One of the biggest questions you would have after the recent changes in the tax slab would be “Am I going to save more or lose more money this year?” This question is understandable as it is often confusing to compare the new income tax slab in India versus the old income tax slab.

And fortunately for you, we have covered all the details and questions necessary for you to choose.

By the end of this blog not only you have a clear idea about which regime to choose for your upcoming tax planning, but you will also be able to answer all income tax-related questions that are thrown your way about the income tax slab in India.

Table of Contents

Is New Income Tax Slab Better Than the Old Tax Slab?

Here we have compared the New Income Tax Slab to the old one. This gives you clarity on, how the new tax slab is going to affect you. Is it positive or negative?

New Income Tax Regime

A new tax regime was introduced in Budget 2020 to offer a wider variety of options while choosing the tax slab based on your income stream.

But at that time, the new income tax slab did not have as many advantages as it has currently, and many opted to go for the old regime.

Because of the changes made in Budget 2023, the rates have changed as follow –

| Tax Slab for FY 2023-24 | Tax Rate | Tax Slab for FY 2024-25 | Tax Rate |

|---|---|---|---|

| Upto ₹ 3 lakh | Nil | Upto ₹ 3 lakh | Nil |

| ₹ 3 lakh - ₹ 6 lakh | 5% | ₹ 3 lakh - ₹ 7 lakh | 5% |

| ₹ 6 lakh - ₹ 9 lakh | 10% | ₹ 7 lakh - ₹ 10 lakh | 10% |

| ₹ 9 lakh - ₹ 12 lakh | 15% | ₹ 10 lakh - ₹ 12 lakh | 15% |

| ₹ 12 lakh - ₹ 15 lakh | 20% | ₹ 12 lakh - ₹ 15 lakh | 20% |

| More than 15 lakh | 30% | More than 15 lakh | 30% |

Now if you’re thinking “Is there any way to save tax in a new tax regime?”

Then there definitely is – a new income tax slab in India offers a full tax rebate on an income of up to Rs 7 lakhs. This means that if your annual income is Rs 7 lakh or below, you do not have to pay any amount of tax. You can also check this – Tax Brackets in India

On top of this, there is a standard deduction of Rs 75,000.

This means that if your annual income is Rs 7,75,000, then you have to pay no tax at all. So if the question was “Is the new income slab better than the old income slab”, then the new regime is definitely better if you are earning below Rs 7,75,000.

Now what if you earned anything above that?

This is where things get tricky, because along with the advantage that the new regime offers, there is a disadvantage too.

What is the disadvantage of the new tax regime?

There is a very clear disadvantage in the new income tax slab which is that it does not have any deductions. All the various deductions such as HRA, LTA, 80C, 80D, etc, do not exist.

So this means that if you’re earning even slightly more than Rs 7,75,000, then it might become a disadvantage for you, due to the unavailability of deductions.

So this is where we can explore the possibilities of the old tax regime. See the Detailed Comparative Analysis of New Tax Slab to Old Income Tax Slab.

Old Income Tax Regime

The old tax regime offers taxpayers deductions so that they can claim these and reduce their burden on taxes.

But this income tax slab in India can get a little confusing, so before getting into the deductions let us take a look at what the slab rates are under this regime:

| Income Slabs | Age < 60 years & NRIs | Age of 60 Years to 80 years | Age above 80 Years |

|---|---|---|---|

| Up to ₹2.5 lakh | NIL | NIL | NIL |

| ₹2.5 lakh - ₹3 lakh | 5% | NIL | NIL |

| ₹3 lakh - ₹5 lakh | 5% | 5% | NIL |

| ₹5 lakh - ₹10 lakh | 20% | 20% | 20% |

| ₹10 lakh and above | 30% | 30% | 30% |

So as you can see, the rates of the old regime were comparatively high but when paired with deductions, it can make or break the amount of tax you will pay.

But what exactly is the amount where you can switch or what exactly is the regime that you should choose?

For this we can look at another table.

New Income Tax Regime Vs Old Income Tax Regime

So while it is still confusing as to which is the best income tax slab in India, we can do a quick side-by-side comparison to see which tax slab really helps you save more tax.

| Income | Old tax regime (Age up to 60 years) | Old tax regime (Age 60-80 years) | Old tax regime (Age over 80 years) | New tax regime (All age groups) |

|---|---|---|---|---|

| Up to Rs 2.50 lakhs | Nil | Nil | Nil | Nil |

| From Rs 2.50 lakhs to Rs 3 lakhs | 5% | Nil | Nil | Nil |

| From Rs 3 lakhs to Rs 5 lakhs | 5% | 5% | Nil | 5% |

| From Rs 5 lakhs to Rs 7 lakhs | 20% | 20% | 20% | 5% |

| Rs 7 lakh to Rs 7.50 lakhs | 20% | 20% | 20% | 10% |

| From Rs 7.50 lakhs to Rs 10 lakhs | 20% | 20% | 20% | 10% |

| From Rs 10 lakhs to Rs 12 lakhs | 30% | 30% | 30% | 15% |

| From Rs 12 lakhs to Rs 12.50 lakhs | 30% | 30% | 30% | 20% |

| From Rs 12.50 lakhs to Rs 15 lakhs | 30% | 30% | 30% | 20% |

| Above Rs 15 lakhs | 30% | 30% | 30% | 30% |

Referring to the above tables will be extremely crucial in submitting your IT returns without any hassle.

This can sometimes seem like an extremely daunting task given the number of columns you have to fill up on the form, but thankfully, Actax can simplify the process of filing your IT returns.

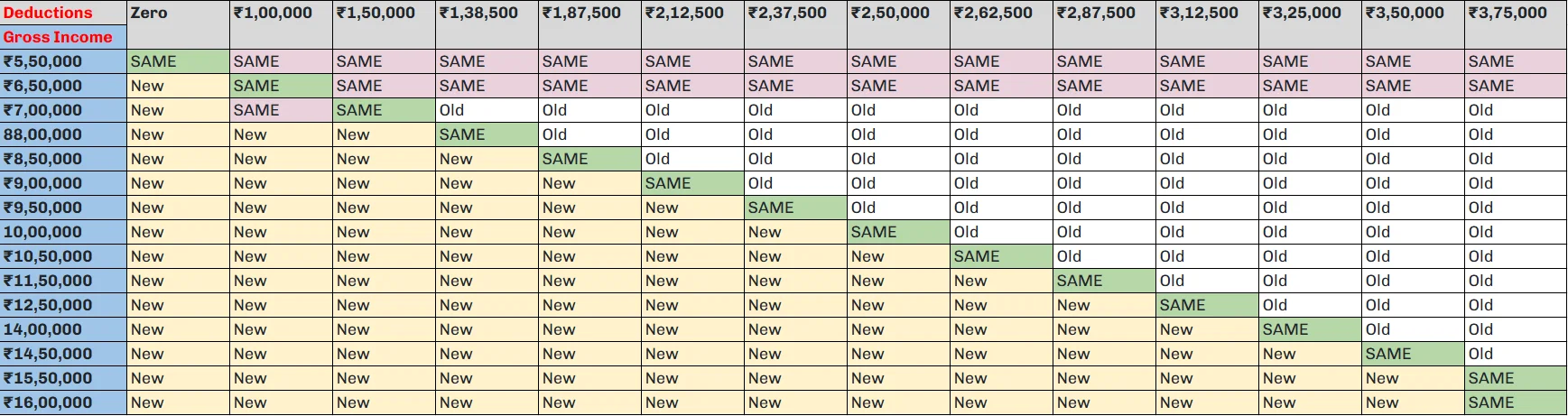

Breakeven Threshold for New Income Tax Slab Vs Old Income Tax Slab:

The Breakeven point is the amount at which there will be no difference between the two tax regimes.

Staying in the old tax regime is better if your total eligible deductions and exemptions exceed the breakeven threshold for your income level.

On the other hand, switching to the new tax regime is more advantageous if the breakeven threshold is higher.

Here is an image to help you make a better choice:

Bottom Line - is the New Tax Regime better than the Old Tax Regime?

The bottom line when comparing both the income tax slab in India is to realize that if you are an individual with a higher salary and more deductions, then opting into the old income tax slab might be beneficial while if you have a moderate salary and no deductions, opting into the new income tax slab would be better.

Using a tax calculator will prove to be helpful in calculating your tax liabilities for the year.

But why stop there? Filing your Income Tax Return (ITR) is another critical step to staying compliant and maximizing your benefits. That’s where Actax steps in to make life easier.

Our ITR services are designed to take the stress out of tax filing. After all, filing taxes doesn’t have to be a hassle when you have the right partner by your side.