The importance of cyber security is paramount irrespective of the fact that whether you’re a business owner who is entrusting the financial well-being of your company to an accounting firm or an accounting firm itself, that deals with sensitive financial information of big to small businesses and individuals. You will not want to experience financial loss if you belong in the first category, and similarly, you will not want to experience a loss of reputation and clients, if you’re from the second category. The growing instance of cyber threats in India has made it extremely difficult for Indian accounting firms to naturally protect sensitive financial information, thus enhancing the importance of cybersecurity for accounting firms. Consider this blog a guide for you to understand the current cybercrime landscape, the laws protecting them, a few actionable tips, and the benefits of cybersecurity for accounting firms in India.

Table of Contents

Analyzing the Crucial Role of Cybersecurity for Accounting Firms in India

Cyber Challenges Faced by Indian Accounting Firms

In India, small and medium-sized accounting businesses are prime targets for hackers because they handle sensitive financial data. According to IBM, professional services, such as accounting (by accounting firms), can incur an average cost of $4.65 million for each data breach; lost revenue makes up 38% of the entire cost of the breach, and there has been a 300% increase in cyber attack since the COVID-19 pandemic. So, imagine the magnitude of the negative impact it is currently leaving on India. The core cyber attacks faced by the Indian accounting firms are as follows

Type | Description | Landscape |

Phishing | Fake messages (email, text, phone) pose as legitimate businesses or individuals in order to steal your personal information (passwords, money, and data). | A substantial percentage of cyberattacks reported in India in 2022 were attributed to phishing emails, as per a report published by CERT-In (Indian Computer Emergency Response Team). It remains constant in the accounting sector as well. |

Malware | Software disrupting a computer’s normal operations which is usually developed by cyber hackers to steal data from computer systems or destroy them. | According to a 2023 research published by the National Association of Software and Service Companies, cybercrime causes $6 trillion in annual economic losses for India, the impact of which also extends to the accounting sector. |

Social Engineering | Through deception, it manipulates people or office workers into divulging private information or computer access, thereby getting in touch with sensitive information. | 2024 Data Breach Investigations Report reveals that the human factor is implicated in 74% of all breaches, where people are impacted by error, social engineering, misuse of privileges, or the use of stolen credentials (thereby highlighting the context of social engineering in accounting). |

Ransomware | A kind of malicious software that threatens to lock up or destroy a victim’s data or device until they pay the attacker a ransom (this can be both, in cash and in kind). | According to a 2023 study conducted by The Economic Times (India), ransomware attacks affected approximately 73% of mid- and large-sized enterprises in the nation, which also extended to the accounting sector. |

Insider Threats | Cybersecurity risks that start with authorized users (workers, contractors, business partners), who either purposefully or inadvertently abuse their rightful access or allow hackers to take over their accounts. | According to the CyberArk 2023 Identity Security Threat Landscape Report, employee departures pose a security risk to 80% of firms. For Indian accounting businesses with a high employee turnover rate, this is particularly troubling. |

Data Breaches | A security event that happens when someone without authorization accesses private or sensitive data (e.g., personal information like bank account numbers). | The Hindu revealed that India ranked in the 5th position for being the most breached country, having a total of 5.3 million breached and leaked accounts (including financial) in 2023. |

Cyberattacks Faced by Indian Accounting & Associated Sector

Here are some real-life examples of cyberattacks that have been faced by Indian accounting & associated sectors:

Credit Score Leakage From “Chqbook” – A Fintech Startup

During this incident, a data breach at Chqbook, a Delhi NCR-based fintech startup took place. The dark web witnessed more than 2 lakh (0.2 million) credit scores being leaked, which showcases an unfortunate reality of the Indian financial security system. Possible source points of the exposed data were the accounting companies that partnered with Chqbook. This episode demonstrated the lack of security of the monetary database systems. It was also a powerful wake-up call for Indian accounting firms to take cybersecurity more seriously, as it has now become a necessity since they deal with delicate data belonging to customers. In simple terms, it vividly highlighted the core cybersecurity concerns for accounting firms in India.

Security System Breach of Upstox – A Top Stock Broking Firm

Upstox, a well-known stockbroker in India, experienced a data breach in April 2021 where hackers gained access to 25 lakh (2.5 million) customers‘ sensitive data, including KYC (Know Your Customer) information. This event underscores the risk associated with customer data held by outside contractors, as the Times of India highlighted. Similarly, to protect their clients’ private financial data, Indian accounting firms that depend on outside data storage providers must exercise extreme caution when it comes to cybersecurity precautions. The relevance of cybersecurity for accounting firms in India gained momentum since this incident.

Data Leakage Case of Justpay- An Indian Payment Portal

A significant attack on the well-known online payment company Justpay (in 2020) exposed 35 million user accounts. Now, imagine the consequences it would have if it had happened to any accounting firm. They manage private financial information such as bank statements, tax returns, and customer investments. A simple data leakage can disrupt at least one small economy. Hence, the concept of cybersecurity for accounting firms has become very important nowadays

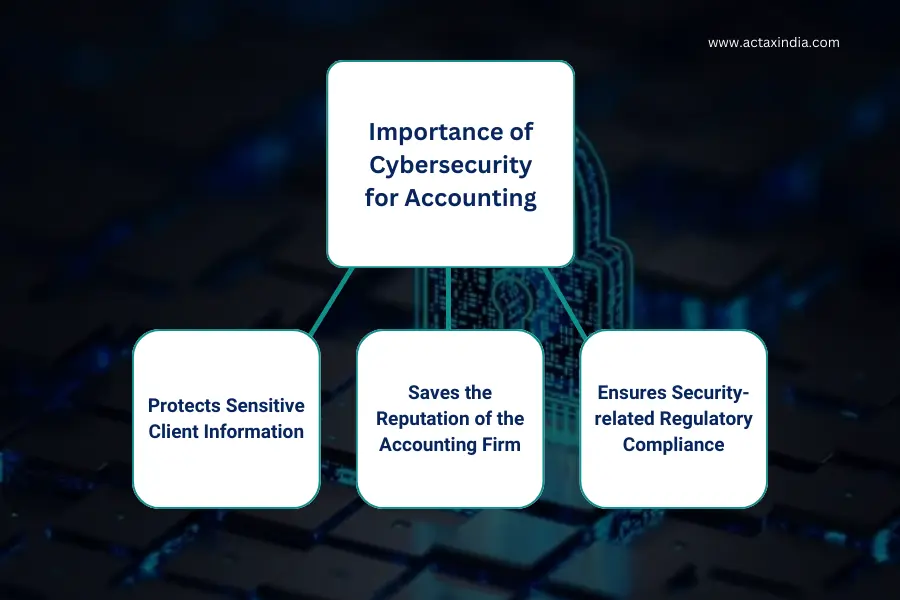

Importance of Cybersecurity for Accounting Firms in India

The key significances of cybersecurity for accounting firms in India are as follows:

Protects sensitive client information

As mentioned earlier, cybersecurity is important for the accounting firms in India because these accounting firms deal with a huge range of sensitive client information, that are financial and are exposed to the risks of cyber theft. The aforesaid information comprises bank statements, tax slips, phone numbers, and so on, which can be easily leveraged by cybercriminals to conduct financial breaches and cyber thefts.

Saves the reputation of the accounting firm

A hefty cyber attack can easily destroy the reputation of an Indian accounting firm. This is because successful data breaches can lead the cybercriminals to confidential client data and they can use the same in the name of the accounting firm to tamper with its reputation. In this way, the firm will not only lose their reputation but also its clients. Cybercriminals usually use them to conduct their malicious activities, like identity theft, black market transactions, and so on.

Ensures security-related regulatory compliance

Cybersecurity promotes regulatory compliance. The Information Technology (IT) Act, of 2000 governs the provisions of cybersecurity. The provisions of cybersecurity for accounting firms in India have also been outlined therein. Based on these provisions, every Indian accounting firm is supposed to keep their client’s data safe and secure. Any violation in this context results in a monetary fine and legal breach of duty. Thus, by implementing cybersecurity, Indian accounting firms also manifest regulatory compliance.

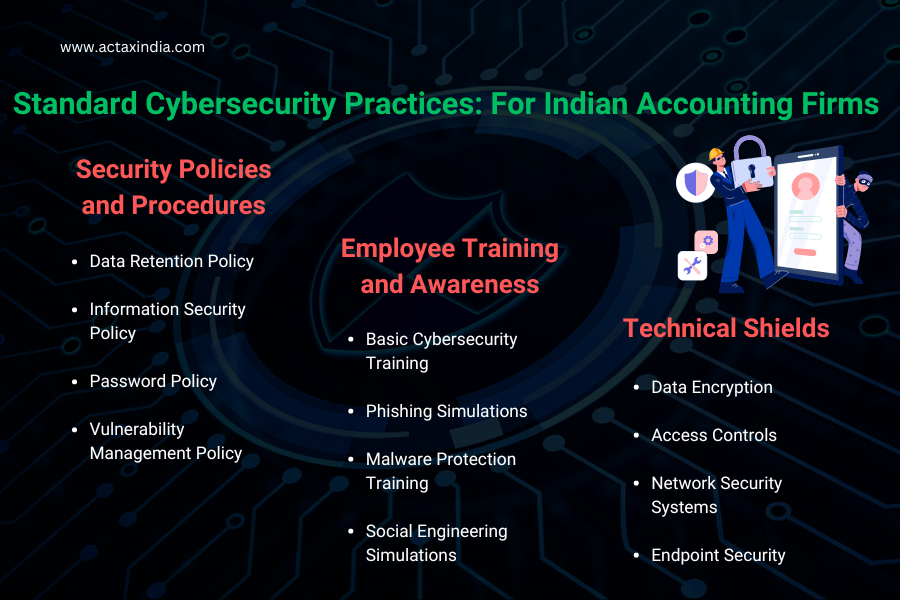

Best Practices of Cybersecurity for Accounting Firms in India: Actionable Tips

The best practices of cybersecurity for accounting firms in India are as follows:

Implementation of Security Policies and Procedures

Data Retention Policy

The “Cost of a Data Breach Report 2023” revealed that the year 2023 saw a 15% increase in data breach costs over the previous three years, to an average of USD 4.45 million worldwide. A strong data retention policy has the potential to help accounting firms to cope with this situation. It usually sets guidelines for how the organization will store and dispose of data and for how long.

2 .Information Security Policy

An information security policy (ISP) frames the rules and guidelines by which an organization protects, distributes, and manages data. The PwC’s Global Economic Crime and Fraud Survey 2022 revealed that 40% of the global organizations that fall under the category of SME mostly experienced platform fraud while encountering any cyber or general fraud. The Indian accounting firms also fall under this category. By opting for ISP, the system of cybersecurity for accounting firms can be enhanced and at the same time issues like platform frauds can be easily escaped.

3 . Password Policy

Password policies, on the other hand, govern the created passwords, their storage and usage systems within an organization. The stronger the password, the stronger its security quotient will be. The system of cybersecurity for accounting firms can be enhanced by creating sound password policies.

4 . Vulnerability Management Policy

To reduce vulnerabilities in the IT environment and the risks that go along with it, the (Company) Vulnerability Management Policy lays out the guidelines for the review, assessment, application, and verification of system upgrades. The same can be used for Indian accounting firms to reduce the risk quotients of cyber attacks.

Administration of Employee Training and Awareness Programs

Basic Cybersecurity Training

A staggering 82% of data breaches featured a human factor, as per the Verizon 2023 Data Breach Investigations Report. So, if Indian accounting firms provide their employees with basic cybersecurity training, there is a high chance that the accounting firm will remain much more protected and well-equipped to tackle cyber attacks.

2. Phishing Simulations

According to KnowBe4’s 2023 Phishing Industry Report, organizations typically have a 3/4th phishing click-through rate. This implies that serious repercussions may arise even if a tiny portion of employees fall for phishing emails. By regularly doing phishing simulations, staff members can become more adept at spotting and avoiding these scams. The same can be applied to enhance cybersecurity for accounting firms in India.

3. Malware Protection Training

Ransomware attacks worldwide have increased by 68%, according to the Malwarebytes Labs Threat Intelligence Report 2023. By educating staff members on how to spot malware infections and steer clear of dubious links or attachments, malware can be stopped from spreading throughout the company. The same can be applied to enhance cybersecurity for accounting firms in India.

4. Social Engineering Simulations

Social engineering simulations give learners real-life scenarios where they are taught to identify and prevent deception by attackers who impersonate employees and lure other employees into giving away sensitive information. Just like phishing simulations, by opting for social engineering simulations, Indian accounting firms can seamlessly dodge social engineering attacks.

Application of Technical Shields

Utilization of Data Encryption Methods

Scrambling makes data insensitive to decoding, even when intercepted and transmitted by attackers. This exceptionally creates the possibility of preventing data breach a lot. This is why the Indian accounting firms should utilize different data encryption methods (be it at rest or in transit) to keep their sensitive documents protected. 2. Application of Access Controls

As mentioned previously, the year 2023 saw a 15% increase in data breach costs over the previous three years, to an average of USD 4.45 worldwide. Powerful access controls, such as multi-factor authentication (MFA) usually create a huge barrier to unauthorized users when trying to access confidential information even if they obtain the login credentials; which eventually has the potential of dodging data breaches. Cybersecurity for accounting firms in India can be implemented in this way too. 3. Exertion of Network Security Systems

Unit 42, a Palo Alto Networks report, identifies that vulnerabilities that remain unpatched are the main cause of cyber attacks. One of the prominent functions that networking security systems perform by implementing first-grade protection is to spot intrusive traffic and hinder cyber attacks from reaching the local IS (Internet Service) system. Hence, the system of cybersecurity for accounting firms in India can be seamlessly enhanced by exerting network security systems. 4 .Application of Endpoint Security

Endpoint security software is the software that safeguards individual devices from malware infections, phishing attempts, and unauthorized access attempts through the installation of robust security through various protection measures. The Indian accounting firms can apply the functionality of endpoint security to dodge the above-mentioned cyber issues.

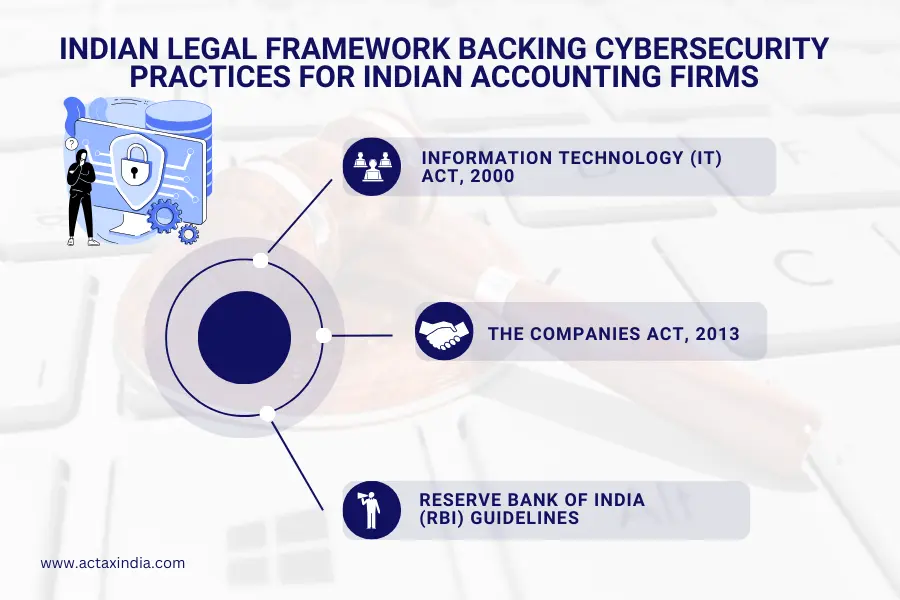

Indian Legal Framework Backing Cybersecurity Practices for Indian Accounting Firms

Cybersecurity for accounting firms in India are governed by the following regulations:

Information Technology (IT) Act, 2000

As mentioned earlier, the Information Technology (IT) Act, 2000, governs the Indian legal framework backing the cybersecurity practices for the accounting firms. Section 43 introduces the term data breach and puts forward the obligation of the company to declare them. Section 66 includes the wrongdoing of hacking and data breaches. Section 72A deals with the degree of liability intermediaries such as cloud service providers can have due to some data mishandling.

The Companies Act, 2013

This act framed the major corporate governance regulations for India which also includes accounting firms. It stipulates that firms should have strong enough internal fiscal controls to protect not only assets but also data. Although the act does not mention cybersecurity as such, it points out the necessity to develop serious internal controls and then refers to data protection measures.

Reserve Bank of India (RBI) Guidelines

The RBI, the central bank of India, issues a set of rules for banking institutions, comprising accounting firms that transfer clients’ financial data. These directives usually focus on the need to take appropriate steps such as encryption for the safety of financial data.

Conclusion: The Growing Relevance of Cybersecurity for Accounting Firms in India

Indian accounting firms are the largest targets for cybercriminals partly due to the huge storage potential of the confidential financial data of their clients. And, breaches of information security can lead to catastrophic results. By incorporating cyber security practices into their framework, such as training of employees and technical means (encryption, access control), businesses may drastically reduce risks and secure compliance with the current regulations. Although there is no such thing as a cyber security law in India, the IT Act, the Companies Act, the RBI guidelines, and forthcoming data privacy regulations have provided the basis for robust data security mechanisms. In conclusion, it can be said that ensuring cybersecurity is not a matter of choice but a necessity, thereby showcasing the growing relevance of cybersecurity for accounting firms in India. Contact Actax India to enjoy a seamless and secure accounting process, as we promise optimal security measures and keep your data protected at all times. book a consultancy with Actax’s Accounting experts.

FAQs

What is Cybersecurity for Accounting Firms?

Cybersecurity in accounting firms protects the confidential financial data of clients from potential cyberattacks via hacking and malware, safeguarding monetary loss and reputation.

Who might be impacted during Cyber Attacks for Accounting Firms?

Accounting firms are the targeted victims of cyberattacks, experiencing financial losses, reputational harm, and potential regulatory penalties in addition to the firms’ clients they serve.

What are the emerging trends of Cyber Security in Accounting Firms?

The emerging trends of cybersecurity in accounting firms are as follows:

- Growing Popularity of Cloud Security

- Existence of Human Element (e.g., Social Engineering, Phishing)

- AI-backed Attacks

- Increased Ransomware Threats

- Enhanced Security Regulations

- Increasing Relevance of Blockchain Technology

How outsourcing minimizes the risks of Accounting Cybersecurity?

Outsourcing will help to maximize cyber-security potential of your organization as cyber-security specialists will apply its expertise and resources to defend your data. However, it is a must to establish a solid vendor management system for that level of security to extend to your organization.

What is a Vendor Management System?

Vendor Management System (VMS) is a kind of software which helps businesses to frame rules for managing and securing their relationships with providers of the external services.

Comments are closed.