Table of Content

Small businesses encounter some critical problems with accounting that significantly impact their financial stability and growth prospects. Small businesses like startups & local businesses should understand the benefits & outcomes of Accounting to their business. This helps them to make use of it to the fullest to enable informed & result-oriented decisions during the process of expansion or crisis.

However, small businesses pose a lot of challenges to set up & maintain the right accounting system & sometimes struggle with the mistakes done to lack of knowledge. If you are a startup founder or Business Owner, then you have to go through this informative blog completely to identify & correct the “money drain” your business might face due to accounting mistakes & problems.

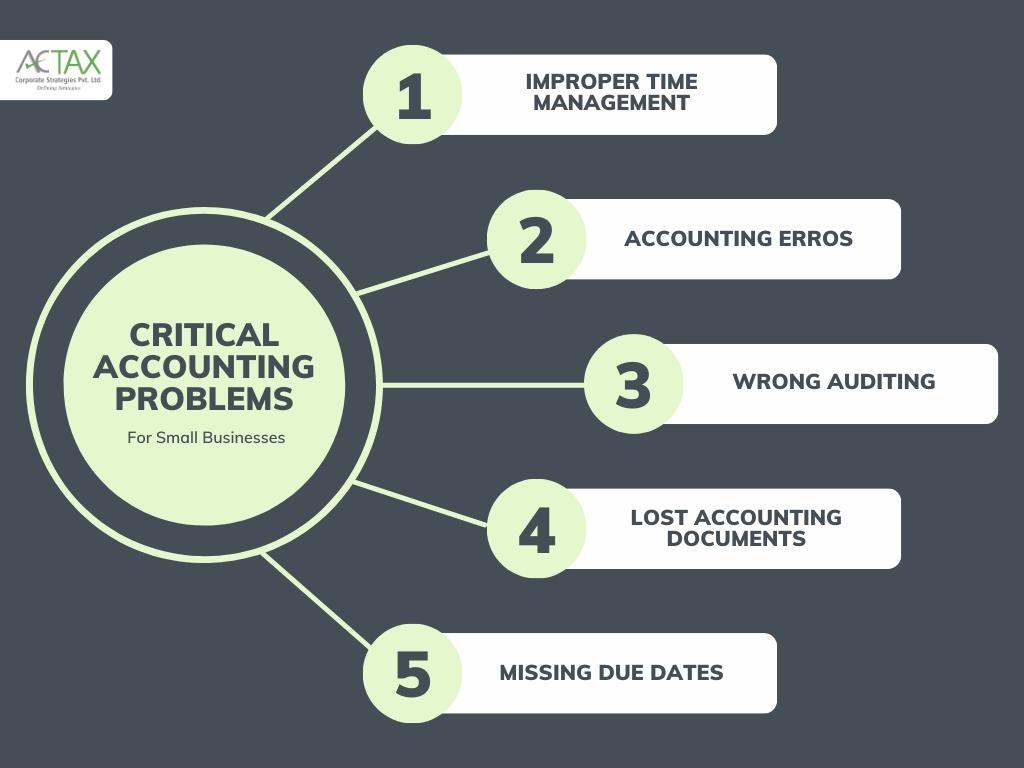

Five most critical problems with accounting for Small Businesses

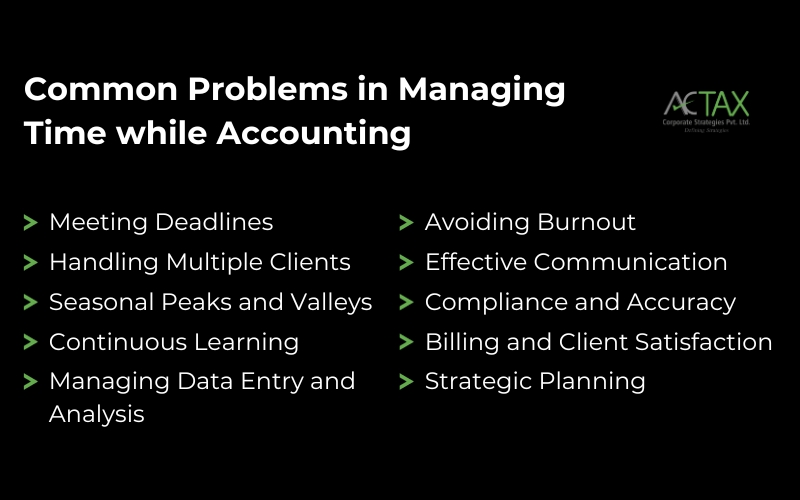

1. Time Management - Significant Problem with Accounting

Accounting is a complex and detail-oriented field that demands precision and accuracy. While many associate accounting primarily with numbers and financial statements, effective time management is one of the most critical aspects of the profession. In the accounting world, time is money, and how it’s managed can significantly impact the quality of work, client satisfaction, and even the financial health of a business.

Why Time Management is a Critical Problem with Accounting?

Improper time management can be the biggest problem with your accounting system. A simple idea to overcome is only with proper training on the importance of Time & impact of timeliness on accounting process.

1. Meeting Deadlines

One of the fundamental responsibilities of accountants is to meet deadlines for financial reporting, tax filings, and audits. Please meet these deadlines to avoid penalties, legal issues, and a loss of credibility. Effective time management is crucial to ensure all necessary tasks are completed promptly

2. Handling Multiple Clients

Many accountants work with multiple clients simultaneously, each with unique accounting needs. Juggling these diverse requirements, tracking deadlines, and maintaining accuracy can be overwhelming without efficient time management strategies. Accountants need to allocate their time effectively to serve all clients adequately.

3. Seasonal Peaks and Valleys

Accounting experiences seasonal variations in workload, especially during tax season or year-end reporting. During these peaks, time management becomes even more critical. Accountants must efficiently allocate time to handle the increased workload without compromising accuracy.

4. Continuous Learning

The accounting field is subject to ever-evolving regulations and technologies. Accountants must invest time in continuous learning to stay updated and maintain professional competence. Managing ongoing education and training time is essential to keep up with industry changes.

5. Managing Data Entry and Analysis

Much accounting work involves data entry and analysis. Efficiently managing the time spent on these tasks is vital for maintaining accuracy while minimizing the risk of errors. Automating repetitive tasks can free up time for more critical analytical work.

6. Avoiding Burnout

Poor time management can lead to overwork and burnout. Accountants often face high-pressure situations; failing to manage their time effectively can result in long hours and high-stress levels. Burnout can have severe physical and mental health implications.

7. Effective Communication

Time management extends beyond individual tasks. Accountants must also manage their time for effective communication with clients, colleagues, and regulatory authorities. Delayed responses and missed meetings can harm professional relationships.

8. Compliance and Accuracy

Rushing through tasks due to poor time management can compromise the accuracy and quality of accounting work. This can result in errors in financial statements, audits, and tax filings, potentially leading to legal consequences.

9. Billing and Client Satisfaction

Accountants often bill clients based on billable hours. Effective time management not only ensures accurate billing but also influences client satisfaction. Clients value efficient and timely service.

10. Strategic Planning

Beyond the day-to-day tasks, accountants are often involved in strategic financial planning for their clients or organizations. Allocating time for long-term financial strategies and forecasts is essential for success.

Hire Experts to Manage Accounting for Your Business

2. Error in Accounting

Accounting is the backbone of every business, providing financial transparency and insights that drive decision-making. However, errors in accounting can lead to significant financial mismanagement, compliance issues, and even legal consequences. In this comprehensive guide, we’ll explore the critical problem of errors in accounting, their types, causes, and strategies to prevent and rectify them.

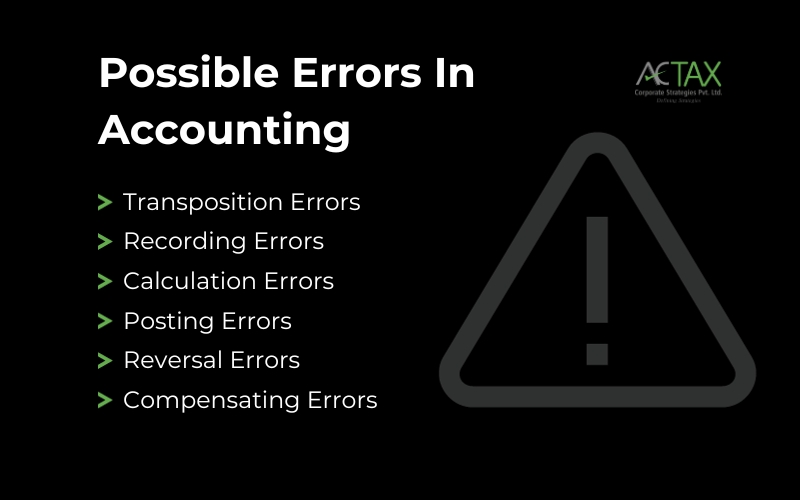

Types of Accounting Errors

Accounting errors can be categorized into several types, each with its implications:

1. Transposition Errors

Transposition errors occur when digits or characters are inadvertently swapped. For example, they are recording a $1,235 transaction as $1,325. These errors can be challenging to detect but can significantly impact financial statements.

2. Recording Errors

Recording errors involve incorrectly entering data into accounting records. These errors can range from incorrect amounts to omitting transactions entirely. They distort the accuracy of financial statements.

3. Calculation Errors

Calculation errors result from mistakes in arithmetic calculations. Errors in addition, subtraction, multiplication, or division can lead to inaccurate financial figures, affecting budgets and forecasts.

4. Posting Errors

Posting errors occur when transactions are recorded in the wrong accounts or with incorrect dates. These errors can distort the financial position of a business, making it challenging to assess its proper financial health.

5. Reversal Errors

Reversal errors involve recording a transaction correctly but then reversing it later erroneously. This can lead to double-counting or omitting transactions, causing discrepancies in financial reports.

6. Compensating Errors

Compensating errors occur when two or more errors offset each other, making the financial statements appear correct while underlying inaccuracies exist. These errors are particularly insidious as they can go unnoticed for extended periods.

Causes of Accounting Errors

Several factors contribute to accounting errors

1. Human Error

Accounting is complex and detail-oriented, making it susceptible to human errors. Typos, miscalculations, and oversight can lead to inaccuracies in financial records.

2. Lack of Training:

Inadequate training in accounting principles and software can lead to errors. Staff members who need proper training may need help with recording transactions accurately.

3. High Workload and Stress

A high workload and stress in busy accounting departments can lead to rushed work, increasing the likelihood of errors. Overworked accountants may need more time or mental clarity to double-check their job thoroughly.

4. Complex Transactions

Complex financial transactions, such as mergers and acquisitions or international business dealings, are more prone to errors due to their intricate nature and diverse accounting rules. Learn More About Golden Rules of Accounting & Bookkeeping

5. Outdated Software

Using outdated accounting software can result in compatibility issues, leading to data corruption or incorrect calculations.

3. Lost Documents for Accounting

Lost documents pose a significant challenge in accounting, where meticulous record-keeping and documentation are essential for financial transparency and compliance. These critical problems with the accounting equation can lead to various issues, including financial discrepancies, legal complications, and reputational damage for businesses and organizations.

Possible Document Loss

1. Physical Loss:

Misplaced or damaged physical documents, such as invoices, receipts, contracts, and financial statements, can occur due to poor organization, mishandling, or accidents like fires or floods.

2. Digital Data Loss:

In an era of digital accounting, losing electronic files, spreadsheets, and databases can be equally detrimental. Data can be lost due to hardware failures, software glitches, or inadequate backup procedures.

Impact of Lost Documents

1. Financial Inaccuracy:

Lost documents can result in inaccuracies in financial records. Missing invoices or receipts can lead to overstatement or understatement of income or expenses, potentially affecting tax calculations and financial statements.

2. Compliance and Audit Issues

Regulatory authorities often require businesses to maintain specific records for compliance purposes. Lost documents can lead to non-compliance, resulting in fines, penalties, or legal actions. The absence of critical documents can raise red flags during audits and prolong the auditing process.

3. Reputational Damage:

Lost documents can erode trust and credibility internally and externally. Stakeholders, including investors, creditors, and clients, may question the competence and reliability of an organization’s financial reporting.

4. Missed Due Dates While Accounting

Missed due dates and late payments represent a critical challenge in accounting, affecting a company’s financial health, relationships with suppliers, and overall business operations. This problem with the accounting equation arises when an organization fails to meet its financial obligations promptly, leading to a cascade of negative consequences.

Causes of Missed Due Dates & Late Payments:

1. Cash Flow Issues:

Insufficient cash flow or poor cash management can lead to delays in settling bills and invoices. Companies may need more liquidity to meet their financial commitments.

2. Inefficient Processes:

Complex approval workflows, bureaucratic procedures, or manual payment systems can slow down payment. Inefficiencies in these processes can result in missed deadlines.

3. Errors and Oversight:

Accounting errors, oversight, or miscommunications within an organization can lead to missed due dates. This may happen when invoices or bills are not adequately reviewed, approved, or scheduled for payment.

Avoid Mistakes, Let Experts Take Care of It!

5. Audits

Audits play a vital role in ensuring the accuracy and integrity of financial records, making them a double-edged sword in the world of accounting. While audits are essential for transparency and compliance, they can also pose business challenges and disruptions. Understanding the critical nature of audits in accounting is crucial for maintaining financial health and regulatory compliance.

Why You Should Perform Audits?

1. Regulatory Requirements

Government agencies and industry regulators often mandate audits to ensure businesses comply with financial reporting standards, tax regulations, and industry-specific requirements.

2. Financial Concerns

Suspicion of financial misconduct, irregularities, or discrepancies in financial statements can trigger internal or external audits.

3. Periodic Reviews

Many businesses conduct routine audits as part of their internal control measures to identify errors, fraud, or inefficiencies in financial operations.

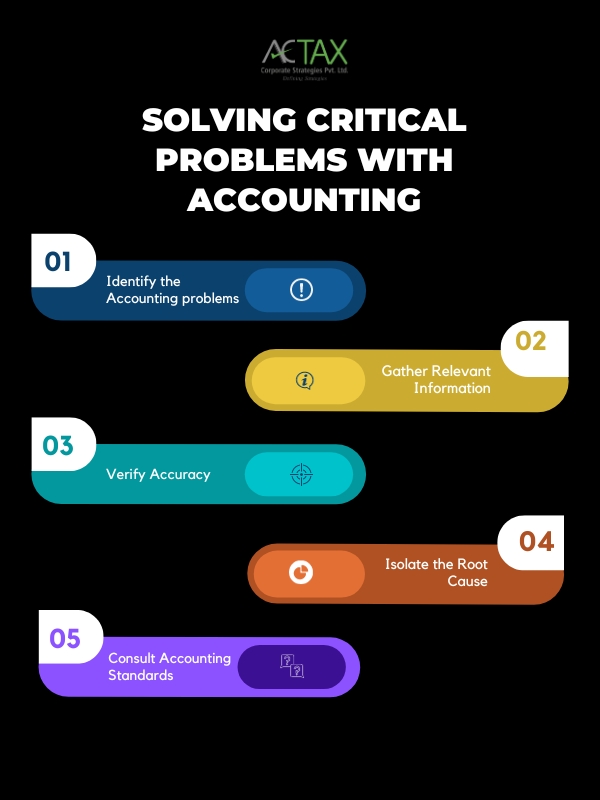

How Do You Solve Critical Problems with Accounting?

Accounting problems, whether related to financial discrepancies, errors, or complex calculations, require a systematic approach to resolution. Here is a step-by-step guide on how to solve accounting problems effectively:

1. Identify the Problems Associated with Accounting

Begin by clearly defining the accounting problem. Determine the nature of the issue, whether it’s a discrepancy, error, or calculation challenge.

2. Gather Relevant Information

Collect all relevant financial documents, records, and data related to critical accounting issues. This may include invoices, receipts, bank statements, ledgers, and financial reports.

3. Verify Accuracy

Carefully review the financial information to identify inaccuracies, discrepancies, or irregularities. Cross-check figures, transactions, and calculations to align with accounting standards.

4. Isolate the Root Cause

Investigate the problem account origin. Determine whether it results from data entry errors, miscommunication, software glitches, or complex financial transactions.

5. Consult Accounting Standards

To ensure compliance, refer to accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Verify that financial records adhere to these standards.

Mitigate The Problems with Accounting

- Firstly, they need more resources, including finances and staff, to maintain accurate financial records.

- Secondly, complex tax regulations create challenges in tax compliance, increasing the risk of errors and penalties.

- Thirdly, effective cash flow management is essential, but small businesses often need help to predict and monitor their cash flow adequately. Additionally, inefficient manual bookkeeping processes can lead to errors and missed cost-saving opportunities.

- Lastly, small business owners’ lack of accounting expertise can exacerbate financial mismanagement. Addressing these issues necessitates meticulous planning, technology utilization, and seeking professional assistance to ensure small enterprises’ economic well-being and sustainability.

Small businesses face several critical problems with accounting that can significantly impact their financial health and operational efficiency. This problem with accounting includes cash flow management challenges, issues related to tax compliance and reporting, accounting software limitations, difficulties in managing payroll and employee benefits, and the need for accurate financial forecasting. Addressing these issues with proactive measures, such as implementing robust accounting systems, seeking expert guidance, and maintaining a clear understanding of tax regulations, can help small businesses navigate accounting complexities and ensure long-term financial stability and success. Understand the Pros and cons of Outsourcing Accounting in India