Do you want your business in India to grow to the next level? Wanting to explore how to convert LLP to Pvt Ltd.? This can be a valuable tactic that opens several opportunities for development and investment. However, what appears to cause difficulties is the process of transition in going between the two forms.

This guide will provide you with all the necessary information that you would require to convert your LLP to a Pvt. Ltd. company. Before moving forward, we will guide you through the steps that you need to know before applying, a detailed process on how to apply for it, and the benefits that arise from it. So, ready to convert your LLP to Pvt Ltd.? Let’s dive in.

A Simple Guide for You to Convert LLP to Pvt Ltd.

Prerequisites to Convert LLP to Pvt Ltd.

There are a few key prerequisites you need to meet to convert LLP to Pvt Ltd. in India:

Minimum Number of Partners

A Pvt. Ltd. company needs at least 2 directors and 7 shareholders in contrast to LLPs where the minimum number of partners is 2. For your greater knowledge, read this – Different Types of Company Directors: Understand Your Board

Partner Approval

The LLP has to pass a special resolution for conversion where all the partners of the LLP have to be present and vote in favor of conversion. The above resolution should capture issues like the prospective name of the Pvt. Ltd. company, share ownership pattern, and so on.

Compliance with Regulations

The LLP is subjected to all filing requirements as per the Indian legal system like income tax filings, Registrar of Companies (ROC) filings, and so on. Learn more about – Mandatory Compliances for Pvt Ltd Company in India [2024]

No Objection Certificates (NOCs)

In some cases, you might require NOCs from creditors, landlords, governmental departments, or any other relevant stakeholders as the situation may warrant.

Financial Records

The LLP should have well-documented financial books that have been audited and prepared by a certified accountant. Contact Actax India for such services.

Other Considerations

The process of conversion may have some tax implications that need to be considered. For detailed specifics, it is recommended to seek advice from a tax consultant. There is a possibility that some of the contracts and agreements that had been signed by the LLP may need to be novated (i.e., transferred) to the new Pvt. Ltd. company.

Taking care of these requirements will help you ease the conversion process of the LLP to a Pvt. Ltd. company.

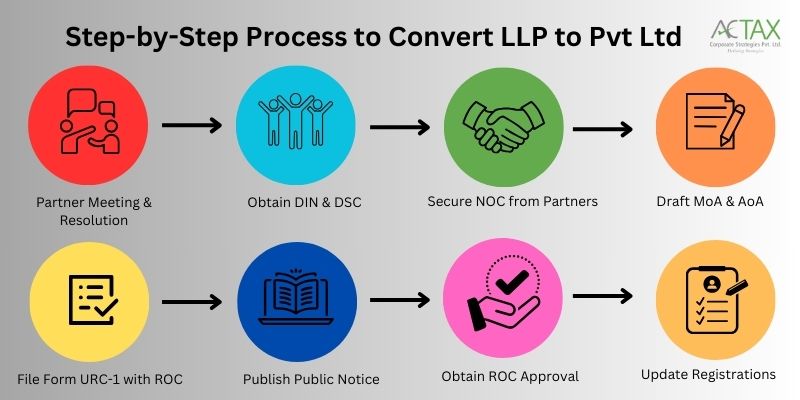

Step-by-Step Process to Convert LLP to Pvt Ltd.

Here’s a detailed breakdown of the process to convert LLP to Pvt. Ltd. company in India:

Step 1: Conduct a Partner Meeting & Pass Resolution

Prepare an agenda for the meeting and invite all the partners of the LLP. Propose and seek the consent of the partners for the conversion from LLP to Pvt Ltd. The decision must be put into a formal resolution written with a specific date, time, and venue. This resolution should include its suggested name for the Pvt. Ltd. company, the proposed capital structure for the company, and share allotment for the Pvt. Ltd. company along with the appointment of directors for the company (minimum 2 as mentioned earlier).

Step 2: Obtain DIN (Director Identification Number) & DSC (Digital Signature Certificate)

Any person, who intends to become a director of the future Private Ltd. company, should have a DIN. If they have not applied for the same, then they have to register through the MCA Portal powered by the Ministry of Corporate Affairs. The other important document that each director needs is the DSC or the Director’s Identification Number used for online submissions of the various forms. A DSC can be procured from any one of the authorized agencies.

Step 3: Secure NOC (No Objection Certificate) from Partners

A written No Objection Certificate (NOC) is required to be obtained from each of the partners of the LLP. This gives them acknowledgment of the change. The format of the NOC is widely accessible over the Internet or it can also be accessed through lawyers and legal advisors. You can also contact Actax India for the same.

Step 4: Draft Memorandum of Association (MoA) & Articles of Association (AoA)

The MoA outlines some of the key objectives and authority of the company. The AoA defines the internal regulation of the company about the shareholding structure, meetings, and voting processes. Some preferred formats for MoA and AoA exist, but one can seek advice from a company secretary to draft them. Seek the expert help of Actax India regarding this and remain compliant with the corporate law of India.

Step 5: File Form URC-1 with the Registrar of Companies (ROC)

An application in Form URC-1 is used as the principal application form for the LLP to Pvt. Ltd. company conversion. The form consists of the proposed name for the company, Memorandum of Association, Articles of Association, and information about the initial subscribers. The form, along with every other document that is supposed to be attached, must be filled out online via the MCA portal.

Step 6: Publish Public Notice

It is essential to publish a notice about the conversion in at least two newspapers – the first one must be an English newspaper and the second one must be a vernacular newspaper published in the district where the LLP is registered. The Companies Act prescribes the notice format and should contain information such as the conversion proposal and the date on which the notice was filed with ROC.

Step 7: Obtain Approval from ROC

The ROC will process the given application and may ask questions if necessary. Always reply as quickly as possible to avoid delays in processing. After going through the process of issuance of the Certificate of Incorporation, the ROC will grant the Pvt. Ltd. company status as an official company from an LLP.

Step 8: Update Registrations and Licenses

Change registrations for taxes, bank accounts, and other licenses with the new name of the Pvt. Ltd. company. Such a process may include alerting the appropriate authorities and producing paperwork if any is required.

It is therefore important to follow these steps carefully to facilitate the conversion of your LLP to a Pvt. Ltd. company in India. Just bear in mind the fact that being compliant and well-prepared is the way to succeed in this process. In short, this is how you convert LLP to Pvt Ltd. in India. Seek the help of Actax experts to enjoy this seamless transition!

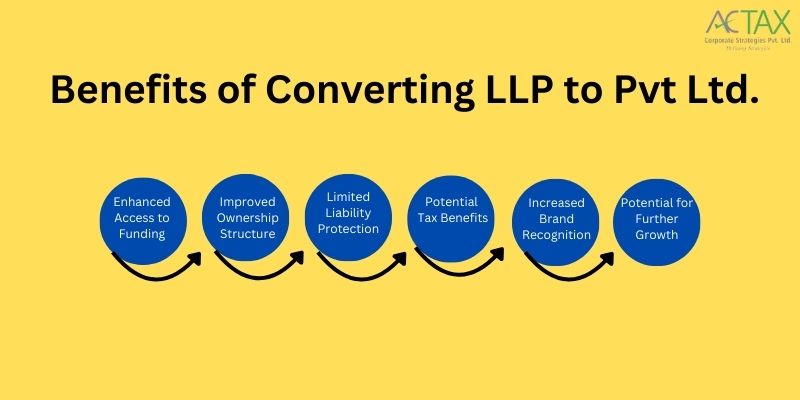

Convert LLP to Pvt Ltd. & Enjoy Some Core Benefits!

Do you choose to convert LLP to Pvt Ltd.? This is because converting your LLP to a Pvt. Ltd. company can unlock several advantages for your business growth and structure. Here’s a breakdown of the key benefits:

Enhanced Access to Funding

Companies that are registered as Pvt. Ltd are more credible in the eyes of investors as compared to LLPs. It also facilitates the process of seeking venture capitalists, angel investors, and bank loans since the risks involved in the business venture are already shared. The Pvt. Ltd. companies can offer equity shares to the public for selling their stakes. This brings in the aspect of being an investor by giving a person a share and a chance to be part of the company. It is also possible to use the Employee Stock Option Plans (ESOPs) to secure talented employees in your company.

Improved Ownership Structure and Flexibility

The Pvt. Ltd. companies have a clear ownership structure that has a distinction in shares that can be transferred. This makes it possible to have changes in partners, entry of new investors, and so on. As compared to the LLPs which have market share agreements, the Pvt. Ltd. companies distribute the profits in the form of dividends, thereby giving more flexibility in the distribution of profits.

Limited Liability Protection

Like LLPs, Pvt. Ltd. companies offer limited liability exposure to shareholders and investors. This implies that while shareholders exercise management control over their business, their assets are immune to business risks.

Potential Tax Benefits

The consideration of taxes can differ depending on individual circumstances; overall, Pvt. Ltd. companies pay less in corporate taxes compared to LLPs at present (25% as opposed to 30% starting in 2024). The process of conversion itself is free from capital gains tax most of the time.

Increased Brand Recognition and Credibility

Pvt. Ltd. companies are looked upon as more reputable than companies that are established as LLPs. This could improve your corporate image and get better clientele and business associates.

Potential for Further Growth

Another advantage of converting to a Pvt. Ltd company is that such conversion can facilitate conversion into a public limited company in the future. This makes it possible to mobilize funds from the general public for purposes of greater business expansion.

Conclusion & Helpful Weblinks

In short, converting your LLP into a Pvt. Ltd. company can be a strategic move that alters the trajectory of your business in India. Offering enhanced control over financing, clearer ownership status, and flexibility to avail better tax exemptions, a Pvt. Ltd. company is capable of growth and brings about a more professional outlook. So, ready to convert LLP to Pvt Ltd.?

This transformation paves the path for attracting more investors, the simple process of distributing the profits, and the future possibility of going public for more capital sourcing. Still, there are extra compliance measures, and depending on the circumstances, there may be legal and administrative procedures. It is advisable to contact some specialists to avoid problems with conversion and benefit from the formation of a Pvt. Ltd. company. Contact Actax India! To decide on this strategic move, compare the benefits against your company’s requirements to decide if it executes the firm’s vision for the future.

Some helpful web links:

- Ministry of Corporate Affairs (MCA): https://www.mca.gov.in/content/mca/global/en/home.html

- MCA Portal (for online form filing): https://www.mca.gov.in/content/mca/global/en/home.html

- Downloadable Company Forms (including Form URC-1): https://www.mca.gov.in/content/mca/global/en/home.html