The penalty for late ITR filing can extend up to ₹5,000. It does not matter whether you’re an individual or a business entity, late ITR filing penalties are irrevocable. To avoid such penalties, it is essential to timely file the ITRs. Moreover, it is also important to claim the IT returns. And, timely filing of ITRs can only be manifested if you’re aware of the ITR Filing Due Dates. For this reason, this blog has provided a comprehensive overview of 2024 ITR Filing Due Dates (both for individuals as well as business entities/companies.

Table of Contents

Secure Your Business With These ITR Filing Due Dates

ITR Filing Due Dates for Individuals (2023-24 Assessment Year)

Key Deadlines for Individual Taxpayers

Precisely speaking, there are typically two key deadlines for individual taxpayers when it comes to ITR Filings. These are:

- Regular Filing (for FY 2023-24)

The regular ITR filing due date is July 31. Note that this due date has already passed for the taxpayers of the financial year 2022-23. However, regular filing is only applicable for those individuals whose accounts do not need to be audited.

- Belated Filing (for FY 2023-24)

The belated ITR filing due date is December 31. This is an alternate date for ITR filing in case you have missed the previous ITR filing due date.

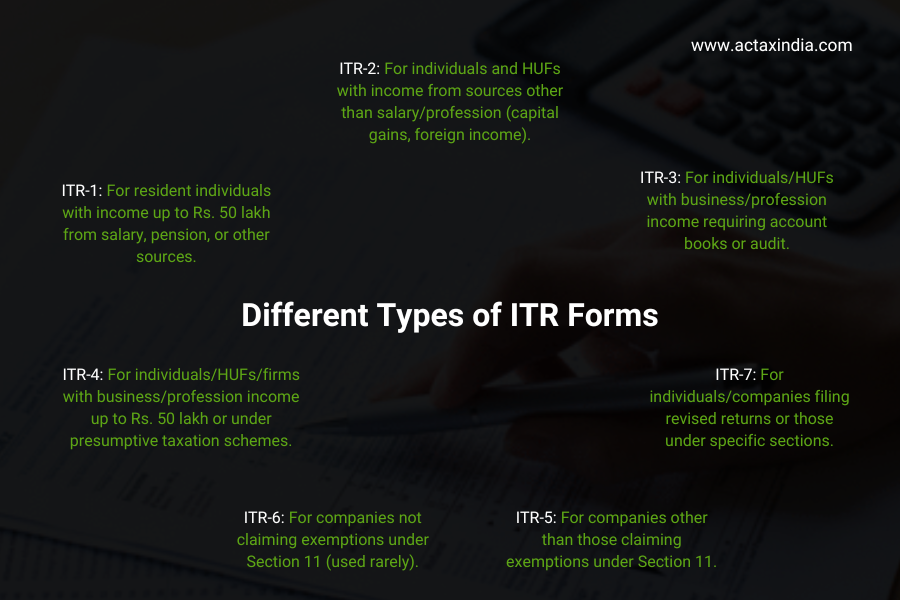

Understanding Different ITR Forms and Their Due Dates (Individual Taxpayers)

When it comes to individual taxpayers, India has a wide range of segregations, based on their level of income and income sources. These segregations impact the usages of the different ITR forms. In simple terms, based on the income level and sources, the ITR forms are prepared by the IT department. However, the ITR filing due date remains constant in all the cases (as mentioned in the previous paragraph). In this section thereby, the different ITR Forms have been discussed.

- ITR-1 (Sahaj)

This is the simplest ITR Form. An individual earning from ₹5,000 to ₹50,00,000 can opt for this form. This relevant earning can come from salaries, agricultural incomes, interests, one-house property, and so on.

- ITR-2

This form is exclusive to Hindu Undivided Families (HUFs) and other individuals whose income comes from sources other than profession or business. These incomes usually come from foreign income, capital gains, property-related earnings, etc.

- ITR-3

This form is also exclusive to Hindu Undivided Families (HUFs) and other associated individuals. But, in this case, their income source comes either from profession or business.

- ITR-4 (Sugam)

This form is mainly for individuals, business firms with presumptive income from business or profession under Section 44AD, and small manufacturers with a turnover of up to ₹2 crore. For any confusion regarding the same, contact Actax India.

What Happens If You Miss the ITR Filing Due Date?

As an individual taxpayer, if you fail to file your ITR within July 31, then you’re liable to pay the following penalties:

- A penalty of a maximum ₹5,000 will be incurred if your total income exceeds ₹50,00,000.

- A penalty of a maximum ₹1,000 will be incurred if your total income ranges up to ₹50,00,000.

- No penalty will be incurred if your income is below the taxable limit.

There are some additional consequences, other than the above-mentioned penalties if you fail to file your ITR timely. Those consequences have been further listed in the section hereunder:

- In case you owe any tax to the state (revenue to be paid), you will be charged interest on the outstanding amount as early as the due date (August 1st ) until the date you submit your return. A rate of 1% per month, 0.01 % per day has been stipulated in this condition.

- In certain cases, you won’t be subjected to financial loss recovery if you fail to timely file your ITR. The same thing happens in cases of a tax refund (i.e., you will not be getting the refund).

As an individual taxpayer, if you further fail to file your ITR before December 31 (i.e., the belated filing date), further late filing penalties are imposed by virtue of Section 234F of the Income Tax Act.

ITR Filing Due Dates for Companies (2023-24 Assessment Year)

The Corporate Tax Obligations: ITR Filing Due Dates

The ITR filing due dates for the corporate world can be segregated into two halves. Both these segregations have been discussed briefly in the section hereunder.

- Original ITR Filing Due Date

The original ITR filing due date, for the assessment year 2023-24, for all the domestic companies of India is October 31. It applies to every company that does not deal with any international transaction. The prohibition further extends to any domestic transaction that requires a Form 3CEB.

- Extended ITR Filing Due Date

Contrary to the previous section, if your company deals with any international transaction, or requires any domestic transaction that requires a Form 3CEB (as mentioned under Section 92E of the Income Tax Act), then it is eligible for the extended ITR filing due date. In this context, the ITR filing due date is November 30.

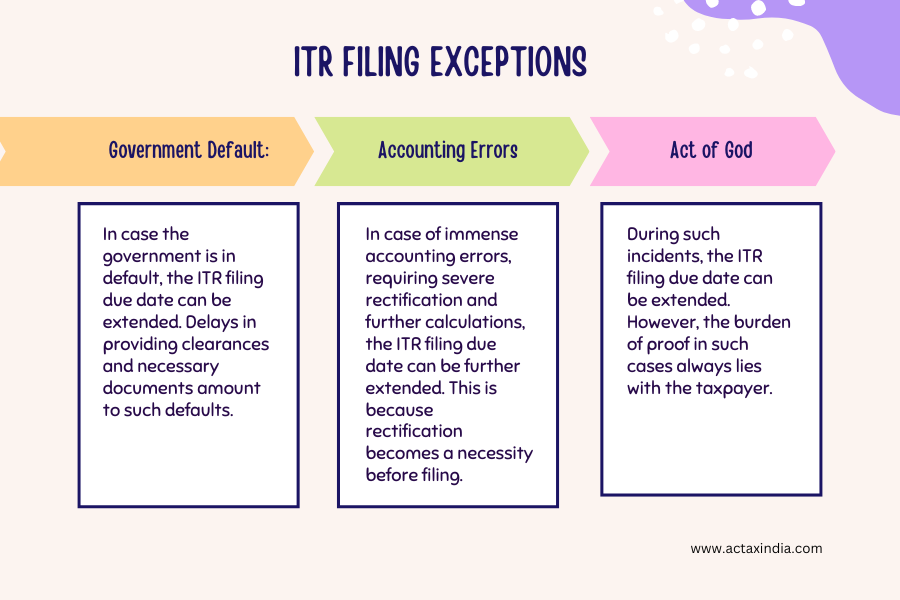

Understanding Extensions and Exceptions for Company ITR Filing

The general extensions and exceptions for company ITR filings are as follows:

- Government Default:

In case the government is in default, the ITR filing due date can be extended. Delays in providing clearances and necessary documents amount to such defaults.

- Accounting Errors:

In case of immense accounting errors, requiring severe rectification and further calculations, the ITR filing due date can be further extended. This is because rectification becomes a necessity before filing.

- Act of God:

Act of God refers to an unanticipated incident that occurs beyond human control. It is generally a natural event and hence is also termed as the Act of Nature. During such incidents, the ITR filing due date can be extended. The most common examples of the Act of God are natural calamities, resource unavailability, etc. However, the burden of proof in such cases always lies with the taxpayer.

However, it would be wise for you to consult an experienced tax advisor, before opting for such extensions and exceptions, especially if you’re a new business owner or startup owner. Contact Actax India to get in touch with a pool of talented tax advisors.

Understanding Different ITR Forms and Their Due Dates (Corporate Taxpayers)

In India, different company structures possess different tax requirements. Even in the most generalized manner, the business capital denotes the company’s taxation schemes. Similarly, the ITR forms somewhat reflect the same. Previously, the different ITR forms of individual taxpayers have been discussed. Now, this section is being utilized to shed light on the ITR Form requirements for the corporate. Notwithstanding anything, the ITR filing due date for the corporate world remains uniform (as mentioned in the previous two sections) in all the cases.

- ITR-5

The following company structures needs the ITR-5 Form:

- Bodies of Individuals

- Association of Persons

- Limited Liability Partnerships

- Investment Funds

- Business Trusts

- Insolvent Individuals

- Property of the Deceased

- ITR-6

The companies that disclaim exemption under the Income Tax Act, specifically Section 11, need to opt for this form. Generally speaking, this functions for all Indian standard companies, be it public or private.

- ITR-7

It caters to the filing needs of the wider individuals as specified in section 139(4A) to section 139(4F) of the Income Tax Act by individuals, companies, and others. Latter categories cover surrounding cases, for instance, income earned through property held for religious and charitable organizations (139(4A)) and income of political parties (139(4B)). For any confusion regarding the same, contact Actax India, and get insights from our expert professionals.

Streamlining Your ITR Filing Process

Essential Tips for Complying with ITR Filing Due Dates

- Know your taxable income:

All of your earnings do not fall under the category of your taxable income. So, firstly figure out your taxable income. You should be subtracting all the deductions and exemptions, as allowed under law, from your total income, to figure it out. For this reason, consult tax professionals to understand it better. Actax India can help you out with this.

- Understand the tax slabs:

The government charges one tax rate in one income bracket and different tax rates in other brackets. Knowing your tax bracket provides a general indication of the amount of tax you will be required to pay. For example, the new tax regime has kept a 0% tax bracket for incomes less than ₹2,50,000. Similarly, it has kept a 30% tax bracket for incomes above ₹15,00,000.

- Understand the deductions:

Deductions are the value of the expense that you can subtract from your gross income and this way you arrive at the taxable income. Illustrations of such events may cover expenditures on medications, repayment of the mortgage loan, relieving the community with charity money, and so on. The deduction of allowed expenses can result in a quite substantial decrease in your overall tax liability. Further, consult a tax professional to get clarity on the same and pay the lowest possible income tax. Actax India is the place for you!

- Make a checklist for the essential ITR documents:

The most important ITR filing documents are:

- Form 16

- Aadhar Card

- PAN Card

- Interest Certificates (if applicable)

- Salary Slips

- Tax-saving Investment Proof

- Proofs of Capital Gains

- Premium Receipts for Health Insurance

- TDS Certificate

- Loan Statement (if applicable)

- Ownership Details (if applicable)

- Company Details

Other documents are subject to the nature of ITR you’re filing.

- File ITR electronically:

Try to use the Income Tax Department’s online ITR e-filing portal service. It is a fast, safe, and mistake-proof alternative to old-school document management, as it eliminates the need for physical filing and human-generated errors. You can use the internet portal, select the appropriate ITR form, put the details of your income, apply for the deductions, and submit the return online.

Free Downloadable Resources

- To understand the updated income tax slabs, refer to https://www.5paisa.com/stock-market-guide/tax/10-tips-for-first-time-taxpayers-while-filing-for-itr

- To opt for e-filing, visit https://www.incometax.gov.in/iec/foportal/

- Download ITR forms from https://www.incometax.gov.in/iec/foportal/downloads/income-tax-forms

The Benefits of Knowing Your ITR Filing Due Dates

The blog has vividly covered all the details about ITR filing due dates, starting from the original to the extended dates, the forms to be used, the penalties to be avoided, and so on. By knowing all these details, you can avoid a huge amount of tax penalties. Apart from that, you can strategically save your finances from unwarranted tax liabilities. Irrespective of the fact that whether you’re an individual taxpayer or a corporate taxpayer, you will benefit significantly if you’re aware of these things.