Trust Registration in Bangalore

Start Your NGO by Registering a Trust in Bangalore with Us

Register Section 8, Trust & Society Quickly with Actax India

Why You Should Register A Trust in Bangalore?

Benefits of Trust Registration in Bangalore

Credibility & Transparency

Registered trusts help to establish credibility with the donors and the beneficiaries as you show your commitment to an issue.

Get Asset Protection

Trust's assets are protected against lawsuit & creditor claims. It safeguards assets as per trust's objectives.

Enduring Legacy of Charity

Resources of trust can keep working even after your death, extending your charitable impact across generations.

Get Tax Exemption

With special provisions of 12A & 80G from IT department, get tax exemptions for charitable activities.

Documents Required for Trust registration in Bangalore

We have decades of experience in simplifying registration process for our clients. We assist with end-to-end documentation to register trust in Bangalore.

Trust Deed

Executed on the correct stamp paper consisting of the provisions of the trust.

Trustee Identification

Two passport-size photographs, photocopies of the trustees’ PAN card, and other valid photo identity proof like Aadhar Card or Voter Card.

Registered Office Proof

Utility bill or any other document proving the registered office address of the trust.

Proof of Property

Any evidence like title deeds of properties owned by the trust, if applicable.

No Objection Certificate

From the property owner in case the trust uses premises, which is let out.

Requirements for documents may vary on multiple factors like the number of trustees, leased property, ownership, etc. So, it is suggestible to contact Actax India to know more about this in detail.

Process of Trust Registration in Bangalore

Trust registration in Bangalore is usually facilitated in the following steps:

Name of the Trust

Select a suitable name for the trust to ensure that they are compliant with the Trademark Act of 1999, the Copyright Act of 1957, other Intellectual Property Rights, and the Emblems and Names Act of 1950.

Settlers of the Trust

Identify persons who will act as settlers of the trust. There is usually no limit to the number of trustees although the organization must have at least two trustees. Benefactor cannot be a trustee and all the trustees should be Indian citizens.

Memorandum of Association (MOA)

The Memorandum of Association (MOA) must be drafted to state the purpose and aim of the formation of the trust. Make sure that the goals provided in the MOA are legal.

Draft the Trust Deed

Appoint a legal trustee and sign a formal document known as the trust deed to form the trust. This document consists of all the terms and conditions that are agreed upon between the author, the trustees, and the beneficiaries and this should be handed over to the registrar when the same is being registered.

Submission to the Registrar

File and sign the drafted trust deed and other necessary documents to the registrar. This process will entail the involvement of the author, and trustees together with the beneficiaries.

Review by the Registrar

The trust will be registered if the registrar approves its formation after the submitted documents have been examined and deemed to be valid and compliant.

Certificate of Trust Registration

Upon the approval of the registration, the registrar will then provide the trust with a trust registration certificate. Both the trustees and the trustor should retain this certificate. After this, since the trust is now a registered one, it is in a position to open an account in the bank of its choice.

Why Choose Actax India for Trust Registration in Bangalore?

Unparalleled Expertise

The blended team of legal and tax consultants has years of experience in the registration of trusts.

Streamlined Efficiency

We take care of the details, meaning – you get to have a smooth and easy registration process.

Cost-Transparency

Our payment schedule is equitable and straightforward forward – so you do not have to worry about inflated costs.

Unwavering Partnership

Rest assured, we are with you all the way – from the initial consultation through to completion and beyond.

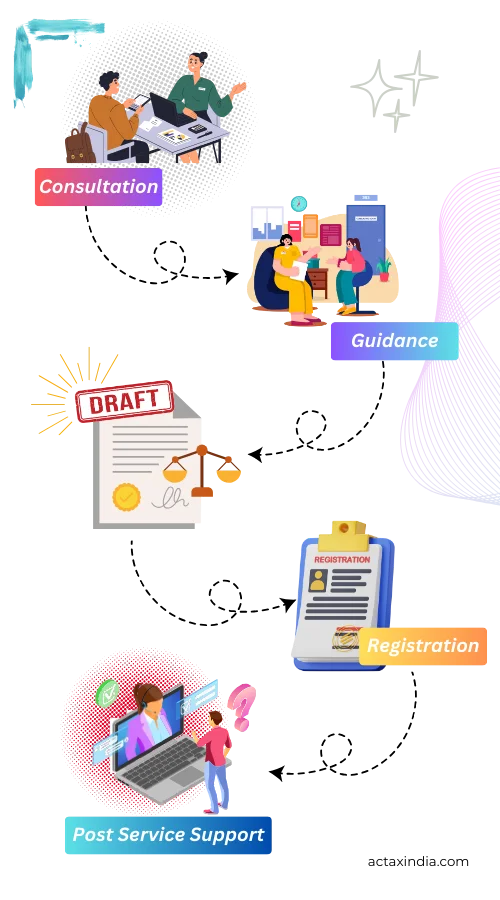

Enjoy A Seamless Journey of Trust Registration in Bangalore With Actax India

We have decades of experience in simplifying registration process for our clients. We assist with end-to-end documentation to register trust in Bangalore.

Free Consultation

Our professionals ask a few necessary questions to the trustees, regarding the purpose and objectives of the trust, and other associated concerns.

Expert Document Guidance

We then systematically present a checklist of documents to you to collect all papers required for registering your trust in Bangalore.

Tailored Trust Deed Drafting

Regarding the trust deed, our legal department prepares a highly personal document that will meet your concept 100% and strictly adheres to the law.

Registration Support

We assist you with all the formalities involved in the process of trust registration in Bangalore, without you worrying or needing to do a thing.

Ongoing Compliance Support

We provide constant guidance regarding the management of trusts, along with providing regulatory compliance required as an after-service.

Frequently Asked Questions on Trust Registration in Bangalore

Do I need any legal help to register a trust?

Although it is not obligatory, legal advice is strongly advised. The trust deed is an essential document, which must be drafted within the legal parameters, which only a lawyer can do to align it with the client’s vision. For any queries or legal help regarding trust registration, Actax India’s legal team has professionals specialized in this field.

What are the eligibility requirements for registering a trust?

As for the eligibility criteria, the settlor does not have to meet any special criteria. But at least two trustees out of which one must be residing in India are mandatory. The objects of the trust must also be legal and beneficial to the society.

How long does the trust registration process typically take?

It may take time depending on how long it takes to complete the paper then the number of documents you will require for registration or sometimes the registrar may take time to process the registration. But when done with the assistance of Actax India, the process can be integrated and successfully ended.

What are my ongoing responsibilities after registering a trust?

Being registered is not enough when it comes to managing a trust as it entails several requirements and considerations. Trustees are also supposed to keep records of the finances properly, they may further be required to file returns and act according to the terms of the trust deed. Minimising risks that may affect the benefits of the beneficiaries is important especially when investing on their behalf or the way they will be informed is crucial. Actax India can assist you in managing all these issues and make your trust run seamlessly.

What are the different parties involved in a trust?

1. Grantor/Settlor/Trustor: This is the person who generates the trust and puts his/her assets into it. They, in a way, initiate the trust in the first place.

2. Trustee: In general, it is helpful to envisage the trustee as the ‘manager’ of the trust. The Board of Trustees is charged with the governance of the trust and the management of the funds through investment and the appropriate distribution thereof in terms of the “Trust Deed” which is a legal document that defines the function of the trust.

3. Beneficiary: This is the person or entity that will benefit from the trust at the end of the day or the end of the term given. They are paid an income or an interest in assets stated in the trust deed.

4. Protector (Optional): At times, there is an accompanying protector whose role is to monitor or supervise the actions of the trustee. The protector makes sure that the trustee performs his duties by the provisions of the trust deed and in the best interest of the beneficiaries.

What are the different types of trusts?

1. Revocable Trust: This trust provides flexibility. This trust can be altered or canceled by the grantor while the grantor is alive.

2. Irrevocable Trust: An irrevocable trust, by definition, cannot be altered by the grantor at any point once it is set up. This may lead to less tax and more protection, yet this needs more investment

3. Testamentary Trust: This type of trust arises from a will, and it comes into operation when the grantor dies.

4. Charitable Trust: Intended for the use or support of a public charity or a particular charitable purpose or use.

5. Support Trust: Offers cash to a beneficiary under certain guidelines on how the cash is to be used. This can help in avoiding situations whereby the money is used unwisely.

6. Special Needs Trust: Designed for use by a disabled individual for his or her own benefit but not in a way that prejudices his or her right to public assistance.

7. Living Trust: Distinguished from a will, a living trust can also help the grantor bypass probate if it is set up while the grantor is alive. Contact Actax India to select the right trust type for you!