

Professional Fee = Proposed Service Charges – Government fee – Stamp Duty – Miscellaneous Fee

It would be suggestible to compare the various price ranges to get the best price offer governing professional fees (also focus on the quality and experience of the service provider).

Miscellaneous Fee

The cost of the Memorandum of Association, notarization fees, digital signature fees, LLP PAN and TAN number fees, and bank account setup fees are additional costs associated with the LLP registration fee in India. These are just a few extra costs, which are completely minimal. However, the cost of a DSC (Digital Signature Certificate) can be over ₹1,000, depending on the service provider. The more partners in an LLP, the higher will its cost become (this is because each partner needs to provide their DSC during the LLP registration process).

LLP Registration Fees in India – State Wise Breakup of Stamp Duty

Here’s a comprehensive state-wise breakup of stamp duty for LLP registration fees in India:

|

State |

Stamp Duty Range |

|

Maharashtra |

1% of the Company’s Financial Contribution (Minimum of ₹500 & Maximum of ₹1,500) |

|

Bihar |

₹2,500 – ₹5,000 (Varies Based on Company’s Financial Contribution) |

|

Chattisgarh |

₹2,000 – ₹5,000 (Varies Based on Company’s Financial Contribution) |

|

Punjab |

₹1,000 |

|

Karnataka |

₹1,000 (For Company’s Financial Contribution Over ₹5 Lakhs ₹1,000 + ₹500 with every ₹5 Lakhs Increase) |

|

Andhra Pradesh |

₹500 |

|

West Bengal |

₹150 |

|

Mizoram |

₹100 |

|

Goa |

₹150 |

|

Gujarat |

₹1,000 – ₹10,000 (Varies Based on Company’s Financial Contribution) |

|

Arunachal Pradesh |

₹100 |

|

Assam |

₹100 |

|

Manipur |

₹100 |

|

Haryana |

₹1,000 |

|

Himachal Pradesh |

₹100 |

|

Kerala |

₹5,000 |

|

Tripura |

₹100 |

|

Jharkhand |

₹2,500 – ₹5,000 (Varies Based on Company’s Financial Contribution) |

|

Rajasthan |

₹4,000 – ₹10,000 (Varies Based on Company’s Financial Contribution) |

|

Tamil Nadu |

₹300 |

|

Uttar Pradesh |

₹750 |

|

Sikkim |

₹100 |

|

Uttarakhand |

₹750 |

|

Madhya Pradesh |

₹2,000 – ₹5,000 (Varies Based on Company’s Financial Contribution) |

|

Odisha |

₹200 |

|

Nagaland |

₹100 |

|

Telangana |

₹50 – ₹100 (Varies Based on Company’s Financial Contribution) |

|

Meghalaya |

₹100 |

|

Delhi |

1% of the Company’s Financial Contribution (Maximum of ₹5,000) |

|

Jammu & Kashmir |

₹100 |

LLP Registration Fees in India – Government Fee Breakup Based on the Financial Contribution of the Company

Here’s a comprehensive government fee breakup for LLP registration fees in India:

|

Contribution Amount |

Government Fee |

|

Up to ₹1 Lakh |

₹500 |

|

More than ₹1 Lakh but less than ₹5 Lakh |

₹2,000 |

|

More than ₹5 Lakh but less than ₹10 Lakh |

₹4,000 |

|

More than ₹10 Lakh |

₹5,000 |

LLP Registration Fees in India – An Overall Average Estimate

Considering the above factors, a rough estimate for LLP registration fees could be ₹10,000 to ₹25,000 (considering all the Indian states).

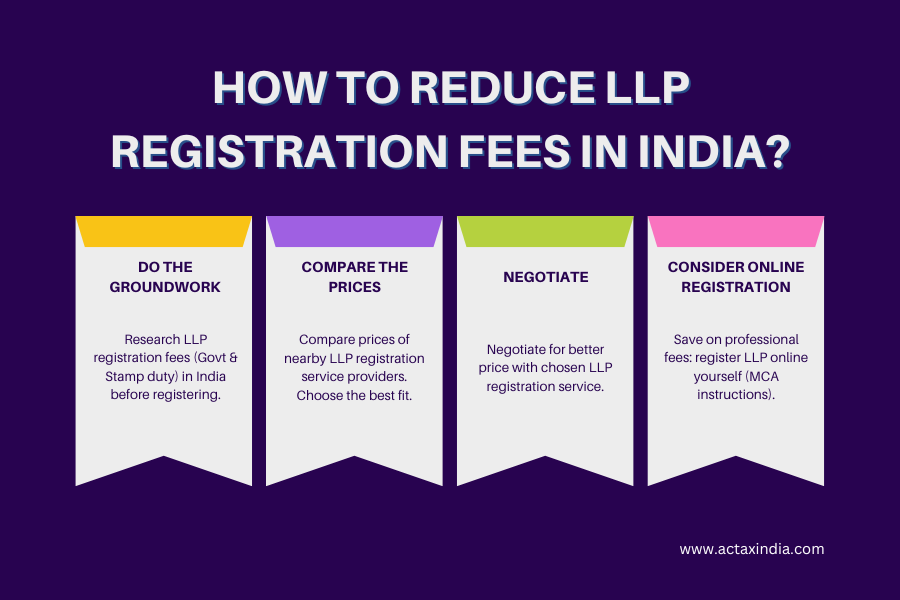

How to reduce LLP Registration Fees in India?

Here are a few points by leveraging which you can reduce your LLP registration fees in India:

- Do the groundwork: Simply speaking, before opting for LLP registration, do your groundwork. Research about the LLP registration fee structure in India. Get to know about the Government fees and Stamp duties for your state.

- Compare the professional prices: Next, look out for the various nearby service providers, who would register your company for you. Compare the prices of a few of the service providers, and then choose the one that will suit you the best.

- Negotiate with your service provider: Now, you already know about the various prices that are available to you; so you can freely negotiate the price with the service provider of your choice. This will further help you with cost-cutting. Contact Actax India, as we are flexible in this regard.

- Consider online registration: Lastly, by considering online registration or DIY, you can seamlessly avoid professional fees. It is not that difficult. You just need to follow the MCA instructions and file the required documents and fees accordingly.

In a Nutshell,

LLP registration fees in India vary depending on your state and the complexity of your case. Expect to pay between ₹10,000 and ₹25,000 which includes government fees, stamp duty (which differs by state), and professional service fees. You can reduce costs by researching fees in your state, comparing service providers, or even registering online yourself if you’re comfortable with the process.

Comments are closed.