The COVID-19 pandemic has accelerated how we do business and how we work, introducing the culture of working from home. But for many remote workers and startup founders, offering remote work options, a nagging question remains: does an employee working from a home office qualify for tax deductions for these expenses? This guide explores India’s present work from home income tax deductions framework. They will demystify what they are, explain the actual situation on potential tax optimization for both wage earners and startup founders, and outline other possible ways to reduce tax payments. This guide will ensure that you know the right steps to take whether you are a new remote worker or a young company that is transitioning to a remote working model to optimize your tax savings and keep more of your money.

Table of Contents

Work From Home Tax Deductions: Fact or Myth?

Work From Home Income Tax Deductions: The Current Scenario

Unlike many countries like Germany, Costa Rica, Austria, etc., India does not have any specific tax form or tax bracket for work from home employees as of 2024. Remote employees enjoy as much tax benefits as any other regular salaried person in India, as per the Income Tax Act, 1961. However, the context of House Rent Allowance (HRA) can be cited in this context. The remote employees might find some benefit from it, as they work typically in a home setting. But, there exist no specific allowances for internet bills, electricity bills, and so on, specifically. Nonetheless, hope lies within the fact that there exist alternative solutions for work-from-home employees in standard deductions, employer reimbursements, and other traditional tax-saving methods. All these sections have been vividly discussed in the sections hereunder, which form a dominant part of work-from-home income tax deductions.

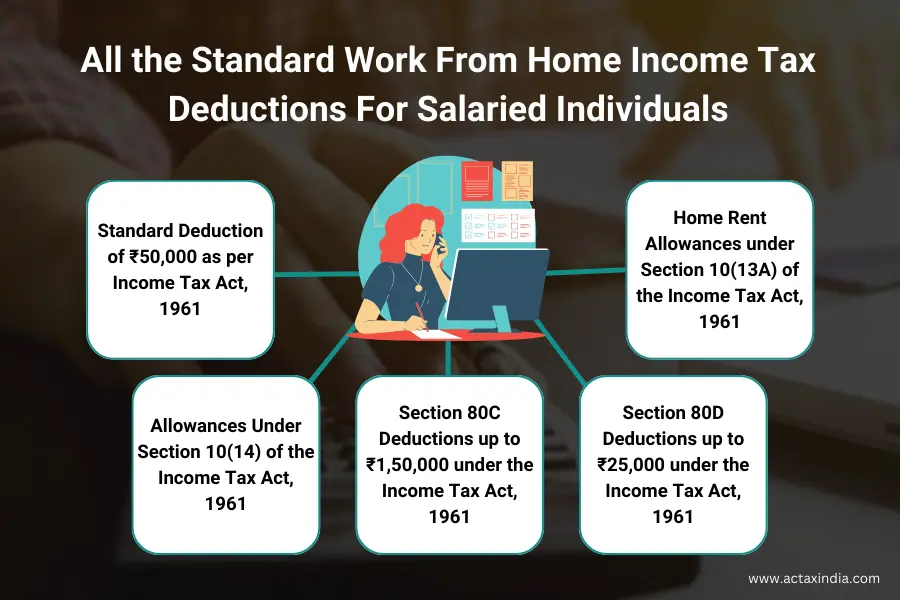

All the Standard Work From Home Income Tax Deductions: For Salaried Individuals

All the standard work from home income tax deductions for salaried individuals are as follows:

Standard Deductions

Any individual receiving a salary or a pension, who is not a part of the business ownership entity, and having their income under the “head salary” are eligible to claim standard deductions as per Section 16(ia) of the Income Tax Act, 1961. In other words, remote workers are also eligible to claim the standard deductions, as they also fall under the category of salaried individuals. The eligible person can claim a standard deduction of up to ₹50,000. Both the old tax regime and the new tax regime permit the same amount of standard deduction to relieve middle-class employees from severe tax burdens. A work from home employee can easily utilize this deduction to cover expenses like electricity bills and internet bills for a year.

Allowances Under Section 10(14)

Section 10(14) of the Income Tax Act allows certain tax exemptions to employees, usually covered regularly. There are three core conditions for obtaining such an exemption, something that can be obtained by any salaried individual in India, including remote employees. The allowance must be meant to be used to cater for expenses as well as costs needed “wholly, necessarily, and exclusively” in the performance of his/her duties as an employee. This can be leveraged by the remote workers to cover their home rent expenses (i.e., HRA) and other associated expenses. Tax deductions include the amount of the allowance or the actual expense that has been made, whichever is lower. The nature of the allowance must be endorsed by the Income Tax department. This means that the government has stipulated a given range of allowable expense categories.

-

Section 80C Deductions

Although there is no separate deduction available for employees under the Income Tax Act, of 1961 for reimbursement of taxes paid on home-office expenses, there is an excellent opportunity to utilize the provisions of Section 80C to save taxes. This section permits to making deductions of about ₹1,50,000 (Refer to this blogs tax slab ) in the bonds or instruments such as Public Provident Funds (PPF.), Employee Provident Funds (voluntary contributions only), National Pension System (NPS.), Equity Linked Saving Schemes (ELSS.), Unit Linked Insurance Plans (ULIPS with a minimum lock-in period of five years) or for expenditure of any type of Life Insurance Premium, Education Fees to children, repayment of Home loan principal (up to a specified limit). In short, this broadly outlined model facilitates tax shelters for remote workers and helps them reduce their overall tax burden.

-

Section 80D Deductions

Work-from-home income tax deductions can further be strategically claimed through Section 80D of the Income Tax Act. Employees working from home can achieve the best of both worlds with Section 80D. It enables them to claim deductions of up to ₹25,000 (₹50,000 for senior citizens) on health insurance premiums for themselves, their spouse, children, and even parents and this is a welcome tax relief over and above the deductions at the rate of 80C. This makes investing in health insurance both a wise decision regarding personal health as well as a smart way to reduce tax liability, especially for those who do not get employer-sponsored health insurance.

-

Home Rent Allowances

Section 10(13A) does not necessarily make you eligible or ineligible to get HRA benefits just because you are working at a remote location. The exemption amount depends on the city (50% of basic salary + DA in metro cities and 40% in other cities) + Rent paid by the employee. The expenses incurred in determining if a part can be claimed from HRA even if your place of work is your home would be beneficial even if one hires a residence, and HRA is paid. Keep an eye on HRA trends to develop remote work capabilities in the future. Also, you can consult tax experts to keep yourself updated (for this entire section and also to know about the required documents that you need to submit to claim these deductions). Herein, Actax India can help you by providing a wide range of income tax experts, accountants, and legal advisors for you to cope with this tricky landscape.

Employer Reimbursements: A Potential Tax Benefit For Remote Employees

Work from home income tax deductions are beyond just income tax now. Many employers have begun to provide reimbursements to cover their employee’s working-from home expenses. But, the tax implications of these reimbursements vary depending on the policy of the employer or the organization. Some of the home office items that may be tax-free include ergonomic chairs, study tables, modems, and high-speed internet connection if deemed necessary for work purposes. For the employee to qualify for this exception, the company must retain the invoices in its name and the expenditure must occur during a specified work-from-home period. In simple terms, the employee needs to store all the necessary expenditure-related documents, which have been incurred in the name of the employer, and must present the same in front of the employer while opting for the reimbursements. Learn – Professional Tax for Employees know things

In India, companies like Hike, OYO, Razorpay, Bobble AI, etc., provides employer reimbursements for remote work (a phenomenon that started from the inception of the COVID-19 pandemic). There are some instances, however, such as increased electricity bills or paying for childcare services, where reimbursements are taxed as income. On the contrary, purchased food during the working hours can be reimbursed up to an amount of ₹50 per meal. All these advantages can be leveraged by the remote employees in their favor to save tax.

Traditional Tax-Saving Strategies Beyond the Home Office

The table hereunder enlists some traditional tax-saving strategies that can be opted for by remote workers beyond the scope of work-from-home income tax deductions (this is also something the employers might need to cover for the employees in certain cases):

Category | Deductible Expenses | Documents Required to Claim | Non-deductible Expenses | Acts/Sections and Citations |

Utilities | Internet bill or a portion of Internet bill (beyond the scope of employer reimbursement) |

| Electricity bill (only partially deductible if a serious work-from-home structure is established by the employee, as per requirement) | Section 80C of the Income Tax Act, 1961* (indirect expenses) |

Equipment | Internet routers, ergonomic chairs, modems, study tables, etc. |

| Printers, chargers, systems provided by the employer like laptops or desktops, etc. | Remote work policy of the organizations (variable/ depends on their discretion) |

Professional Courses | Professional courses associated with skill development (directly attached to the job role), subscription to work-related resources, etc. |

| Personal development courses, subscriptions associated with entertainment or personal gain, etc. | Kerala High Court in the case of T.K. Sunil Kumar vs. Union of India & Ors. (WP(C). No. 15625 of 2020)** (The employer should consider their responsibility of upskilling the employees) |

Phone Bills | Cost of phone bills incurred from office works |

| Bill for personal phone calls | Section 36 of the Income Tax Act, 1961*** (expenses incurred for earning income) |

Note: Tax laws are subject to change. The section has been framed for informational purposes only. To know the strategies with more accuracy and precision, consult a tax expert. Actax India can help you with this.

Work From Home Income Tax Deductions & Benefits Based On Residential Status

work from home Income tax deductions are facilitated on Indian residents based on their residential status; and the same works for remote settings, especially because the NRIs (and sometimes the RNOR) will naturally be working in a remote setting. Here’s how the taxes work in India for different residential status:

Resident of India (RES)

An individual is considered a resident of India for tax purposes if they meet either of the following conditions:

- Reside in India for at least 182 days in a particular financial year.

- In the current financial year, has worked for 60 days or more.

The residents (RES) are taxed on a worldwide basis, and the same goes for their remote work setting.

Resident but Not Ordinarily Resident (RNOR)

A person will be classified as an RNOR if he or she has been an Indian resident in the current year, but has not been a resident of India for the last four years or more. The RNORs are taxed based on their incomes that are earned within the territory of India. It works for them similarly in a WFH setting as well.

Non-Resident Indian (NRI)

A non-resident Indian usually stays in India for less than 182 days in the ongoing financial year for business or employment purposes, occurring outside India. It is a general rule that an NRI is not required to be taxed on income that is earned outside India, including income earned from work from home income tax deductions outside India. But there can still be exemptions depending on the tax treaty between India and the country (in which she or he is working) of the NRI.

Conclusion: The Future Implications

Don’t fall for the myth of standard work from home income tax deductions As for the internet bills, electricity bills, and furniture bills, there are no specific breaks; however, the standard deduction of ₹50,000 takes care of some expenses related to work such as part of the internet bills and electricity used in the workplace. Do not overlook old-school tax-saving instruments such as Section 80C investments (PPF, NSC, tax-saving mutual funds) and deductions for health insurance under Section 80D of the Income Tax Act. It is unclear what the future holds for work from home income tax deductions, but the increased popularity of remote work may result in changes like the restricted deduction for expenses, an expanded standard deduction, or inclusions of certain types of deductions from tax returns (stationery bills, system bills, etc.) and so on. Stay in touch with the official tax updates and find a tax advisor to get the most out of being a remote worker in India. Contact Actax India and plan it out!

Comments are closed.