If you are a small business owner in India, this blog is for you! Are you confused about generating e-way bills? Don’t worry, this guide is here to help you out. E-way bills are an essential part of India’s GST system, but creating them is not as complicated as it may seem. Our guide will provide you with a comprehensive understanding of e-way bills, from what they are and when they are required, to how to generate them online in just a few simple steps. By the end of this guide, you’ll be an expert in creating e-way bills and ensuring that your business shipments move with ease. Generating E-Way Bills: Definition, Process, Validity, And Cancellation

Table of Contents

Generating E-Way Bills: Definition, Process, Validity, And Cancellation.

When is an E-Way Bill

The Electronic Way Bill or the E-Way Bill is a mandatory digital document that every individual, who transports goods over a value of ₹50,000 must have as per provisions of Section 68 of the Goods and Services Tax Act. Failure to produce this document can result in severe legal consequences. The document can be obtained by the taxpayer or logistics company through the E-Way Bill system portal(ewaybillgst.gov.) As soon as it is issued, each unique number is a qualified electronic waybill, and it includes essential information about the goods in motion, such as the sender, receiver, goods details and vehicle that vehicles it. Generating e-way bills is used as a tangible confirmation that the goods being carried are in line with GST regulations and it is therefore crucial to make sure that the movement of goods is done smoothly at all times.

When is an E-Way Bill Required?

As mentioned earlier, generating e-way bills becomes mandatory when the value of the transportable goods is more than ₹50,000. In simple terms, if you’re transporting goods that are crossing the aforesaid worth, then you must carry with you an e-way bill. When operating in such a scenario, a consumer can obtain a taxable invoice or invoice from the dealer or supplier by presenting his bill or invoice.

Who is Responsible for Generating E-Way Bills?

Generating e-way bills are the responsibility of the following:

- Registered person

- Unregistered person

- Transporter.

Note: When a non-registered individual gives goods to a registered person, the person receiving the goods is responsible for issuing the E-way bill. In the case that the supplier has not created an E-way bill, then the transporter has to do so. When submitting the application form on the E-way bill portal, unregistered transporters will be given a Transporter’s ID.

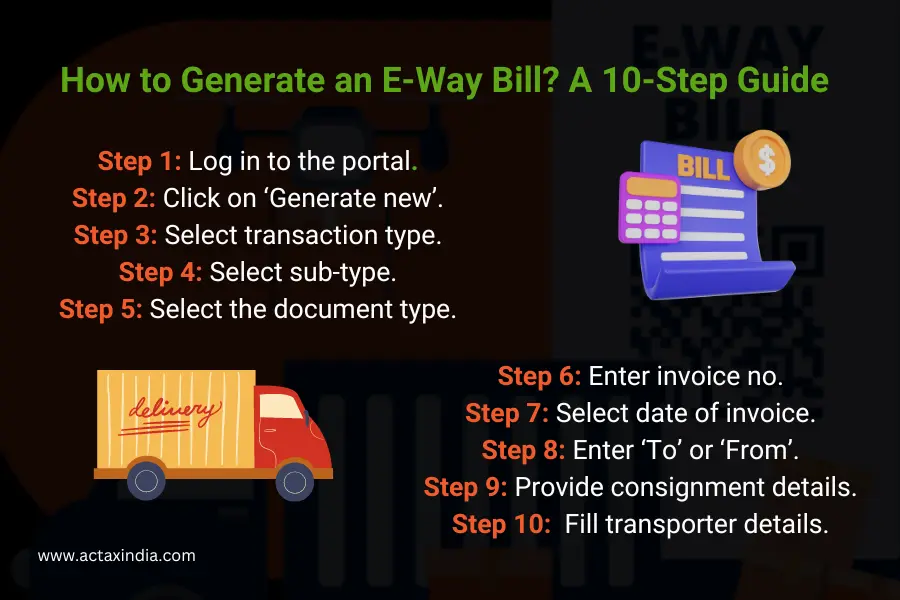

How to Generate an E-Way Bill?

Generating e-way bills is now easy. Let these following steps guide you to seamlessly generate an e-way bill:

- Step 1: Log in to the e-way bill portal. Click here waybillgst.gov.in. Enter the Username and Password to log in. Also, fill in the Captcha, and then finally press the Login button.

- Step 2: Click on ‘Generate new’ under ‘E-waybill’ option appearing on the left-hand side of the dashboard.

- Step 3: Now select the transaction type. Select ‘Inward’ or ‘Outward’ based on the motion of the consignment. In case you’re the supplier of the consignment then select ‘Outward’, but if you’re on the receiving end select ‘Inward’.

- Step 4: Select the relevant sub-type that applies to you. If you select ‘Outward’, then the following sub-types will be available to you – Supply, Export, Job Work, SKD/CKD, Recipient Not Known, For Own Use, Exhibition or Fairs, Line Sales, and Others. If you select ‘Inward’, then the following sub-types will be available to you – Supply, Import, SKD/CKD, Job Work Returns, Sales Return, Exhibition or Fairs, For Own Use, and Others.

- Step 5: Select the document type. To be precise, select either Invoice or Bill or Challan or Credit Note or Bill of Entry or Others if not listed.

- Step 6: Enter the invoice or the document number.

- Step 7: Select the date of the invoice or document or challan.

- Step 8: Depending on whether you are a supplier or a recipient, enter the ‘To’ or ‘From’ section details.

Note: If the supplier or client is not registered, enter ‘URP’ in the GSTIN field to indicate that they are an ‘Unregistered Person’.

Shorter Checkpoint Wait Times

E-way bills allow for faster clearance, keeping your goods on the move.

Cost Reduction

The streamlined process reduces paperwork and speeds up transportation, leading to significant cost savings.

Short Transportation Time

E-way bills minimize delays, ensuring your products reach their destination quicker and happier.

FAQs

What are the key documents required to generate an E-way Bill?

- Registration on the EWB portal.

- The Invoice or Bill or Challan related to the consignment of goods.

- If transport is by road – Transporter ID or the Vehicle number.

- If transport is by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

What are circumstances that do not require an E-way Bill?

As per Rule 138 of CGST Rules, an e-way bill is not required to be generated in certain situations. These situations include the transportation of goods such as Liquefied petroleum gas for supply to household and non-domestic exempted category (NDEC) customers, Kerosene oil sold under PDS, Postal baggage transported by the Department of Posts, and several others. Furthermore, an e-way bill is not required when there is no supply as per provisions contained in Schedule III of the Act. So, if you are planning to transport any of the above-mentioned goods or if your supply falls under Schedule III, you can rest assured that you don’t need to generate an e-way bill.

What is a consolidated e-way bill?

A consolidated e-way bill contains multiple e-way bills for different consignments transported in one conveyance. This saves time and effort by eliminating the need for multiple e-way bills. Switch to the consolidated e-way bill for streamlined operations and compliance.

What are the repercussions of omitting an E-Way Bill?

It’s crucial to remember that carrying an E-Way Bill during transit is not only a legal requirement under GST laws, but it’s also essential to ensure that you avoid penalties and confiscation of goods. Don’t risk the safety of your goods and your business- make sure to always carry the E-Way Bill during your transportation.

How does the E-Way Bill system work?

Taxpayers can easily generate, modify, and cancel E-Way Bills on a centralized online platform, and that is how the E-way Bill System works.

Conclusion

Do not let the hassles of transportation slow down your business. Generating E-way bills is the key to a seamless transportation experience. This blog provides all the vital information that you need to create an E-way bill. And, if you want further assistance, don’t hesitate to reach out to Actax India’s experts. They are always ready to help you o