Ever thought about how much you have already saved for your retirement in your EPF account? Feeling fed up with the process of checking your balance? You’re not alone! But worry no more! This manual is your single destination for a seamless and stress-free EPF balance check. We realize that saving for the future is a very essential thing for you. This guide will not only teach you how to check your balance in minutes, but will also give you an idea why it is important to monitor your EPF regularly. Besides, this blog will guide you to the best way to tackle the common mistakes and also to debug any problem you will face in the beginning

Table of Contents

Simple Ways to Conduct an EPF Balance Check

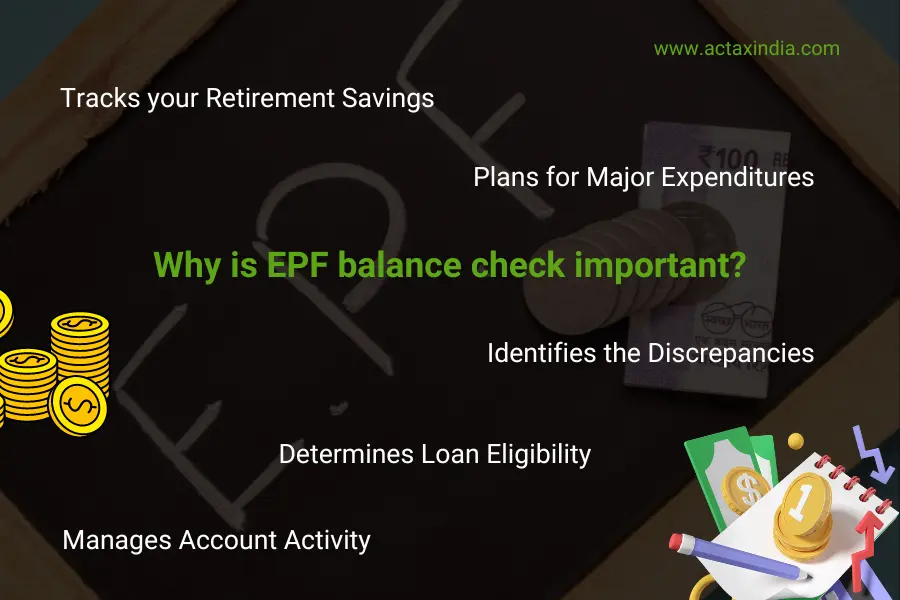

Why is EPF balance check important?

There are various reasons why EPF balance check is so important:

- Tracks your Retirement Savings: The EPF is a savings scheme that provides long-term financial stability during your retirement, which reduces the pressures of future living. One way to manage your savings is by checking out your balance to see the amount you have and draw out a savings plan for yourself. It may be required to revise your template of savings or consider the other investment instruments if your EPF account is lacking to meet your retirement goals.

- Identifies the Discrepancies: Frequently checking your EPF balance to ensure that your contributions are correctly reported is a very important aspect. It is possible that wrong or misled outcomes are generated by the side of your employer on the part of the EPFO. Early detection makes sure that immediate remedy for the problem is provided, returning your account to proper balance.

- Plans for Major Expenditures: Under special circumstances, the EPF scheme is also allowable to cater for withdrawals. Knowing the balance enables you to decide if this will save enough periodically to cushion emergencies, buy a house or be used for other major expenditures.

- Determines Loan Eligibility: As and when required, you are eligible to arrange loans against your EPF balance. It is important to know your balance to help you to figure your loan eligibility and to determine the maximum amount you can borrow.

- Manages Account Activity: Guarding EPF balance helps you to monitor the contribution from your end as well as your employer’s. It allows you to have everything in order on your EPF account. This is why you should frequently facilitate EPF balance check. Refer to this blog How to Withdraw My EPF Amount: A Simple Guide

What should be the frequency of the EPF balance check?

There is no unique answer as to when you should check your EPF balance. However, here’s a breakdown of some factors that you must consider, that can help you determine the best frequency for you:

- Peace of Mind: If a close monitoring of your finances is a priority and you’d rather be a proactive follower, a 1-3 months check could be the most suitable for you.

- Recent Job Change: It is better to check your balance every month or two (for the first year) for the purpose of making sure that your contributions are made properly to an account that is still active.

- Low Contribution: If that is your case, a 6-month inspection interval should be okay for you.

- Upcoming Financial Needs: If you have plans for EPF withdrawals either in one go or in a drip fashion for down payment or any other reason, checking every alternative three-four months can help you in mapping your progress towards your goal.

What is a UAN number and how to obtain one?

A UAN (Universal Account Number) is a 12 digit number, which is given to any individual worker in India by the Employee Provident Fund Organisation (EPFO). It serves as a vessel, through which all the PF contributions you have made with various employers throughout your working career are gathered.

Here’s why a UAN is important to facilitate an EPF balance check:

- Portability: The account number given to you by your employer will be different every time you change jobs. However your UAN is never changed. This would allow all your PF contributions from various employers to be consolidated under one umbrella and hence help you to manage and track it easily.

- Convenience: Through your UAN, you will be able to do the things like processing your EPF account online by EPFO portal or UMANG app. This is convenient for you to keep an eye over balance, contributions and to start using services like, transfers, claims and many others.

Process of obtaining the UAN number

There are two main ways by which you can get a UAN, depending on your employment status:

Through Your Employer:

- The employer will establish your UAN in case you are a first time employee working under a registered company. They would need you to furnish details about you including KYC (PAN, Aadhaar etc. ), and your bank account details. The EPFO (Extended Provident Fund Organization) will then issue you your unique account number (UAN) and notify you about it.

- UAN is an inevitable step you should not skip at all. But in case you already have a PF account but there is no UAN yet, linking your current PF account to the new UAN can be done by your new employer.

Through Self-Registration (For Existing PF Account Holders):

- If you’re already employed and have a PF account but haven’t been allotted a UAN yet, you can register for one yourself on the EPFO website (https://unifiedportal-mem.epfindia.gov.in/).

- You will need your earlier PF amount, KYC, account number with Aadhaar, and an active phone number with Aadhaar, for verification.

Here are some additional points to remember:

- It is also possible to find your UAN on the salary slip issued by your company.

- In case you have forgotten your UAN, you can get it retrieved from the official EPFO website, once you provide the registered mobile number and PAN or Aadhaar details.

How to conduct an EPF balance check with a UAN number?

There are multiple feasible ways to facilitate an EPF balance check if you have a UAN number:

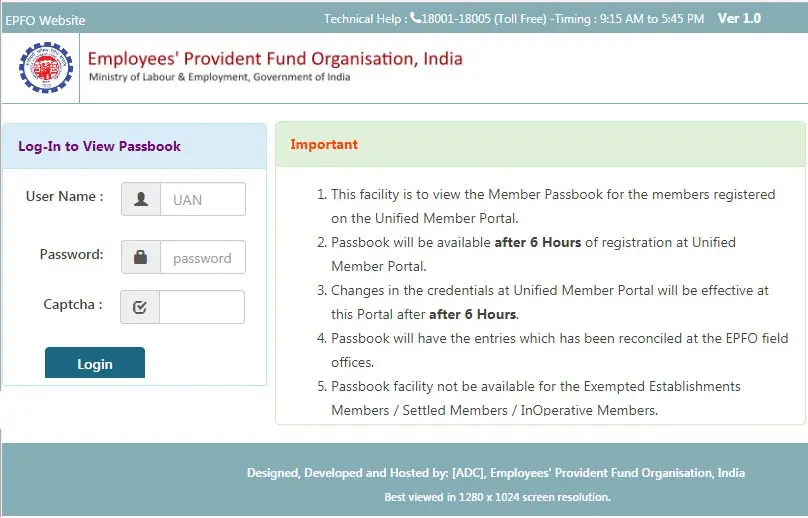

1. Using the EPFO e-Passbook Portal:

- Visit the EPFO Member e-SEWA portal (https://passbook.epfindia.gov.in/MemberPassBook/Login).

- Enter your UAN number and captcha code, then your password.

- Tap the “Sign In ” button.

- Under the “Member ID” menu, choose which one “you want to inquire about” as you have multiple UAN accounts linked to it.

- Click on “View Passbook” to see your current balance and detailed transaction history.

- This also enables you to print your e-passbook to get a hard copy for your records.

2. Using the UMANG App:

- Download the UMANG app from the Google Play Store or iOS App Store and then install it.

- The application supports both mobile number and Aadhaar registration, so you can use either of them for login.

- Navigate to the “Social Security” section in the service menu and then choose “Social Security”.

- Click the “EPFO” button amongst various other services.

- Under “Employee Centric Services” pick “View Passbook”.

- Enter your UAN number and select the “Get OTP” option.

- Type in the OTP sporadically received on your registered mobile number in the tab provided by your UAN.

- Click “Submit” after you have made your selection of EPF passbook for the preferred PF account.

- You have the option of either downloading it to your phone or printing it out so you can access it in both scenarios.

3. Missed Call Service:

- This technique is fast and offline based.

- Call 011-22901406 but be sure to dial this phone number from the mobile phone you registered with your UAN.

- The phone will ring twice and then go unanswered.

- Within a moment you’ll get an SMS with your account balance.

4. SMS Service:

- The SMS can be sent from your mobile number (the registered one) to 7738299899.

- In the message body, type: EPFOHO UAN <Your 12-digit UAN Number> (For example: EPFOHO UAN 123456789012).

- You will receive an SMS reply with your EPF balance amount.

See to it that your mobile number is linked to the UAN for the SMS and UMANG app methods to be up and running.

How to conduct an EPF balance check without a UAN number?

Unfortunately, to conduct an EPF balance check directly through mobile apps or online portals demands a UAN number. However, if you don’t have one, there’s still an option:

Contact Your Employer:

- This is the most trusted option for all those who do not have their corresponding UAN.

- Your employer holds and manages your PF account information and can easily check your current balance.

- Furthermore, they can walk you through UAN registration if needed.

Here are some additional points to consider:

- Limited Information: In the absence of your UAN number, you may not be able to view your detailed transactional data or reach online services like EPFO portal and UMANG app.

- UAN Benefits: The UAN creation grants the applicant with many long-term advantages. It encompasses the recent developments in balance checking which occurs online and gives you the ability to oversee your EPF account. Moreover, it serves as a one-stop-shop where all your PF contributions are integrated.

Disclaimer: You may need to contact your previous employer after changing your job if you have not yet received your UAN.

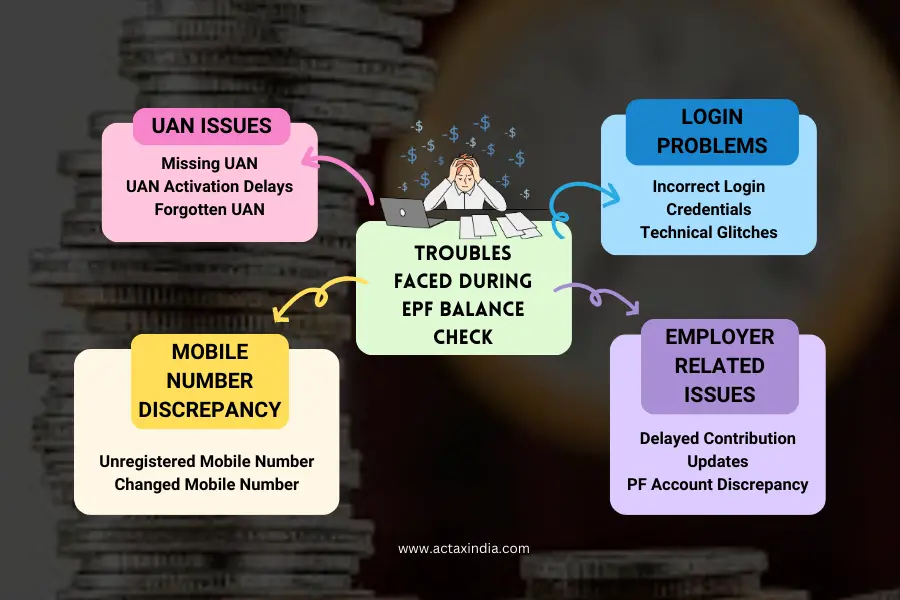

What are the troubles faced during an EPF balance check?

While EPF balance check can be a straightforward process, there can be some occasional roadblocks, which are as follows:

UAN Issues:

- Missing UAN: In case you are new in a company or you have not activated your UAN yet, you would better take care of this beforehand and then check your account online.

- UAN Activation Delays: Since the EPFO is likely to be lagging in terms of UAN filings from your employer, the activation process may take some time.

- Forgotten UAN: Getting back a misplaced UAN calls for your mobile number that is registered in addition to PAN or Aadhaar details.

Login Problems:

- Incorrect Login Credentials: Typo errors in your UAN number, password or captcha code do not allow a login to the EPFO portal or UMANG app.

- Technical Glitches: The EPFO website and UMANG app can sometimes undergo technical issues that can lead to difficulties of logging in.

Mobile Number Discrepancy:

- Unregistered Mobile Number: If the mobile number you have is not linked to your UAN number, then you will not be able to use SMS or OTP services from the UMANG app.

- Changed Mobile Number: If you have recently changed your mobile number, you need to update that with the EPFO to use all these services.

Employer Related Issues:

- Delayed Contribution Updates: It might take some time before your employer’s contributions are finally showing in your EPF Savings Balance. Information between the TDS and UAN transfer can be updated on the EPFO server with occasional delay.

- PF Account Discrepancy: Once in a while, there could be a situation where your PF account is not in sync with your employer’s details. Approaching your employer’s HR department is one of the ways that you can get these matters resolved.

Solution to the problems

Here are some tips to avoid these troubles:

- Activate Your UAN Promptly: If you are new to a company, make sure that you activate your UAN immediately as you start there.

- Maintain Updated Information: Maintain the active mobile number and other KYC details to be able to access the portal online.

- Be Patient with Delays: Give them some time to settle in your account, and for the UAN activation process to wrap up.

- Save Login Credentials: Make sure to keep your UAN number as well as your password safe since you might encounter login problems if you cannot remember these.

- Contact Your Employer: In case any unusual activity is shown in your account data, you may contact the HR department straightaway for explanations and resolutions.

Take Control of Your Financial Future through EPF Balance Check

Knowledge of your EPF balance is the key to effective retirement planning. You will be able to monitor your progress, detect the discrepancies, plan for emergencies, and make the decisions based on the knowledge. Through the following, you will be able to control your financial future: monitor your savings, adjust contributions, find errors, assess emergency options and use balance information for wise choices. Get ready to triumph over the stress of EPF balance checks and gain the power to plan for retirement in a stress-free manner! Contact Actax India to strategically plan out your future finances and retirement savings. We promise to help you flourish financially.

Comments are closed.