Ever felt lost while trying to opt for TAN registration online and offline? Are you also struggling to opt for TAN registration on the income tax portal? It is a common hurdle for many. This blog will walk you through a foolproof method, ensuring you get it right whether online or offline, irrespective of the fact whether you’re a startup owner or an individual. Dive into our easy-to-follow steps and make your interaction with the income tax portal hassle-free.

Table of Contents

Definition of TAN

TAN is a ten-digit alphanumeric number that is mandatory for all individuals and organizations who are required to deduct or collect tax at source as per the Income Tax Act, 1961.Tax Deduction and Collection Account Number (TAN) is a key identifier issued by the Income Tax Department for entities responsible for deducting or collecting tax at source.

Registering and activating your TAN online and offline is crucial for a smooth tax-related process, ensuring compliance with tax laws and facilitating the correct processing of tax deductions.

Who Needs a TAN?

Any entity—including individuals, companies, and firms—that deducts tax at source is required to have a TAN. The eligibility for tan registration online and offline includes as follows:

- Employers deducting TDS from employee salaries.

- Financial institutions collecting tax on interest payments.

- Companies making payments to contractors or subcontractors.

Pre-Registration Requirements

Documents Needed

For tan registration process, ensure you have the following documents:

- PAN (Permanent Account Number) of the entity or person applying.

- Proof of identity (Aadhaar, passport, voter ID, etc.).

- Proof of address (utility bill, rental agreement, etc.).

Documents Needed

Before starting the process of TAN registration online and offline, gather these details:

- Name of the applicant.

- Name of the business or organization (if applicable).

- Address for correspondence.

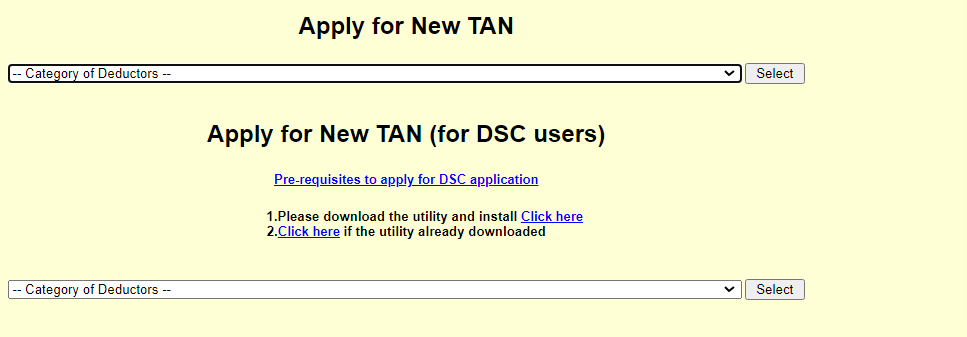

TAN Registration online

Step-by-Step Guide

- Visit the NSDL e-Governance website.

- Click on the “TAN” option and select “Apply Online.”

- Fill in the necessary details in the application form.

- Submit the form after verifying all entered information.

- Pay the processing fee through online modes.

- Download the acknowledgment receipt.

Website Links for Registration

For online registration, visit: NSDL e-Governance

Tips for a Smooth Registration

- Double-check all details entered to avoid any discrepancies.

- Keep digital copies of your documents for easy submission.

- Use a stable internet connection to prevent disruptions during the process.

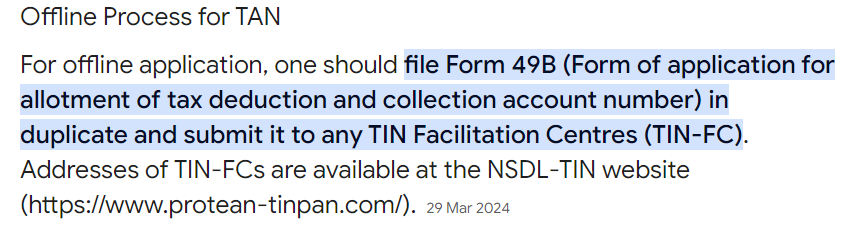

TAN Registration offline

Where to Go

You can register for TAN by visiting the nearest TIN Facilitation Center (TIN FC)/ NSDL office.

Documents to Carry

Ensure you carry:

- PAN of the applicant.

- Identity proof.

- Address proof.

Step-by-Step Process

- Obtain the TAN application form from the center or download it online.

- Fill out the form accurately.

- Submit the form along with the necessary documents.

- Pay the prescribed fee.

- Collect the acknowledgment slip.

Activating TAN on Income Tax Portal Online

Step-by-Step Activation Guide

- Visit the Income Tax Department’s official website.

- Log in or register using your PAN and other credentials.

- Navigate to the ‘TAN’ activation section.

- Enter the details as required.

- Submit the form and await confirmation.

Troubleshooting Common Issues

- If you encounter a ‘TAN not recognized’ error, verify the details entered.

- Check for any system updates or maintenance announcements on the portal.

- Ensure your browser is updated for compatibility.

Verification Process For TAN Registration

How to Verify Your TAN

To verify your TAN, visit the NSDL website and use the TAN verification tool available. Enter your TAN to check its status.

Timeframe for Verification

Typically, TAN verification can take a few hours to 5 business days, depending on the processing of your application.

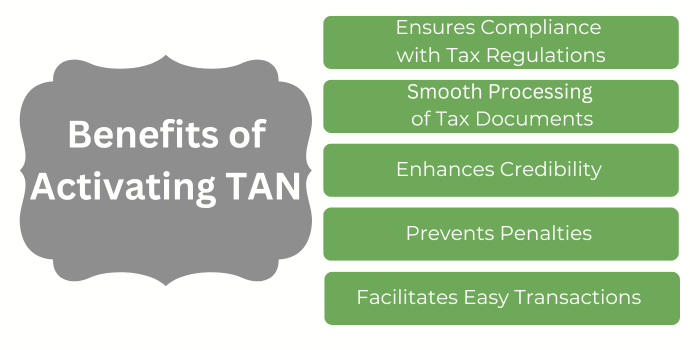

Importance of TAN Activation Online & Offline

Benefits of Activating TAN

Activating your TAN provides several benefits:

- Ensures compliance with tax regulations.

- Facilitates the smooth processing of tax-related documents.

- Enhances credibility with financial institutions and tax authorities.

Legal Implications of Non-Activation

Failure to activate TAN can lead to penalties, difficulties in filing returns, and challenges in conducting business that requires tax deduction.

Conclusion: TAN Registration Online & Offline Process

In summary, TAN registration online or offline, is essential for entities involved in tax deductions. By following the outlined steps and ensuring all requirements are met, you can streamline your tax processes and maintain compliance. Also, TAN registration on Income Tax Portal further simplifies the process for you. Don’t delay—take the necessary steps to register and activate your TAN today!

Contact Actax India, to enjoy a seamless process of TAN registration for your startup or for you. We can guide you through both the online and offline processes. We are also available for you to help you with registering your TAN on the income tax portal. Don’t hesitate to contact us today!

FAQs

You can retrieve it through your registered email or by visiting the NSDL site.

Yes, a nominal fee is charged for processing your application.

Yes, any individual responsible for tax deductions can apply for TAN.

Related Blogs

- How to File ITR Online: The Ultimate Guide

- ITR e-filing – All you need to Know About Income Tax e-filing Portal

- Form SPICe+ and Form FiLLiP – Instruction Kit and Comparison

- Impact of Budget 2024-2025 on Upcoming Tax Planning

- Income Tax Slab Changes: Income Tax Slab for AY 2024-25

- Impact of Budget 2024-2025 on Upcoming Tax Planning

- How to Convert LLP to Pvt Ltd.? Step-by-Step Process

- Top 10 Authentic Steps For Company Registration In Bangalore!

Comments are closed.