Has it ever happened to you that you always run out of time for TDS? It is quite common for different businesses and in particular startups to fall short when it comes to the intricacies of TDS e-filing due dates but worry not, as many sources are available that will help you gain deep insights about how to do it.

If you do not catch up with the deadlines it might lead to penalties and uncontrollable situations.

Do not get discouraged, this down-to-earth guide has got you covered!

First, we’ll take you through the processes of e-filing through TDS in India and show you the exact due dates to fill out the returns. As a result, it becomes easy to file the income tax by TDS and avoid unnecessary stress.

Table of Contents

What Is Tax Deducted At Source [TDS]?

TDS stands for ‘Tax Deduction at Source’. As its name suggests, it refers to the act of tax withholding (as facilitated by the Government), to collect tax on the income of people, transferred assets, dividends, and so on.

The Income Tax Act, of 1961 vividly covers the concept of TDS charges or how they are collected on immovable property and dividends.

To break it down, the TDS is cut when the payer pays an income amount to the payee, at the very source of its payment. The payee usually receives the deducted amount.

Why is Timely TDS Filing So Important for Your Business?

Especially for small businesses and startups, timely TDS Filing is extremely important.

For this reason, if you’re a startup owner, you need to know about the basics of TDS E-Filing due dates. Timely TDS filing manifests regular tax collection. It further reduces risks like tax evasion and protects small businesses from the liability of a significantly huge tax burden at the end of the financial year.

Apart from that, TDS E-Filing is a mandatory part of Indian regulatory compliance (as per the IT Act), the violation of which results in penalties. It further drives a healthy business credit score for your company, ensuring a good tax standing.

Various TDS Deposit E-Filing Due Dates

The TDS Deposit E-Filing Due Dates can be typically segregated into two categories. Both of these categories have been briefly elaborated in the section hereunder.

1. Non-Government Deductors:

Non-government deductors are those who have to deduct tax (TDS) from certain payments they make even though they are not the government as such.

Consider them as the tax inspectors for particular situations. They deduct a portion as tax (TDS) from payments they make, for example, salaries, rents (if they are high enough), or fees paid (if they are high enough).

This in turn guarantees the money being collected upfront by the government.

The TDS E-Filing Due Date for Non-Government Deductors –

The TDS E-Filing Due Date for non-government deductors is generally the 7th of the following month for TDS deducted in any month. But for March, there’s a rule exempting due dates extending till April 30th.

2. Government Deductors:

Government deductors, on the other hand, are the typical government departments that function as tax collectors. Just like the non-government deductors, the government deductors deduct the TDS taxes from the payments made by them.

However, the main distinguishing factor lies with the varying TDS E-Filing Due Dates. In this context, the government deductors are more flexible than the non-government deductors, depending on the payment method.

The TDS E-Filing Due Date for Government Deductors –

If the TDS is paid through the means of a challan, then the TDS E-Filing Due Date will be the 7th of the following month.

However, if the TDS is paid through the means of an entry book, then it is due on the same day the TDS was deducted.

TDS Return E-Filing Due Dates for FY 2023-24

TDS Return E-Filing in India is typically filing a summary electronically with a government agency, indicating the sum of TDS (Tax Deducted at Source) you have withdrawn from a variety of payments.

The TDS Return E-Filing Due Dates can be segregated into four quarters, which have been displayed in the chart hereunder.

Quarter | Period | Last Date of Filing |

1st Quarter | 1st April – 30th June | 31st July 2023 |

2nd Quarter | 1st July – 30th September | 31st October 2023 |

3rd Quarter | 1st October – 31st December | 31st Jan 2024 |

4th Quarter | 1st January – 31st March | 31st May 2024 |

In the upcoming days, these dates are subject to change, based on the changing tax regulatory discretions (i.e., 31st May 2024 onwards). However, if you’re a startup owner, you need to know about these basics of TDS E-Filing due dates, as mentioned previously.

Penalties Associated with Non-Compliance of TDS Filing within Due Dates

TDS filing (Tax Deducted at source) in India is subject to penalties for violation of Tax authority deadlines (i.e., TDS E-Filing Due Dates). Here’s a breakdown of the potential consequences of non-compliance:

Description | Penalty | Amount |

Late Filing (Section 234E) | ₹200 per day of delay, capped at total TDS amount | Up to total TDS amount |

Incorrect/Incomplete Return or No Filing (Section 271H) | ₹10,000 – ₹1,00,000 | Minimum ₹10,000 and Maximum of ₹1,00,000 |

Interest on Late Deposits | Interest on the delayed TDS amount | Not Constant |

TDS on Property Purchase

TDS on property purchase will be levied on the acquisition of immovable properties valued at ₹ 50,00,000 and above only. Commencers are to be subjected to a 1% deduction which has to be deposited within 30 days from the deduction. The payment of TDS is addressable within a time limit of 30 days of their deduction by filing it in Form 26QB online.

TDS Return E-Filing Due Dates for FY 2023-24

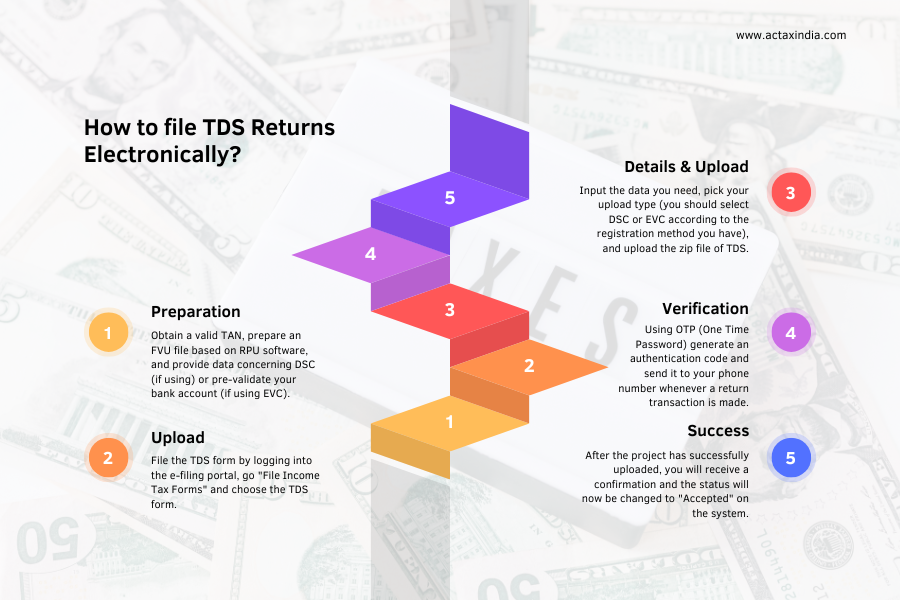

Avoid missing the TDS E-Filing Due Dates. TDS Returns can be feasibly filed electronically through these simple steps:

- Preparation: Obtain a valid TAN, prepare an FVU file based on RPU software, and provide data concerning DSC (if using) or pre-validate your bank account (if using EVC).

- Upload: File the TDS form by logging into the e-filing portal, go “File Income Tax Forms” and choose the TDS form.

- Details & Upload: Input the data you need, pick your upload type (you should select DSC or EVC according to the registration method you have), and upload the zip file of TDS.

- Verification: Using OTP (One Time Password) generate an authentication code and send it to your phone number whenever a return transaction is made.

- Success: After the project has successfully uploaded, you will receive a confirmation and the status will now be changed to “Accepted” on the system.

Conclusion

Keep in mind that it is essential to file the TDS-enlisted payment on time to avoid unnecessary penalties and foster sustainable business operations.

This guide has equipped you with the knowledge to:

- Understand what TDS deposit or return filing deadlines are.

- Be aware of particular deadlines for government as well as private due collectors.

- Use the step-by-step online process to easily file your TDS returns electronically.

By keeping yourself aware and remitting your TDS reports on time you will have hassle-free tax filings and a higher chance to be in the grace of authorities.

Hence, forget about ‘deadline tension’ and, instead, relax and enjoy the stress-free TDS e-filing in India, within the TDS E-Filing Due Date.