The internal users of financial statements use the financial information of a company or a corporate entity to make important company decisions, both financial and non-financial, that ultimately seal the fate of the company’s operations. By knowing who these internal users are, especially if you’re a new business owner, you will be able to determine how these internal users of financial statements impact the operational processes of your business or corporation; and what and how much power they have to leave an impact. Who knows, maybe, you’re also a part of it. Consider this blog a guide in your navigational endeavors.

Table of Contents

Internal Users of Financial Statements: Who Are They?

Who are the Various Users of Financial Statements or Accounting Information?

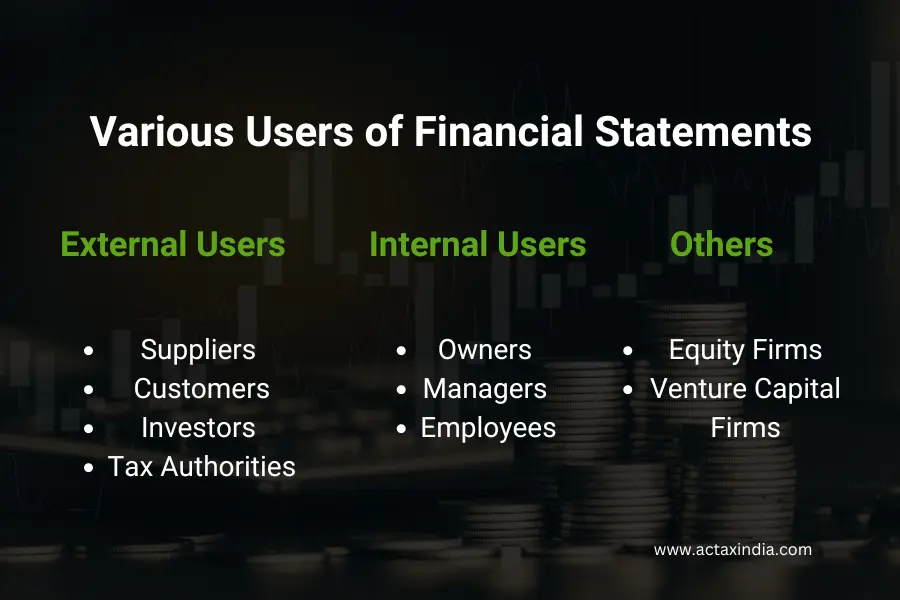

Be it vivid accounting information or simple financial statements, a wide range of users seek access to them, backed by their own set of reasons. These users can further be categorized into two types, the external users and the internal users of financial statements (the general users fall under the extended category). Let’s classify them:

External users of financial statements:

External users such as investors, creditors, and government agencies depend on accounting information to evaluate the financial health and stability of a business.

Internal users of financial statements:

Internal users, such as company managers and bottom-line management (also employees), rely on accounting information to assess past performance, make informed decisions about the future, and allocate resources effectively. In the upcoming section, the context of internal users has been discussed vividly.

Others:

Other users such as banks, lenders, regulatory agencies, tax authorities, suppliers, and unions also use accounting information to make informed decisions and ensure the smooth functioning of business operations.

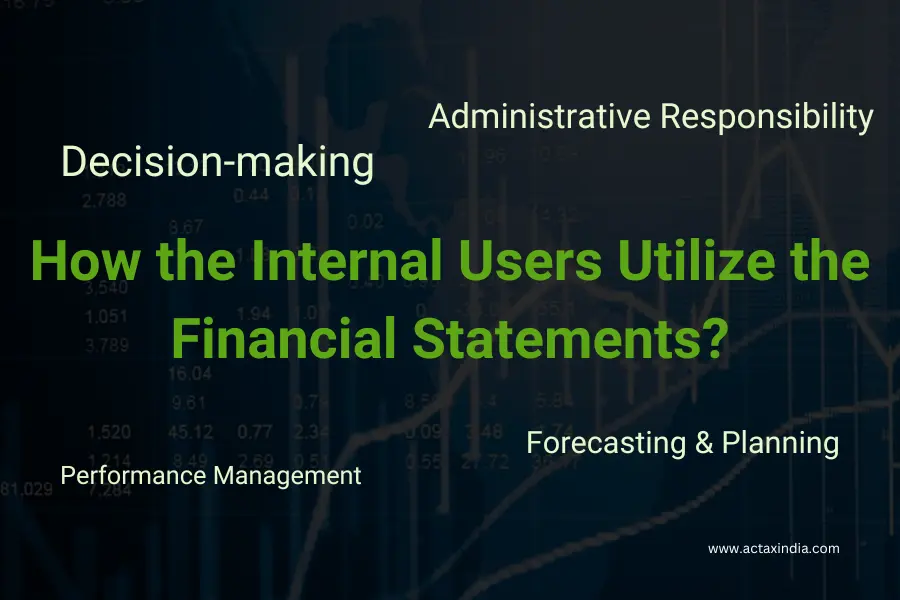

How the Internal Users Utilize the Financial Statements or Accounting Information?

The internal users of financial statements (i.e., the management, the business owners and the employees) use the aforesaid information in the following ways:

Decision-making:

The internal users of financial statements, as mentioned previously, use the financial statements or accounting information to facilitate active decision-making. Such decision-making is done in terms of financial investment for the company, budgeting and subsequent resource allocation, profitability analysis, and so on. These are made to ensure steady organizational growth, healthy finances, and operational seamlessness. For example, the shareholders (i.e., the owners) often resort to them to come to important investment decisions.

Forecasting & planning:

Financial forecasting demands this resource (i.e., financial statements) to ensure precision. In simple terms, a historical forecast leverages data from the past, precisely the financial statements to project future growth, and plan growth strategies subsequently. In this context, it is important to mention that these financial statements cover cash flow statements, balance sheets, income statements, and associated records.

-

Performance management:

Departmental performance, as well as, overall company performance, are often judged and analyzed based on the financial indicators, which in turn, are obtained from the financial statements. For example, the management utilizes them to check which organizational department is delivering more results, from the financial perspective (also which department requires a new strategy or improvement to have an optimized ROI).

-

Administrative responsibility:

By leveraging the financial statements, both the employees and the management take important administrative decisions, as a part of their core responsibility. These decisions are associated with operational management, marketing, finance, legal and public relations. The financial statements are used to understand the effectiveness of resource utilization.

Difference between External Users and Internal Users of Financial Statements

It is important to understand the basic differences between external and internal users to understand their functionalities governing the utilization of financial statements or accounting information. The core differences between external users and internal users of financial statements are as follows:

|

Features |

External Users |

Internal Users |

|

Who are they? |

|

|

|

What information do they use? |

|

|

|

Core functions |

Making decisions associated with its relationship with the business (e.g., investing in it, buying shares, etc.). |

Operate and manage the business and take strategic growth decisions (e.g., resource allocation, forecasting, etc.) |

|

Access to information |

Limited access to financial information, because of privacy, security, and regulatory reasons. |

Absolute access to any financial information, even the details and analogies, whenever required. |

|

Need for using financial statement |

|

|

|

Impact on financial statement |

|

|

|

Time horizon |

Focuses on long-term returns. |

Focuses on everyday facilitations. |

|

Financial statement analysis technique |

|

|

|

Regulation |

Income Tax Act, 1961 |

Companies Act, 2013 |

Ethical Considerations Associated with the Internal Users of Financial Statements

The ethical considerations associated with the internal users of financial statements are as follows:

-

Fair Representation

Internal users may manipulate figures to meet targets or hide financial difficulties, but the Companies Act, 2013 requires true and fair representation. Penalties for manipulation can be severe, including imprisonment. Maintaining transparency and integrity in financial reporting is crucial to avoid legal or reputational consequences and maintain stakeholder trust.

-

Selective Disclosure

Sharing crucial financial information with colleagues is essential for a level playing field at work. Insider trading regulations are strict in India, and selective disclosure can lead to legal repercussions. Always follow ethical practices and share important information with all stakeholders to avoid legal or ethical issues.

-

Maintenance of Confidentiality

It is important to keep in mind that financial data is often sensitive and should be treated with care. The Information Technology Act of 2000 has strict guidelines in place to prohibit unauthorized access, disclosure, or modification of electronic records. It is critical for internal users to be aware of these regulations and maintain confidentiality to avoid any legal issues that may arise.

-

Corporate Governance

Financial targets can sometimes lead to unethical practices, but the Companies Act, 2013 emphasizes transparency and accountability. Strong internal controls and whistle-blowing mechanisms can encourage ethical behavior, prevent manipulation, and maintain a positive reputation.

-

Adherence to the Indian Accounting Standards

It is important for internal users to understand Indian Accounting Standards, similar to IFRS, to interpret financial statements accurately and prevent misinterpretations. Familiarizing themselves with Indian Accounting Standards will ensure a comprehensive understanding of financial information.

Key Takeaways: Defining the internal users of financial statements

In order to drive growth, optimize resource allocation, and ensure the long-term success of your company, it is imperative to understand how internal users utilize financial statements. This guide provides a comprehensive overview of the various internal users, their roles, and the ethical considerations they must adhere to. By effectively using the statements, internal users of financial statements can make informed decisions that can help your business thrive. It cannot be overstated that transparency, ethical conduct, and a strong understanding of financial accounting principles are key to the success of any business. At Actax India, we have the best accountants and financial analysts ready to provide you with the best financial advice and solutions. Contact us today to ensure that you are fully utilizing your financial statements and making the most of your business opportunities.